It's like clockwork.

During the shoulder gas season, the lack of 1) catalysts and 2) price sensitivity to the in and out of financial flows makes it extremely volatile for traders.

This is why, in our experience, waiting for the obvious in natural gas trading has almost always paid off. But even when the obvious appears, like the price action we saw today, it pays to wait a while longer.

The last thing you want is to get extremely confident and buy the dip only to get your face ripped off. You need to understand the inner workings of the natural gas market, predict what other traders will do, and then act according to that assessment.

In this case, here's what you need to know.

Playing the Short Term

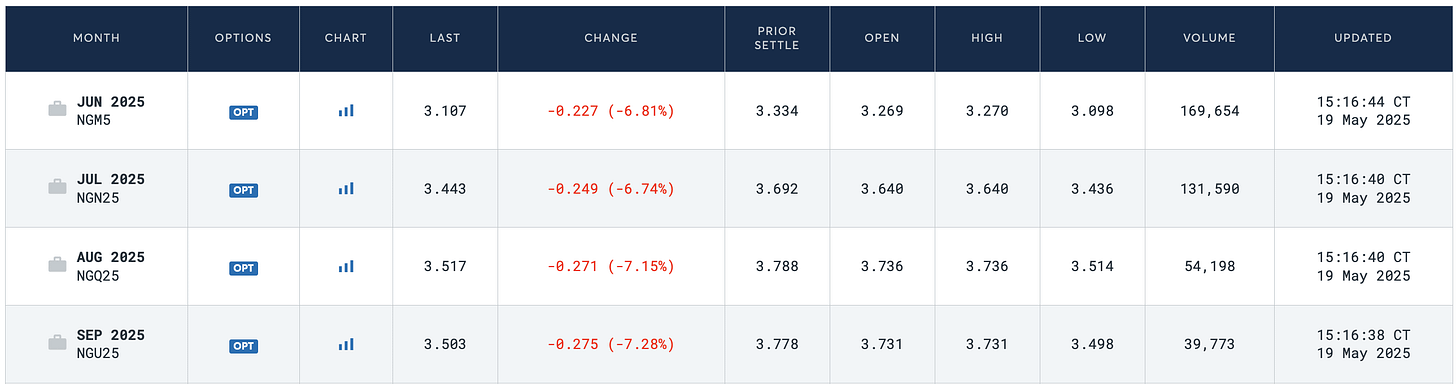

In our recent NGF write-ups, we've been pointing to sub-$3.5/MMBtu for the July contract as an attractive area to go long.

This is what we said in our action plan write-up:

So, when do we go long?

Cooling demand doesn't materially impact natural gas balances until mid-June, which means ECMWF-EPS weather updates don't become meaningful until the end of May. We have another 2 weeks to go before any catalysts appear.

