By: Wilson

I feel like I'm writing an awful lot of memos lately, but I can't help myself, the stories are too juicy to pass on and the opportunities are too plentiful.

With each passing day in the market, value investors are becoming increasingly scarce. For some, they have doubled down and really embraced the art of value investing. For others, they are giving up and buying into the hype.

Aside from the usual suspects (AI and crypto), a new buzzword has entered the investment lexicon, quantum computing. After Google's announcement that it had a "breakthrough" in quantum computing, anyone associated with the catchphrase is getting bought. That's how beautiful algo trading really is and I just can't help but be jealous of the glorious trading systems they have made.

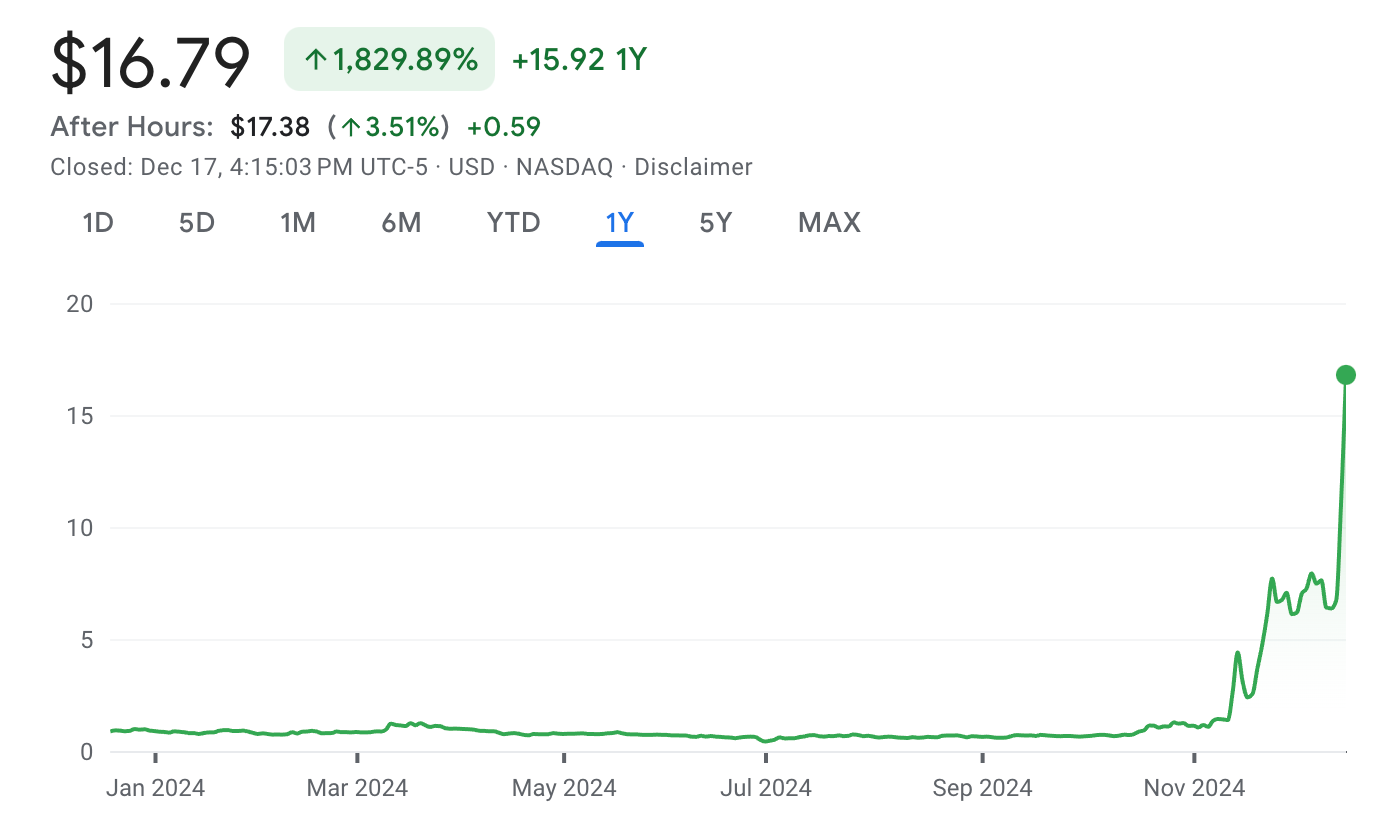

But in the clearest example of market euphoria, I present to you exhibit 1,278,890: Quantum Computing Inc. or QUBT.

The stock price is up 51% today after announcing that it won a contract with NASA for a grand total of... wait for it... $26,000.

No, I am not missing any zeroes there. The market cap, as a result, went up a staggering $531 million.

