By: Wilson

We live in an interesting time. President Trump held a meeting with some of the top energy executives this past Friday, and the mandate from the top is to have US oil companies invest huge sums of money to revitalize the Venezuelan oil sector. Meanwhile, the President also wants $50/bbl WTI.

You can’t have your cake and eat it too.

As we detailed in our piece on Venezuela, it will take years of capex and billions of dollars before we see any meaningful increase in Venezuelan oil production. The first major hurdle is the legal framework behind any joint venture deals going forward. Some questions that oil majors will want answers to are:

What is the royalty split with PDVSA?

Who controls the barrels? (i.e., extraction, handling, loading, selling, payment)

In the event of another government change, what’s the clawback and legal mechanism to protect the investments?

Will there be enforcement in the event of theft and other illegal activities?

The questions go on and on, and until the new government is stable and there are legal frameworks in place that make any future deals bulletproof, Venezuela is uninvestable, period. Exxon’s CEO isn’t wrong and the truth hurts, but what no one seems to be talking about is the other point that was made last week.

WTI at $50/bbl makes the entire energy sector uninvestable.

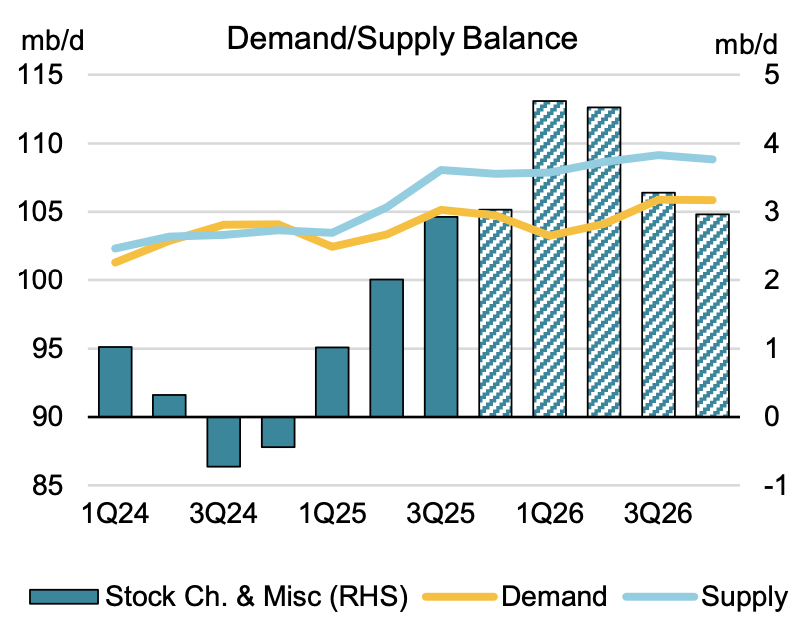

And there lies an even bigger issue on the horizon. Just as the world is about to find out how much spare capacity OPEC+ holds today (watershed moment of 2026 write-up), non-OPEC supply growth ends at the end of 2026, and the current administration wants even lower oil prices. This won’t end well at all.

Sentiment Bottom

Towards the end of 2025, we took our XLE short position off the table.

Why?

It’s too much of a consensus trade. Everyone appears to be bearish on oil. Some of my favorite sentiment indicators are flashing right now, and here they are:

Cramer

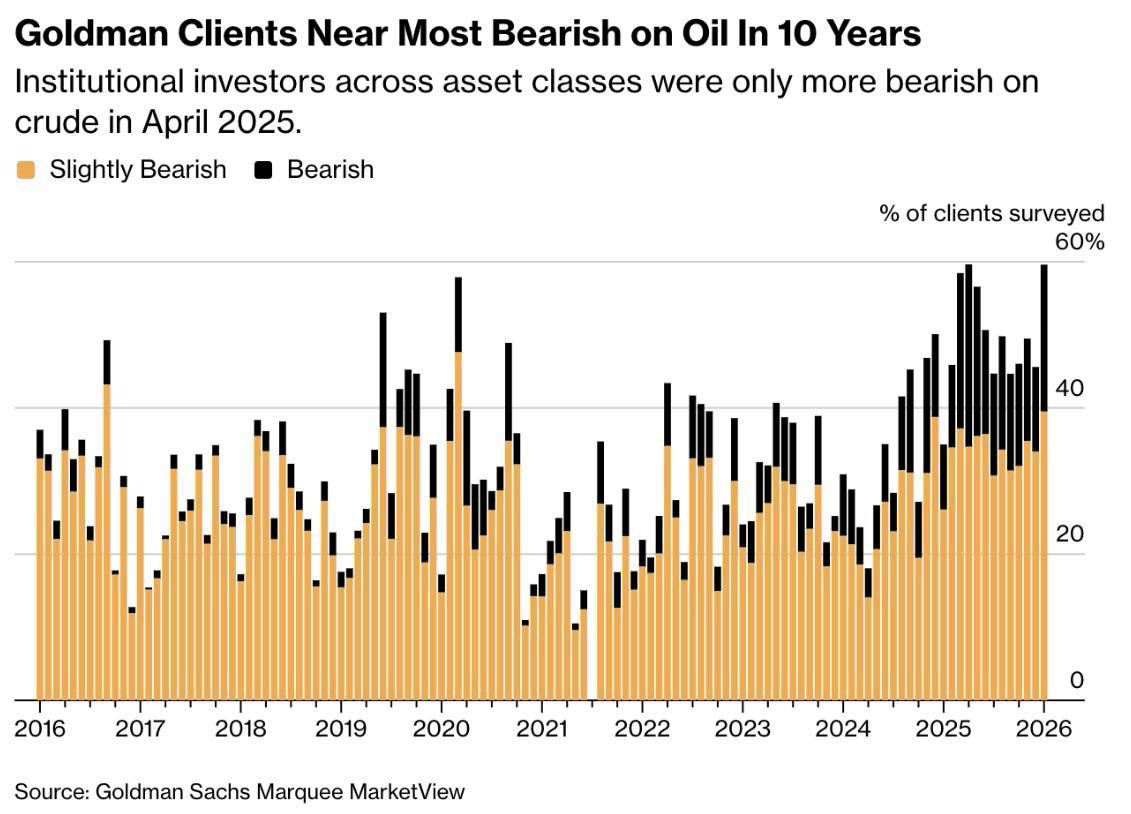

Goldman’s Clients

IEA

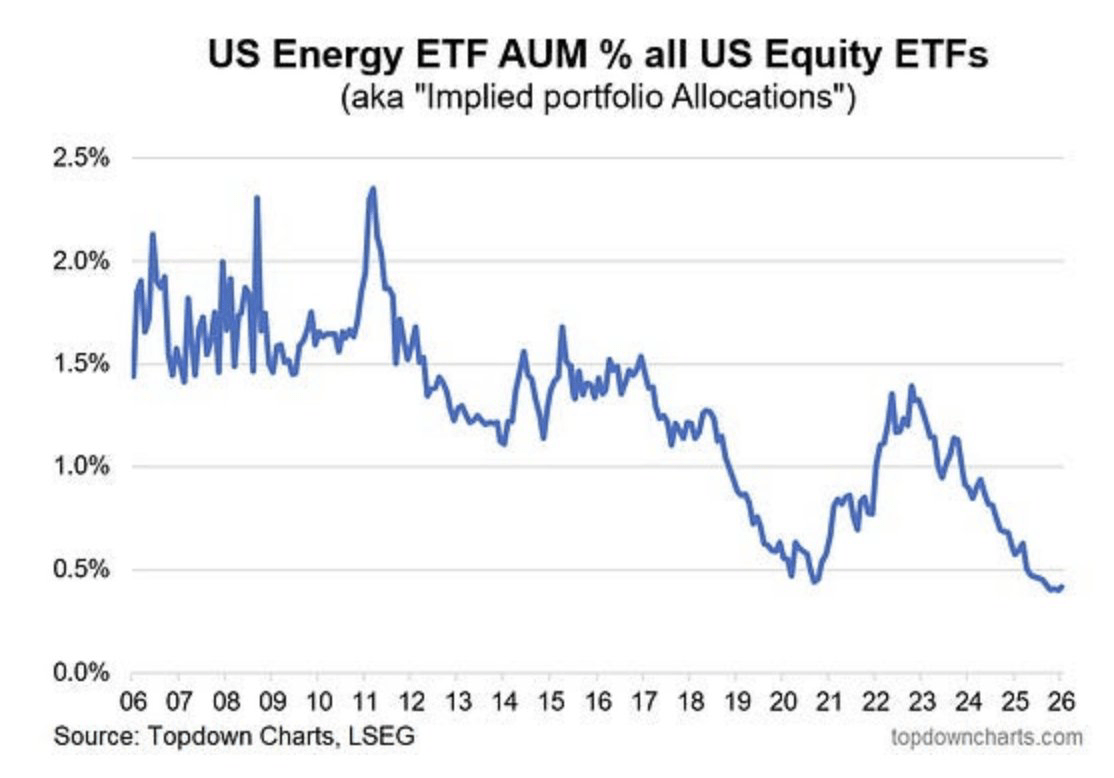

Energy as a % of US ETFs

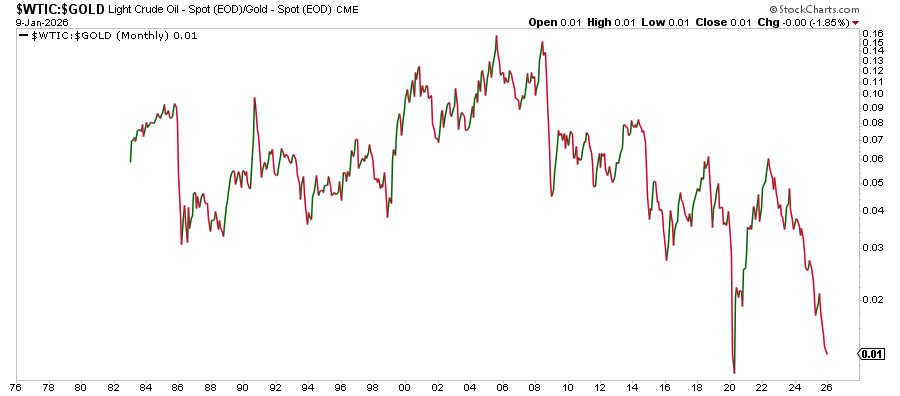

WTI to Gold

The key lesson I’ve learned from my years of following the oil market is that fundamentals do not call bottoms or tops; sentiment does. And if there’s one thing common, it’s that the world is almost universally bearish on oil today.

Fundamentally, one can make the argument that the “bottom” won’t happen until H2 2026, but the oil market never bottoms or tops when you want it to. If there’s a bottom, it will likely coincide with some significant news event (such as a peace deal or the like), and people will think we will have a surplus forever. When that happens, you will see us get really aggressive on the buying.

Until then, it pays to keep following these sentiment indicators. Perhaps it gets worse, but bottoms take time, and if you remember in 2020, the catalyst to buy (with the least amount of risk) was when the Pfizer COVID vaccine was announced. The signal will be obvious; you just have to pay attention and care.

Rant Time

It frustrates me to no end when people think cheap oil prices will last forever. It won’t. To understand why the oil market is where it is today, we all have to be thankful for the Permian. Without this play, we would all be trying to figure out where we can find supplies to meet the insatiable demand.

Again, for those keen on statistics, here they are:

Permian added 4.72 million b/d of crude oil production since 2015.

OPEC+’s effective spare capacity today is 1.73 million b/d.

Delta = ~3 million b/d

If oil prices averaged over $100/bbl, would we have been able to supply the ~3 million b/d difference? Maybe, but the Permian did it with oil averaging in the $60s. And it’s evident by the competitiveness of the Permian that no other plays in the world could even come close.

But the Permian isn’t forever. There’s an end, and Exxon is eating all of the last low hanging fruits from its acquisition of Pioneer. Yes, the Delaware Basin outperformed a lot this year allowing Exxon to be the only producer to show material gains y-o-y (+300k boe/d , almost the entirety of the US crude oil production increase), but Midland Basin wasn’t so fortunate. Producers like Diamondback are instead opting to save the best for when oil prices are higher, as any competent/disciplined producer should do. But the Exxon growth spree has an end to it too.