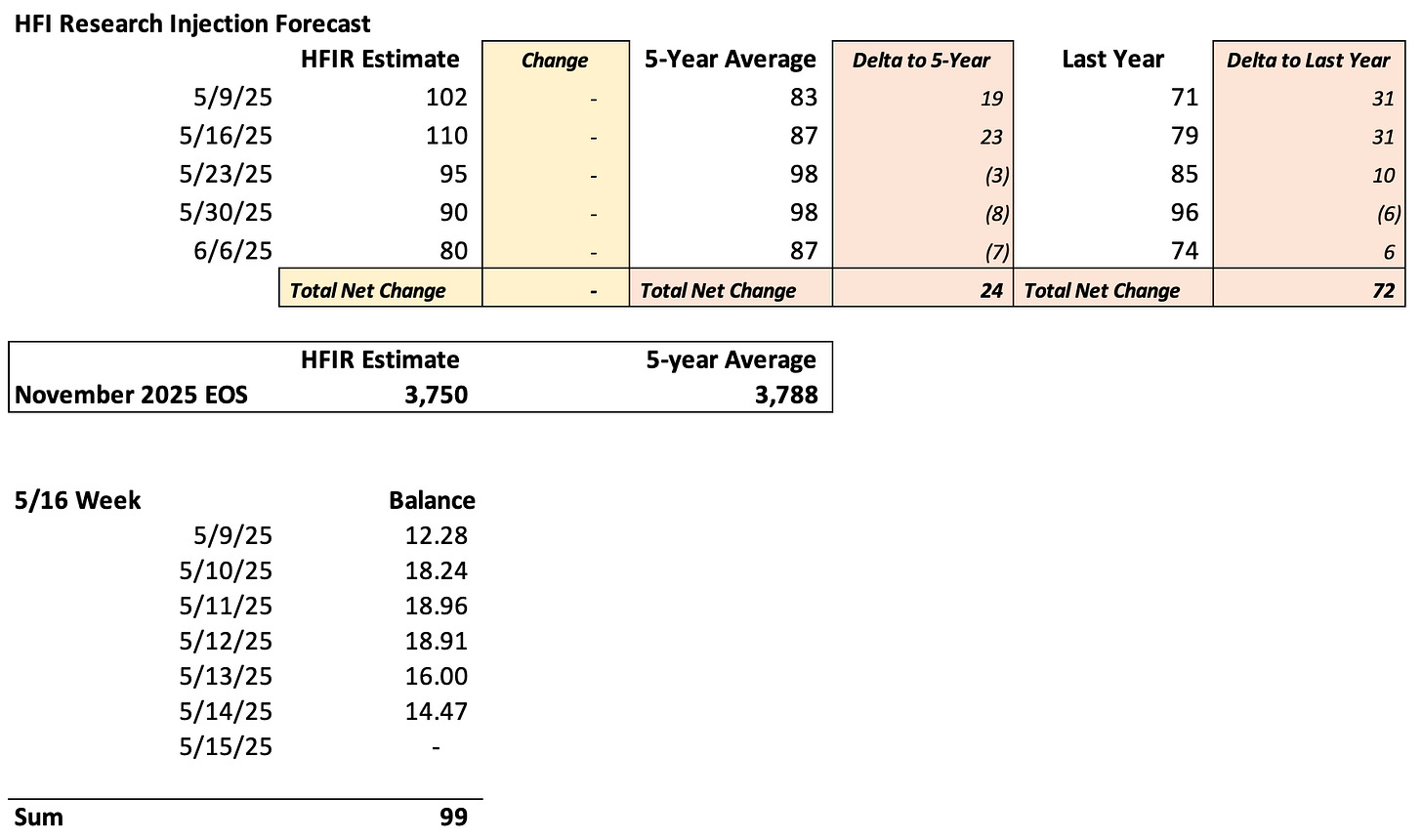

In the meantime, storage injections will continue to be bearish. Following today's injection report of +110 Bcf vs our +102 Bcf, the market sees balances skewing to the downside (surplus) in the near-term.

There are going to be at least 3 more reports that will come in above the 5-year average, so it doesn't hurt to wait.

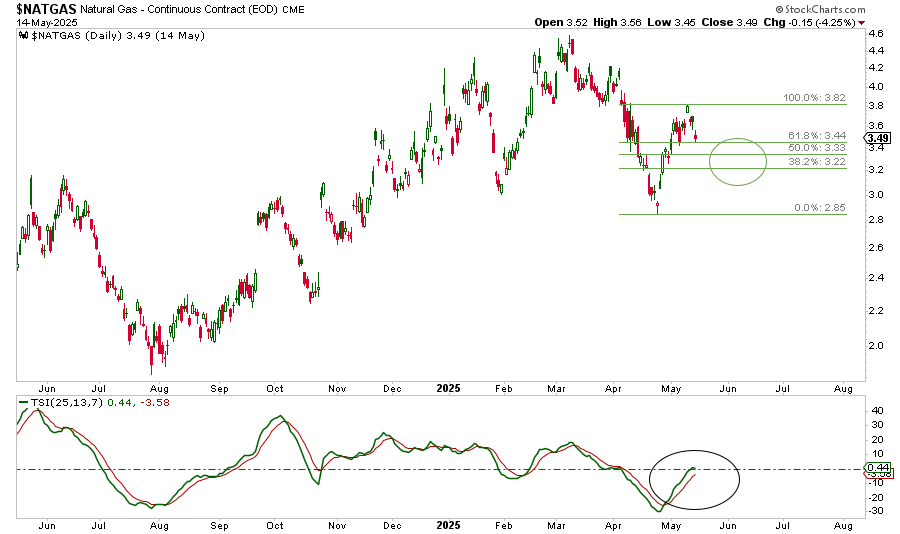

Lastly, from a technical standpoint, natural gas prices are heading lower in the near term.

Following the short squeeze we saw from $3/MMBtu, July contracts reached $4/MMBtu before starting the current pullback. We think there's more room to the downside in the near term, and buying July contracts below $3.5/MMBtu offers us a very attractive risk/reward payoff.

Once we put on this trade, we will want to hold our long natural gas (commodity) exposure for a while. I think there's a case to be made for why natural gas could jump to as high as $5/MMBtu during the summer months.

With today's sell-off, natural gas has reached our attractive risk/reward range.

But I didn't pull the trigger yet. Why?