Once Q1 oil balances show little to no build, the consensus will look pretty out of sorts. US oil inventories are starting the year on a bullish note with total liquids declining by ~16 million bbls in January.

As we noted in our December WCTW report titled, "Endgame." We said:

Everyone has written off energy investing in 2025. With the IEA's false advertisement of abundant supplies next year, no one is allocating capital to this beaten-down sector just as US oil production starts to rollover.

I believe several catalysts in 2025 can easily sway sentiment in favor of the bulls. Here are the two immediate catalysts I see in the near term:

Colder than normal winter.

Iran sanction enforcement.

Mother Nature has ruined natural gas and oil bulls alike the last 2 winters, but this time feels a bit different. In Europe, we are seeing one of the fastest storage withdrawals in recent years.

Source: Giovanni Staunovo

For the oil market, bearish heating demand has tampered at least 750k b/d of global oil demand in Q1 2023 and 2024. But this may change with the current outlook for January. According to the latest ECMWF-EPS long-range outlook, bullish weather is expected to show up around the first week of Jan. The colder-than-normal temperature would push down gasoline demand, but it would spike propane/propylene and distillate demand. The surge in the heating demand component coupled with production freeze-off could swing balances by as much as ~1.75 million b/d for one month.

And since market participants are confident that Q1 balances will show a surplus, the draw scenario will immediately shift attention, especially given the low absolute storage environment backdrop.

With this first catalyst, I expect WTI to start trading in the mid-$70s.

Luckily for the oil bulls, January 2025 is one for the record books. It's going to be the coldest January since 1988, and this has resulted in oil inventories trending bullish. In addition, the colder-than-normal weather has materially dampened US oil production to start the year.

Last week's materially colder-than-normal weather resulted in a major drop in US oil production. According to our tracker, US oil production is currently around ~12 million b/d. If we normalize US oil production, the January average is around ~13 million b/d, or in line with our estimate.

For the rest of Q1, the slow start in January will materially dampen any production growth momentum from US shale. Because we ended 2024 with decelerating growth momentum, the freeze-off event last week will only worsen the growth velocity in Q1. We expect an average production of ~13 million b/d or ~500k b/d below the consensus estimate, and by Q2, this delta will grow to ~650k b/d.

In addition, as we stated in our Dec report, higher than normal heating demand is resulting in a boost to total implied demand.

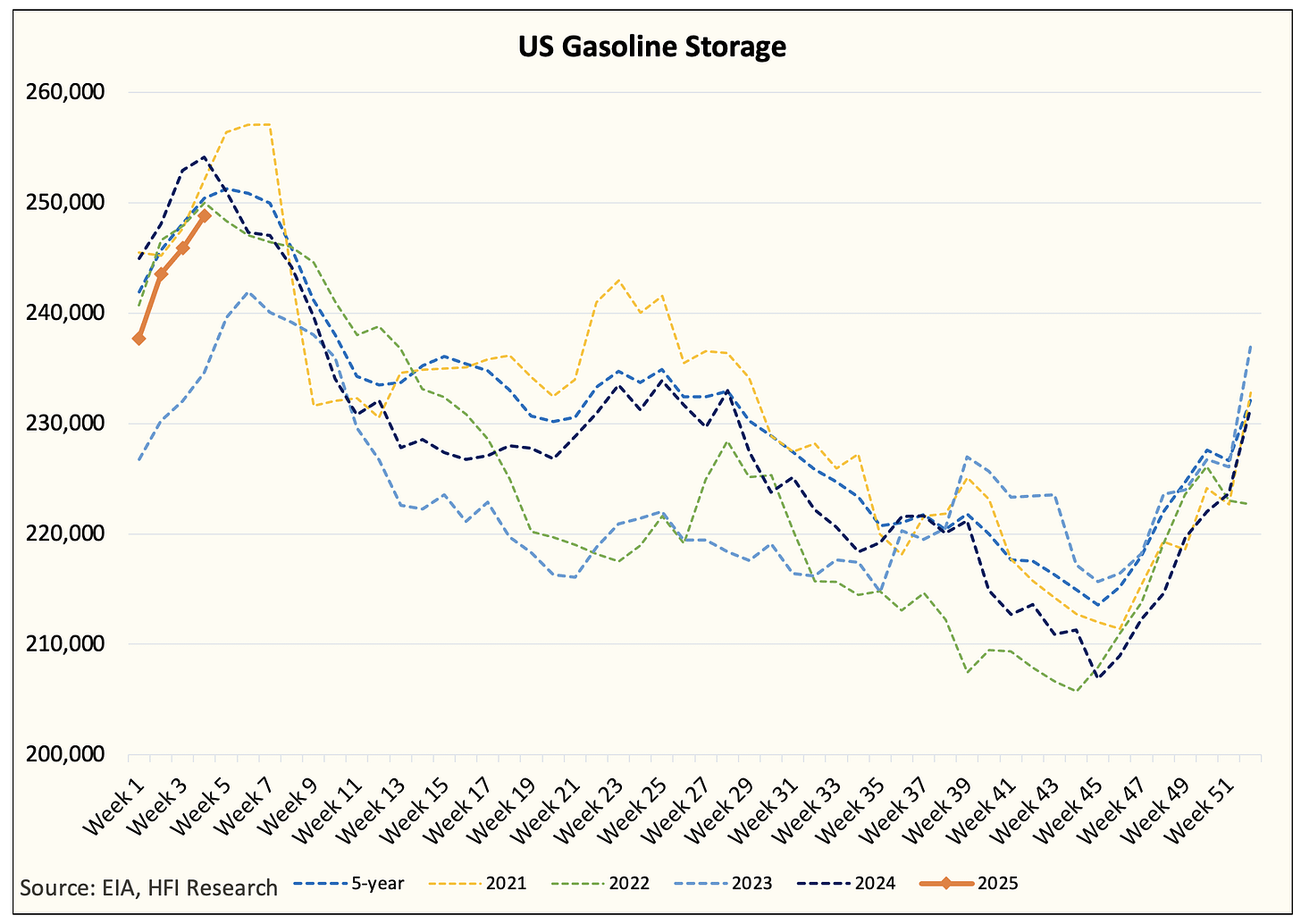

Aside from the erroneous data the EIA reported for 2022, US implied oil demand is at a multi-year high to start the year. One area of worry for us is the bloated gasoline storage we are currently seeing.

This will serve as a headwind on refining margins, which will cap how much upside we see in crude.