By: Wilson

I'm just glad this year is coming to a close.

Source: HFI Portfolio

From a portfolio performance standpoint, the underperformance to the S&P 500 was not without the many mistakes along the way. While my decision to liquidate the energy portfolio in April 2024 turned out to be a key part of why we are still positive for the year, the re-entering in May/June cost us a good chunk of the returns we made previously (up 31.54% in early April).

From the analysis standpoint, there were also a lot of blunders along the way. In June 2024 when we saw OPEC+ crude exports meaningfully drop, I thought the setup for an oil price spike (albeit temporary) was in the making.

The reality?

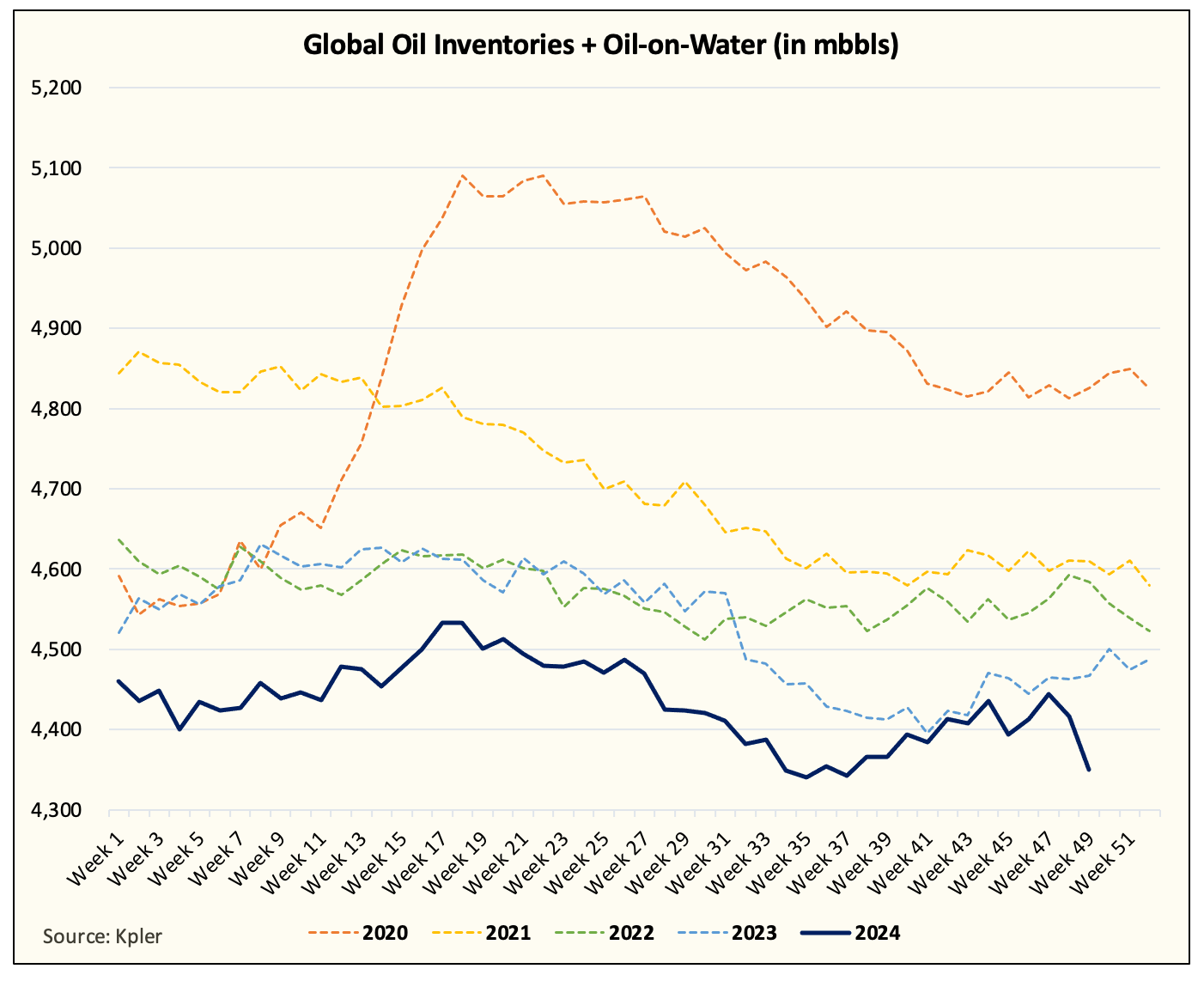

OPEC+ crude exports did remain low. Global oil inventories dropped.

OPEC+ Crude Exports

Global Crude Inventories + Oil On Water

OECD Oil Inventories

However, oil prices failed to gain any traction as concerns over 2025 oil market balances (surplus), weak Chinese oil demand, and OPEC+ spare capacity continue to keep a lid on prices.

In addition, unrealistic non-OPEC supply growth, no matter the reality, continues to keep investors' sentiment negative on energy.

Source: Michael McDonough

As a result, energy is once again the worst-performing sector in 2024. Since 2011, energy has ranked either as the worst or 2nd worst performing sector in 8 out of the last 14 years. It takes a special skill to be that bad for that long, but that's what a bear market looks like.

Inversely, Bitcoin has been the best-performing in 11 out of the last 14 years.

A sign of the times I suppose. It's no wonder no one cares about energy.