The oil price weakness is just getting started.

When we published our piece titled “US Crude Oil Production Hits An All-Time High And What To Expect Going Forward“ on Sept 5, we said:

While we know with a high degree of certainty that August US crude oil production is outperforming, we don’t know how much of this outperformance is structural or temporary.

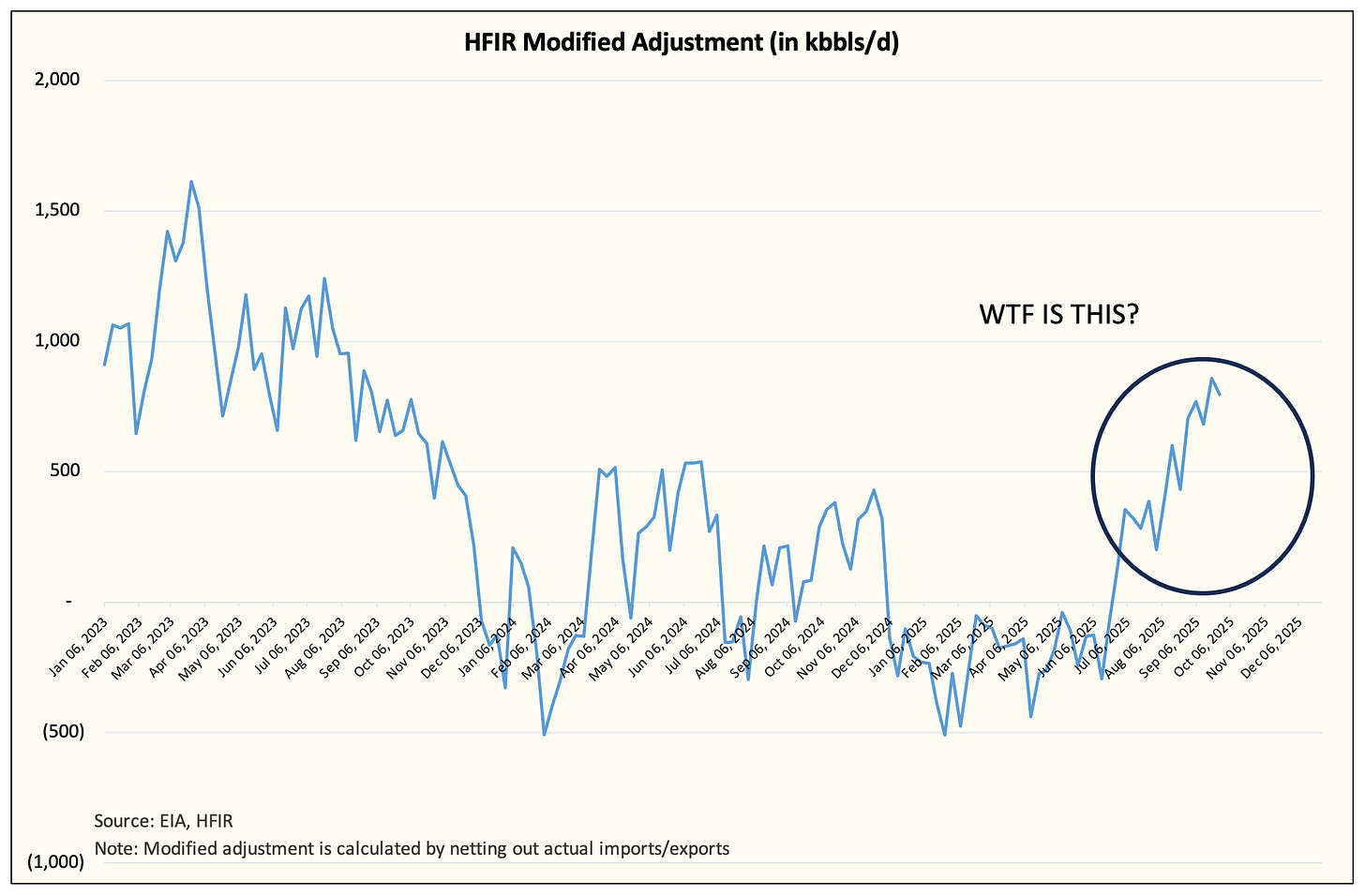

For starters, EIA data quality is an issue, and the recent strong modified adjustment reading could be the result of bad data. But if this were the case, we would see a meaningful revision to the downside in the coming reports, which would also push our implied US crude oil production lower.

Note: Chart is updated using today’s figures.

Obviously, we would report back if the modified adjustment started to meaningfully correct lower, but for now, you just have to use the assumption that US crude oil production is outperforming.

