(Public) Don't Be Fooled By The IEA's 2024 Global Oil Market Balance Projection

IEA published its latest oil market report today and the chart that's grabbing everyone's attention is this:

Source: IEA

By IEA's calculation, the global oil market will be oversupplied by more than ~1 million b/d. But if you dig deeper into how it estimates these balances, you will arrive at a far uglier truth that the IEA doesn't want you to know.

For any experienced oil analyst out there, global oil supply & demand forecast is akin to weather forecasting. It's likely going to be wrong and it's extremely challenging. The reason for this is that while it is becoming easier and easier to forecast global oil supply, the demand side is a guestimate. To make matters worse, if you miss global supply or demand by just 1%, that could imply a difference of $65/bbl WTI or $95/bbl WTI.

However, it is not as bad as weather forecasting. I've seen from experience just how crazy weather model roulette can be, and thankfully, oil balance forecasting is not like that.

With that being said, the 1st and 4th quarters of any given year are the most important in global oil supply & demand forecasting. Why? Because how you exit a year is how you start calculating balances for the next year, and how you start a year is how you calculate Q2 and Q3. As a result, it is paramount to get the 4th quarter of any year correct, because it directly impacts how balances look for the following year.

So when you look at IEA's projection of a surplus market, you need to first figure out how it estimated Q4 2023 balances. And what a surprise I have for you today.

Here is IEA's explanation for Q4 2023 balances:

Source: IEA

Now what you will notice is that total observed stock changes in Q4 2023 came in at -400k b/d. This is lower than the -1 million b/d we had expected. and we wrote about why that was the case in previous reports (hint: lower demand from China).

But as the IEA casually explained, the draw is in stark contrast to its model of +770k b/d. As a result, there must be some unexplainable variable for the missing ~1.2 million b/d.

Instead of revising its historical figures to match reality, IEA does the opposite. It assumes that its model is correct and reality is hiding something. What do we call this phenomenon in finance? Anchoring, confirmation bias?

Now the issue with this is that because the IEA is off by 1.2 million b/d, and it is choosing not to revise any figures, it is using this erroneous balance and projecting it into 2024. And this is where that surplus balance in 2024 is coming from!

This is why readers need to be aware of how IEA forecasted Q4 2023 balances to get around to its 2024 balance.

Nitpicking, but there's more...

Now aside from the fact that IEA is off already on its balance by 1.2 million b/d, there are more issues we see in the table.

For example, IEA was off for Q4 2023 because it used ~13.3 million b/d for US crude production vs the reality of 12.921 million b/d (please read this article as to why).

And because it is using an estimate that's nearly ~400k b/d higher, it is also overstating 2024 balances by 400k b/d. (Analysts use Q4 figures to extrapolate (excel drag) into the following year)

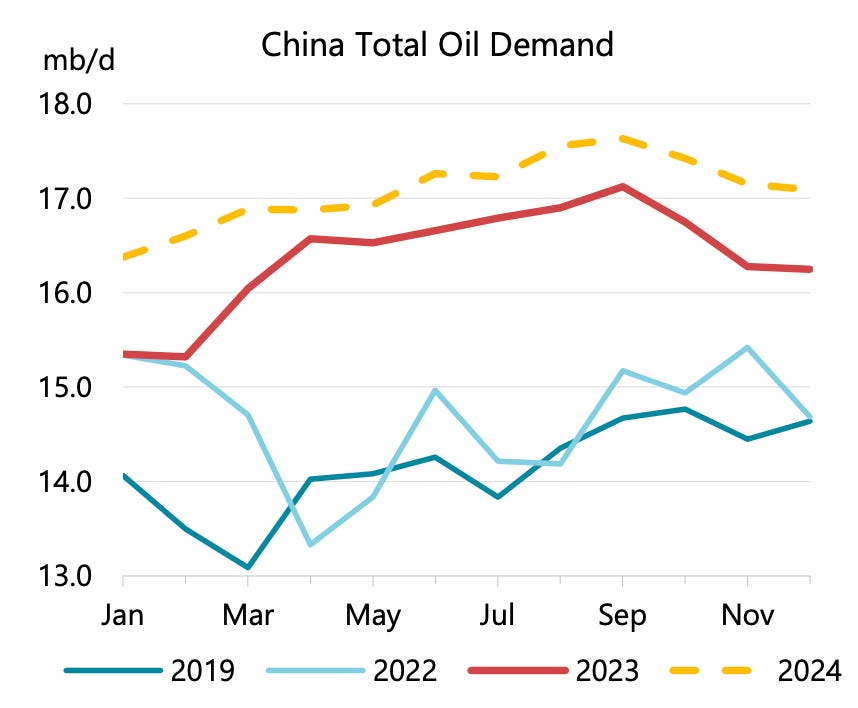

Now if you also assume that the IEA was too bearish on implied Chinese oil demand, then that likely explains why an additional ~800k b/d was missing from its balance.

Source: IEA

So no, we disagree with IEA's assumption that the 1.2 million b/d was just "missing". Instead, we think it is just bad modeling that explains the difference in reality.

Conclusion

Don't be fooled by IEA's projection for a vastly oversupplied oil market in 2024. As we explained above, the ~1.2 million b/d delta is manifesting itself in the erroneous assumptions it is using for 2024. In addition, the underestimation of Chinese oil demand coupled with overstated US oil production likely underpins why the IEA was so off.

For readers, the reality is far simpler than this. Look at global oil inventory changes in Q1 and into Q2, and if the market fails to build, then it signals that balances are far tighter than what's on paper. Focus on reality, and don't be like the IEA.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.