Over the weekend, weather models trended slightly warmer with no meaningful colder-than-normal risk on the horizon.

With winter heating demand coming to an end soon, the lack of a bullish surprise on the cold front equals “sell first and ask questions later.” One of the key things to understand for winter gas trading is that the market doesn’t care about whether the price is “fairly” valued or not; it only cares about the direction of where the weather models are headed. And as we wrote in our natural gas update last week:

Purely from reading the weather maps, I can tell you that buying the dip is way too early. I don’t see any bull signals that can rapidly flip the narrative (warmer trend) around in the near-term. As we explained in the fundamental section, if the market believes storage is headed for 1.9 Tcf, then natural gas prices are headed for $3/MMBtu. I don’t think it makes sense to fight the market here, especially given how sensitive everyone will be on how weather models develop.

March Henry Hub contracts are now trading near $3.2/MMBtu and this is well below the level we believe to be “fair value” especially considering that the incoming weather trend is far from being “bearish”. But in order for us to take a long position, we need to see the signals turn bullish (more on this later).

The Weather

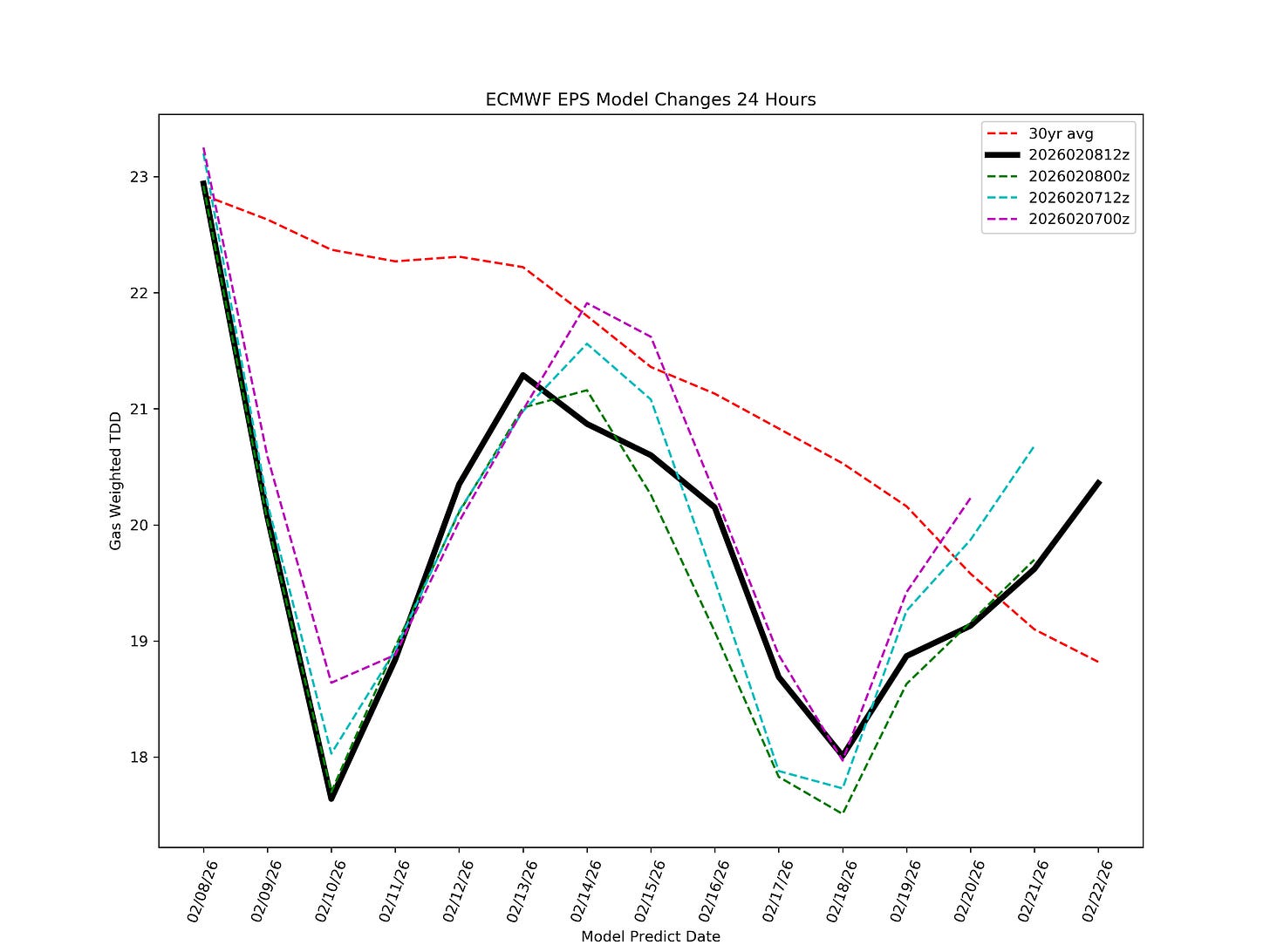

The last ECMWF-EPS update had heating demand below the 10-year norm for the next 15-days.