As a result, the only way for this to be a false alarm is if both September and October US crude oil production fall meaningfully. Outside of this scenario, the jump in US crude oil production looks real.

I will keep a very close eye on this, so please be sure to read all of our US crude oil production update articles.

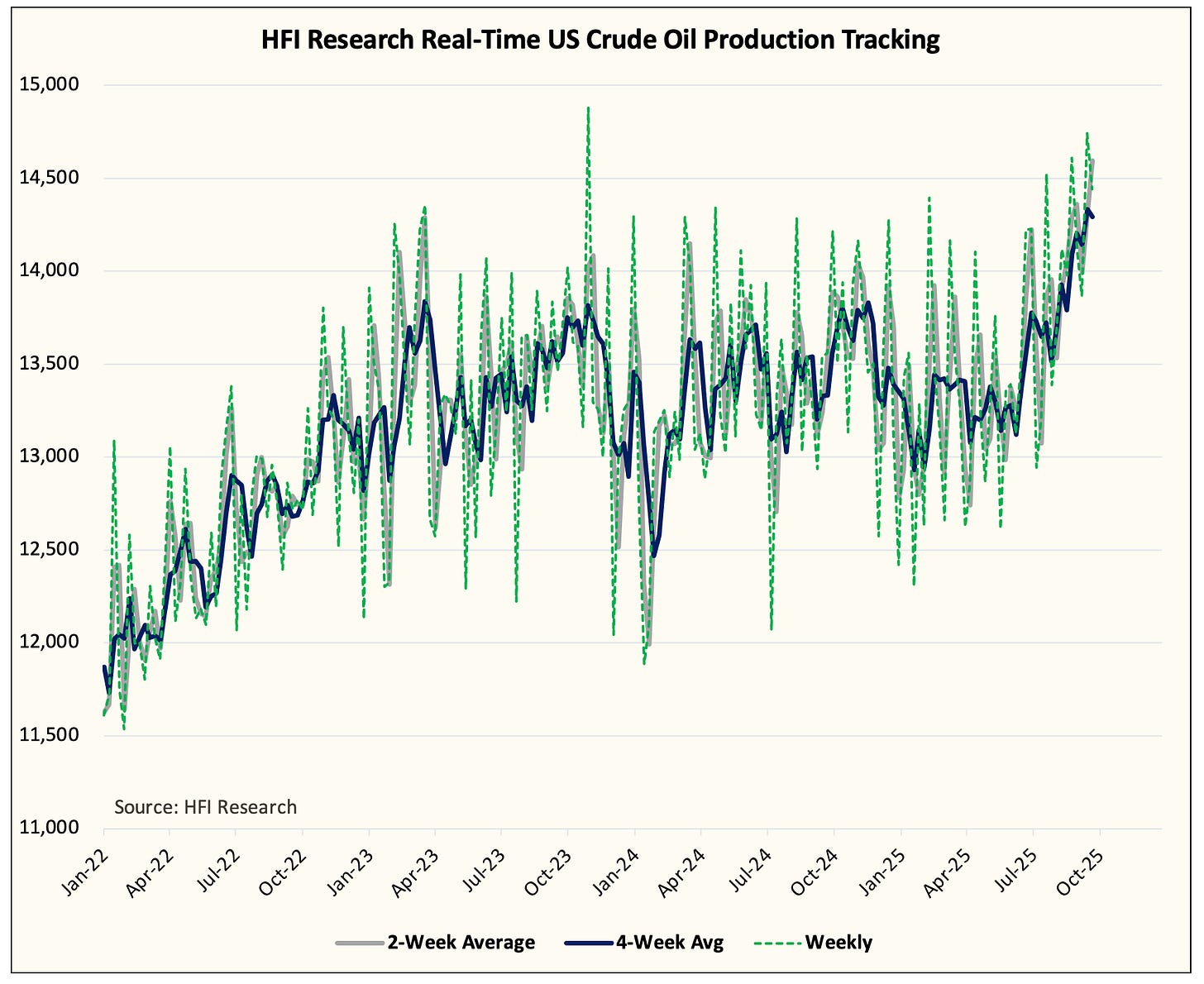

Fast-forwarding a month later, September US crude oil production did not reverse the strong gains we saw in August. In fact, it was the opposite outcome. US crude oil production marched even higher throughout September.

Based on our real-time data, US crude oil production averaged ~14.3 million b/d or +300k b/d from August. We think some of this is due to noise, and the real increase is less, but the fact remains the same: US crude oil production is surprising to the upside.

While we are currently not seeing this manifest into materially higher US commercial crude storage just yet, the writing is on the wall. US oil inventories will build into year-end, and more global visible inventory builds will take place. Couple that with higher OPEC+ crude exports, and the end result is a persistently weaker oil market environment.