In last week's Wednesday NGF update, "Natural Gas Tightness Is Coming, "we noted that natural gas fundamental balances weren't as loose as the market perceived. In particular, the main driving force for the higher-than-normal injections we saw throughout April and May was bearish weather-related demand.

Following the NGF, we alerted paying subscribers that we went long BOIL at $49.22. We plan to hold onto this natural gas long position for a while as we think the market underestimates the possibility of a mini-price spike this summer. As we will explain below, both the fundamental setup and speculator positioning point to more upside in natural gas.

Speculators Gone Wild

Momentum for the sake of momentum in natural gas trading seldom works.

Source: MacroMicro

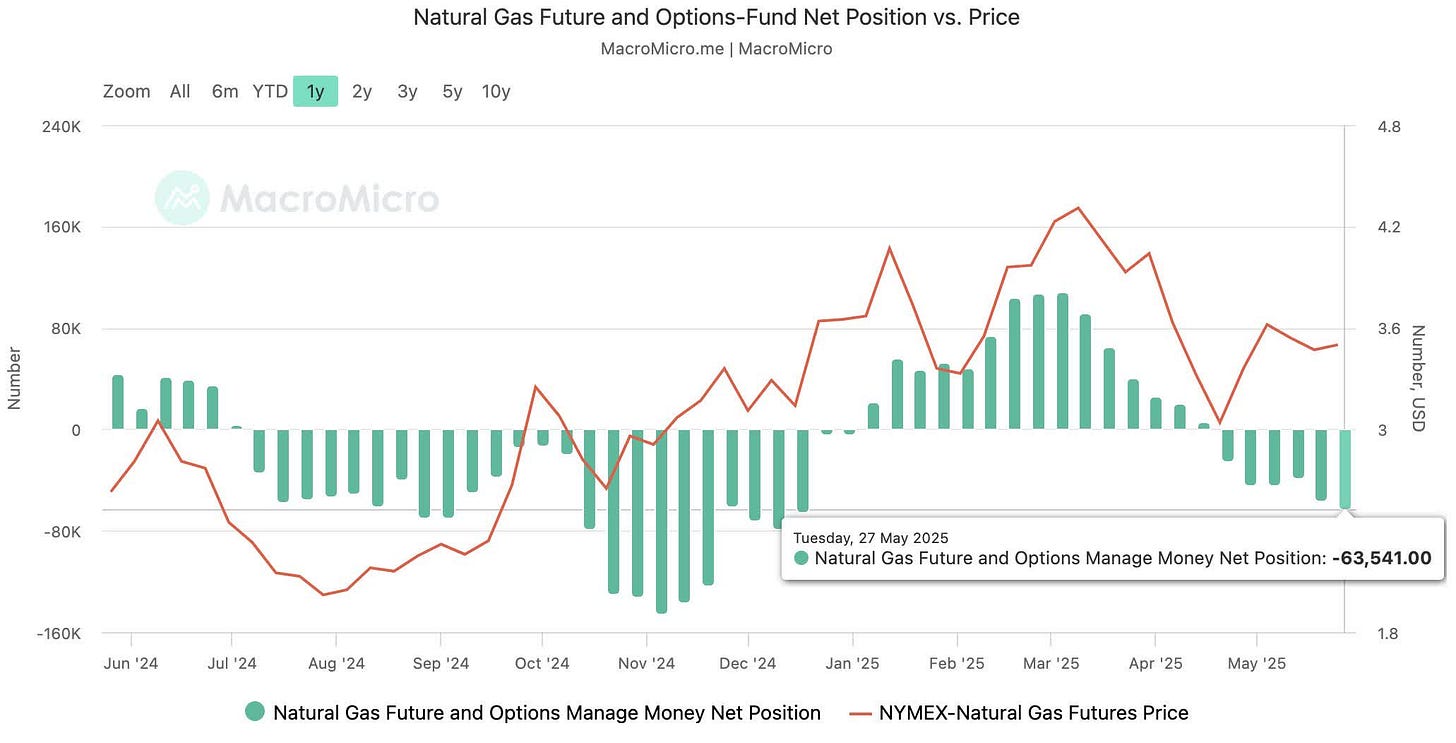

In the case of the current speculator positioning, the steep short positioning built up so far is a recipe for disaster later this summer. The current short squeeze that we are seeing today is just a tease for what's to come later.

CTAs, or commodity trading advisors, tend to extrapolate the near-term fundamental balance and momentum in anticipation of that trend to continue.

In this instance, natural gas balances were very bearish throughout April and May, so the funds started to pile in on the bear side with the initial bet paying off as July contracts declined from $4.4 in late March to $3.35.

But if the CTAs were smart and reversed the trade right away, prices wouldn't have dropped as steeply, and the disconnect between fundamental and reality wouldn't have been stretched to extremes.

Instead, CTAs did exactly that: stretching fundamental vs reality to an extreme. This is what I've often pointed to as the "obvious" in natural gas trading.

This is no different. Speculators have gone wild, and they will pay the price.