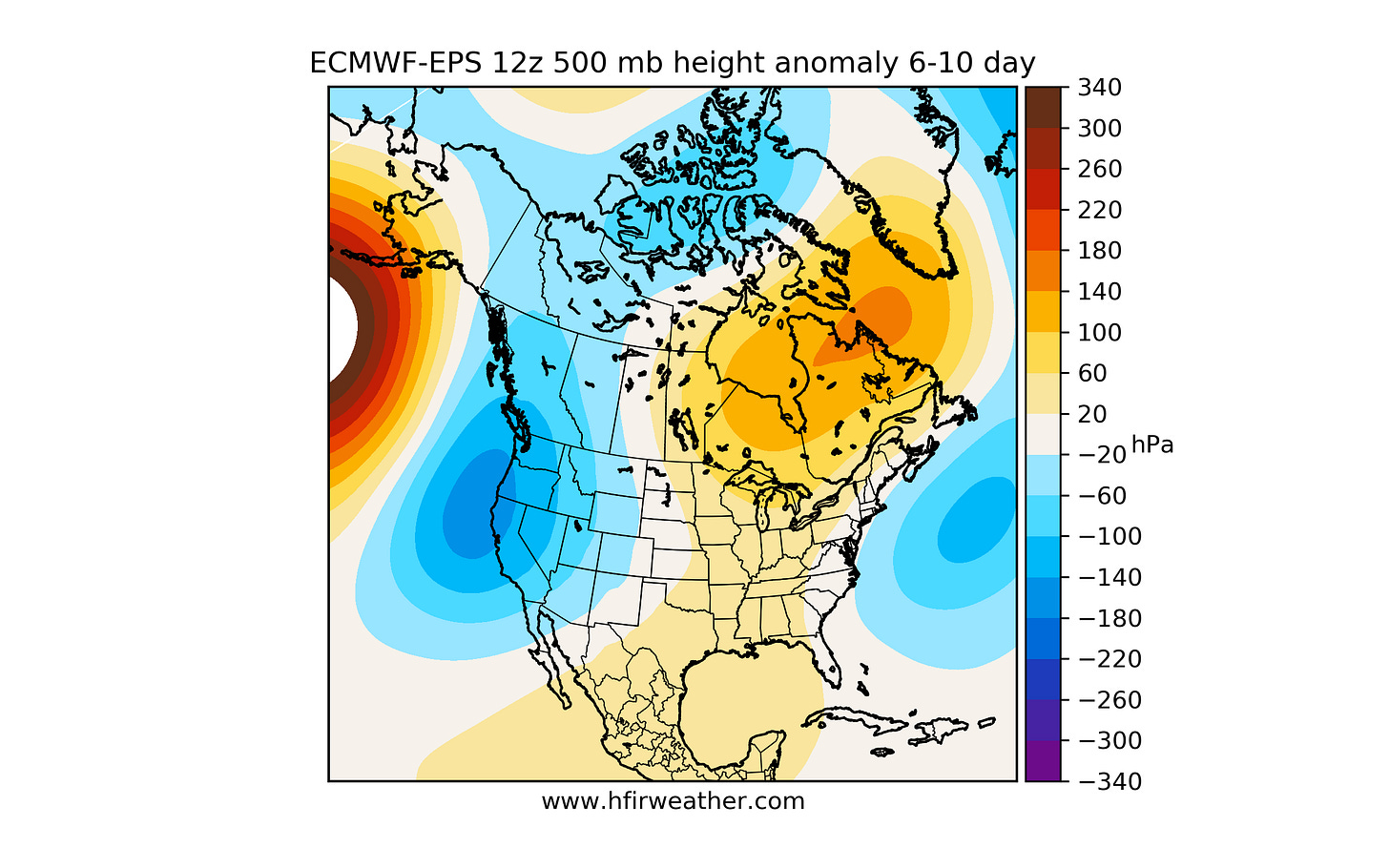

6-10 Day

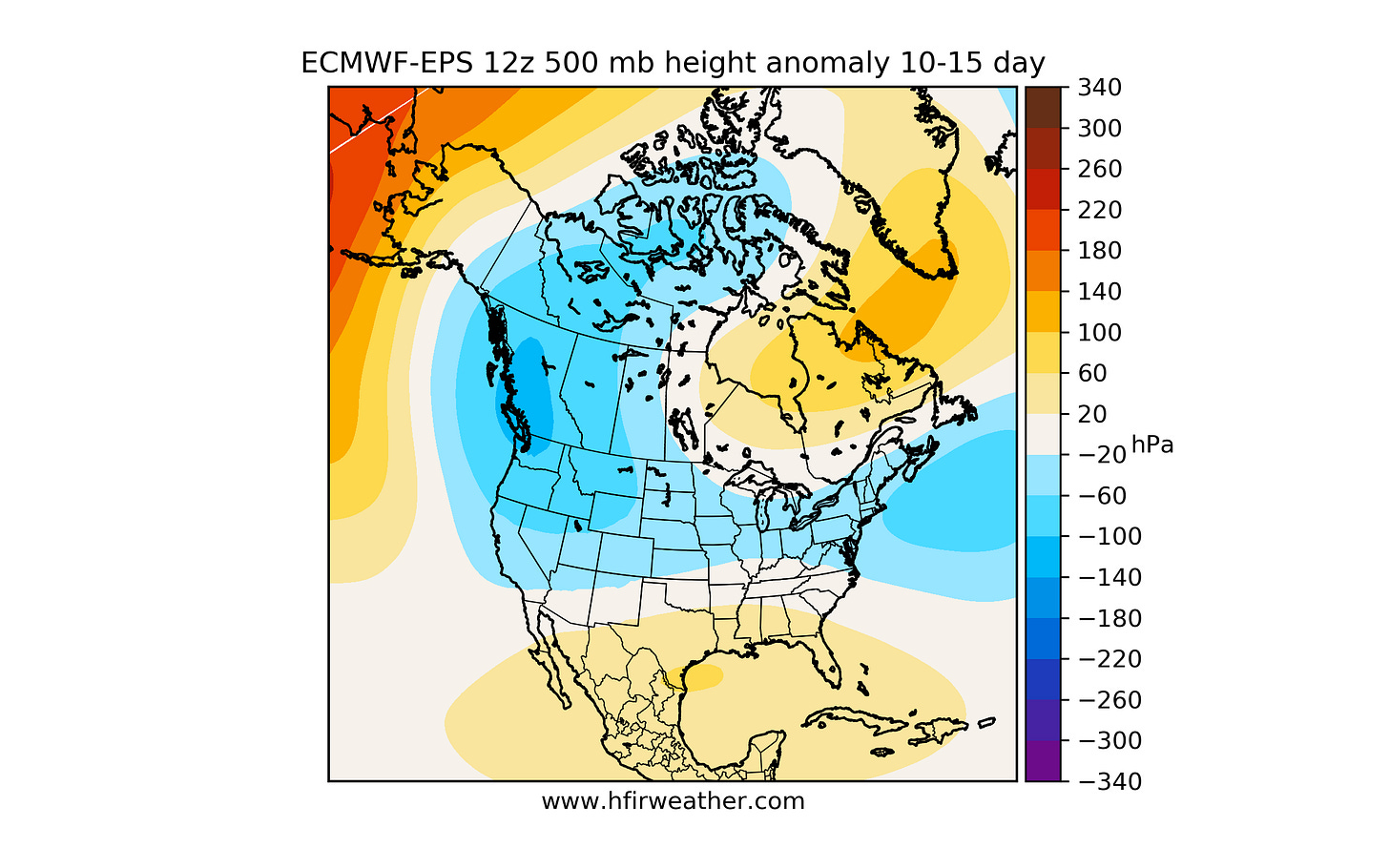

10-15 Day

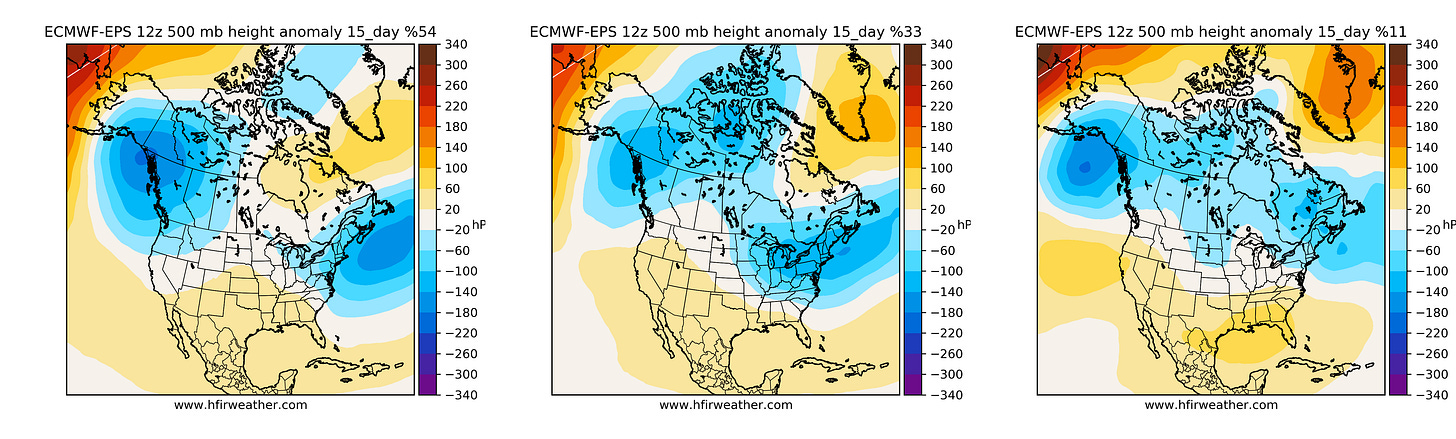

15-Day Cluster

What you will notice in the weather charts above is that the weather trend doesn’t fall into the category of being overly bearish. The 6-10 day outlook has the potential to delay the slightly colder weather at the backend of the model, but this is far from the very bearish scenario the market appears to be pricing in.

But for the bulls to buy the dip with confidence, we need the teleconnection signals to turn bullish, and they aren’t on the bull’s side just yet.