It's Getting Extreme Out There

Negative sentiment in the oil market is unlike anything I've seen before.

Headlines drive bottoms and peaks, not prices. That’s my takeaway from all the years I’ve been in the energy markets. And in the case of the oil market, we are certainly approaching the final blowout phase.

The issue, as I’ve explained in detail in the past, is that the market has the perception that global oil market balances are way oversupplied.

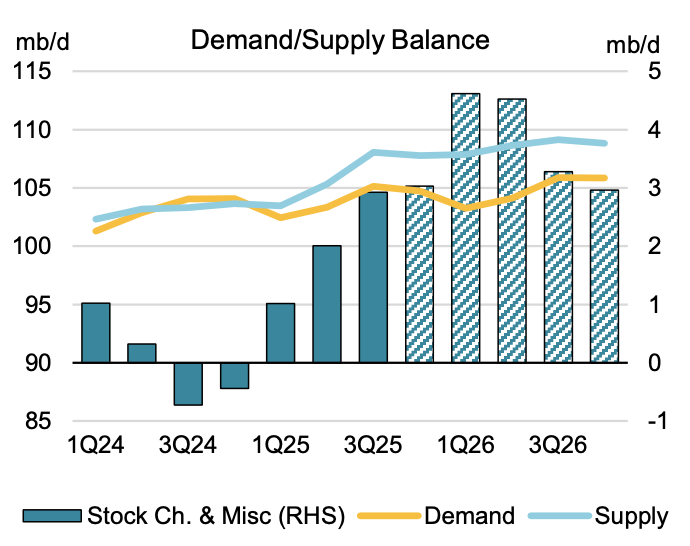

The IEA, which has a terrible reputation, does have the potential to influence market sentiment and when it publishes figures like 4+ million b/d surplus in Q1 2026, the market undoubtedly pays attention.

Source: IEA

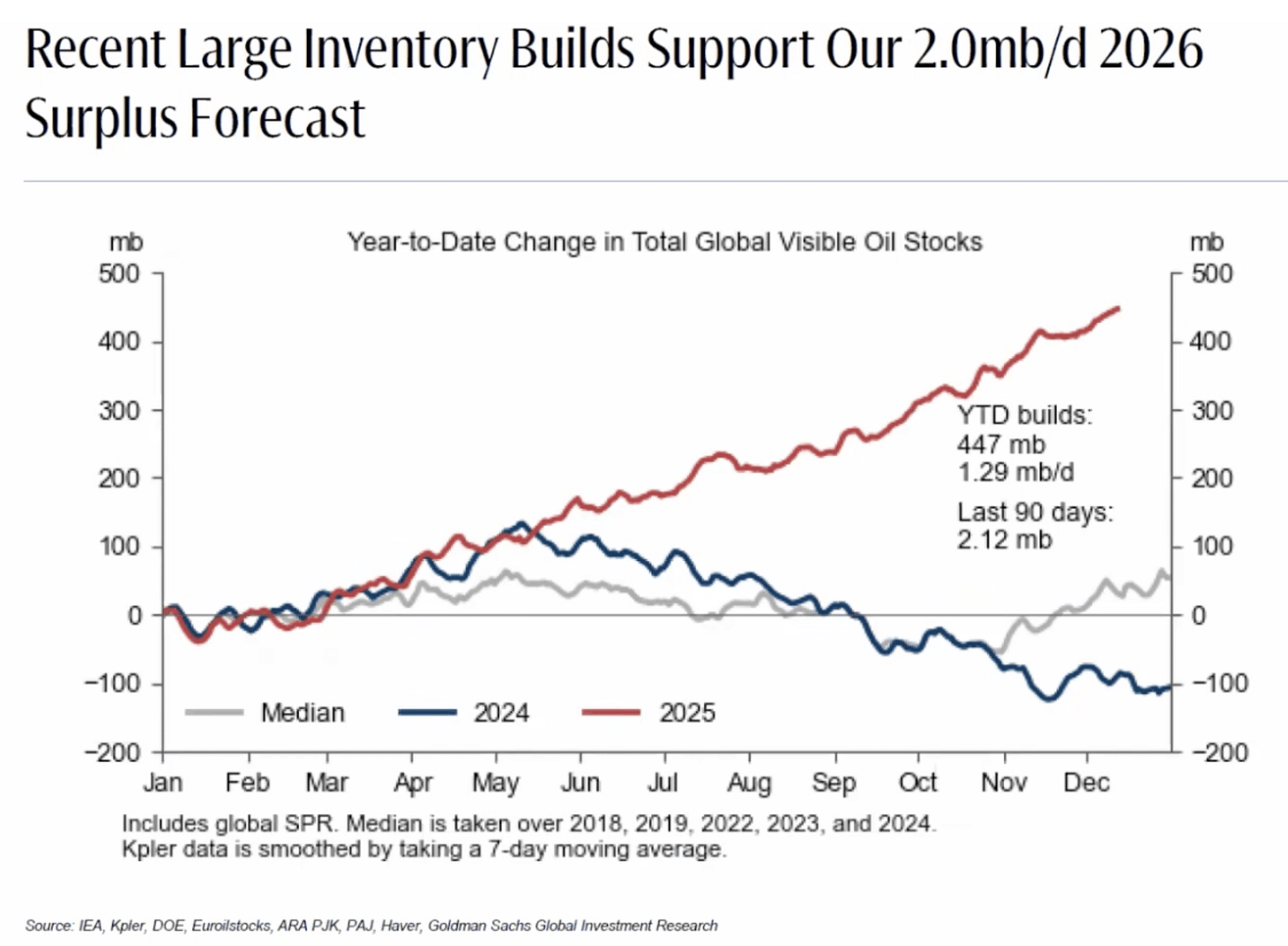

And from Wall St analysts, sell-side is in agreement that global oil market balances are extremely loose with oil-on-water and visible onshore oil inventories amounting to +1.29 million b/d YTD.

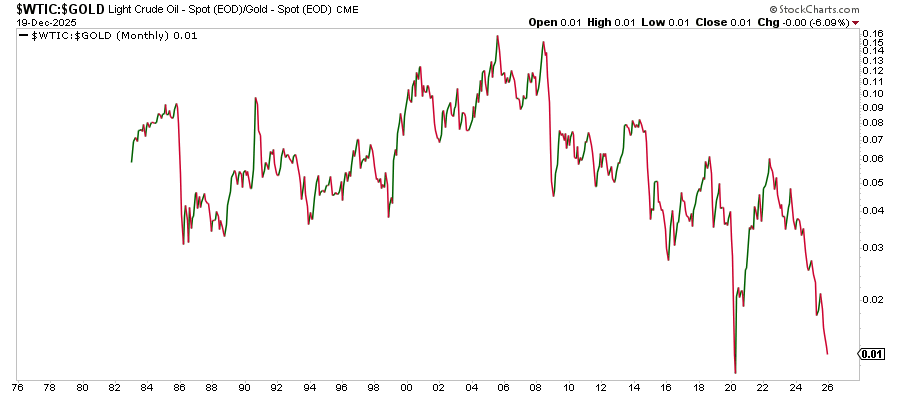

Headlines such as these, coupled with investors’ obsession over precious metals, have resulted in charts like the gold-to-oil ratio blowing out to levels unseen since COVID.

So the question is, when will all of this turn?