By 2030, Exxon expects total liquids in the Permian to grow by ~800k boe/d, and that’s it. No more growth, plateau forever, and this is just a few years away. What happens after 2030? Where will we find another Permian? Guyana, which was supposed to be the largest offshore oilfield discovery over the last decade will only supply ~1 to ~1.3 million b/d of supply growth by 2030.

Without another Permian, the world won’t be so lucky. The low oil prices we are seeing today won’t last, and sadly, it’s too little too late already. Oil is uninvestable in a lot of people’s mind and energy companies have taken note. Instead of reinvesting excess free cash flow in exploration and development, companies are instead buying back shares and paying dividends. Yes, shareholders will benefit, but the world is more f***ed.

It is what it is.

All the while, the current administration, which is supposed to be pro-energy, is actively trying to push oil prices into the low $50s, making oil, already uninvestable, more uninvestable. What a bizarre time we live in. You would think that with Chris Wright at the helm, the administration would have a better pulse on the realities of the US shale industry, the very industry that saved the world from what would have already been a global oil supply crisis. Instead, they are trying to slow it down.

It is what it is.

Whatever happens to the oil market in the years to come is the result of everything we’ve done up to this point. After being beaten down for 12 years, most people have forgotten what it’s like to set a capital budget without being paranoid about prices collapsing in the months ahead. What about demand? What about OPEC? The constant paranoia will impact capex spending for years to come even if oil prices move higher. That’s what happens when you structurally beat down the very industry that’s keeping the world running. But again, it is what it is.

The truth is $50 oil is uninvestable. You can’t make fairy dust numbers work. The truth will be obvious in the months and years ahead, and I hope we can look back on this memo and realize what a precarious time we’ve lived through.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FANG either through stock ownership, options, or other derivatives.