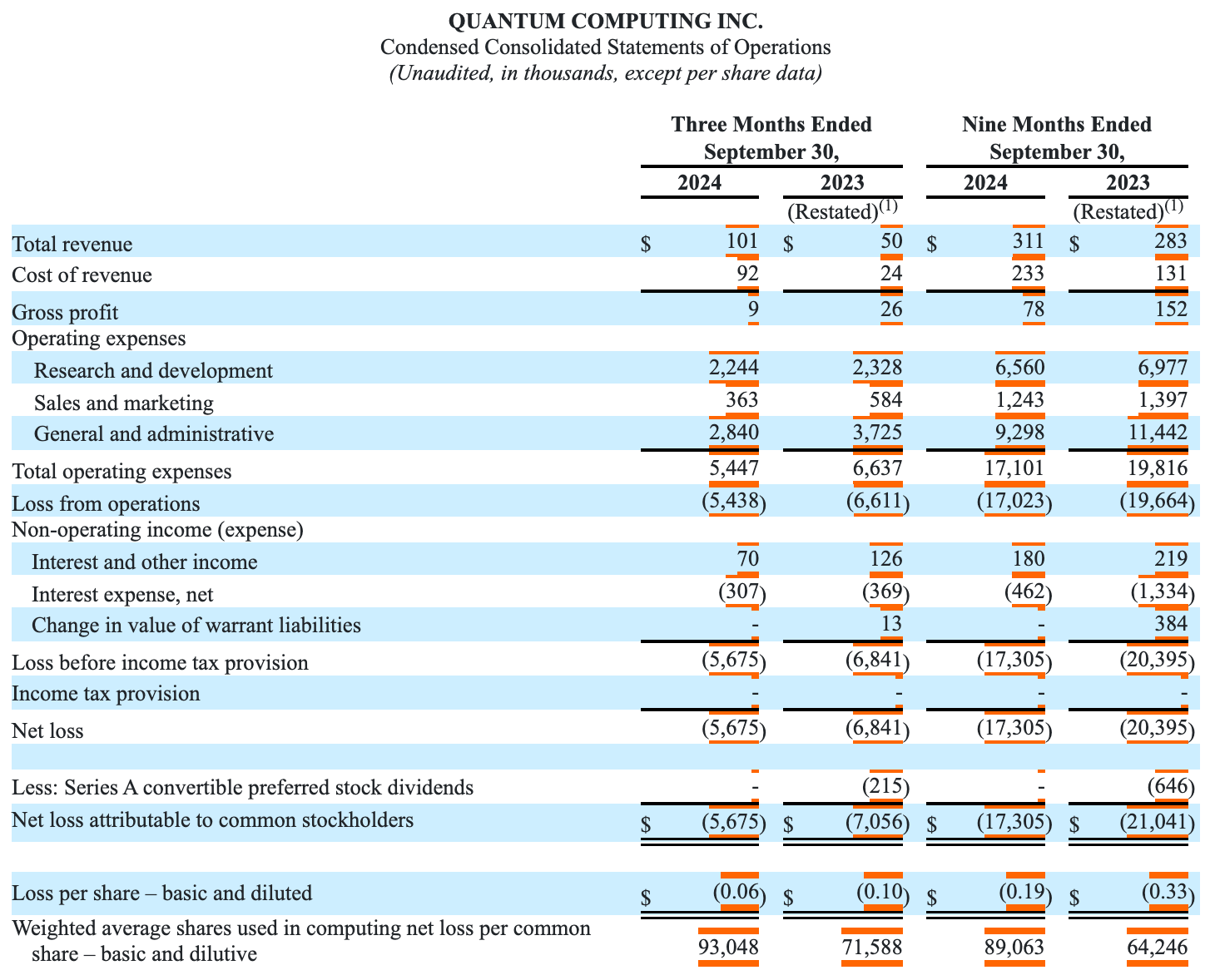

What's even more remarkable about this story is that if you look at the financials of the business (no one does today, but what the heck):

It has total revenue over the last 9 months totaling $311,000. Again, I am not missing any zeroes.

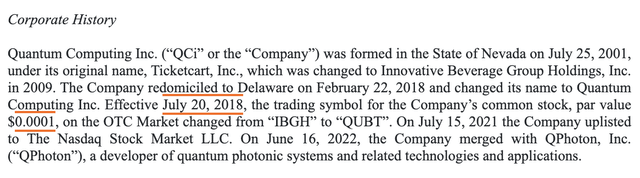

In fact, what's even more entertaining about this story is that the company used to be called Innovative Beverage Group Holdings up until 2018.

Source: 10-Q

I wish I were making this stuff up. I'm not. At times, it feels like we are living in a simulation as opposed to reality.

Screaming Into the Void

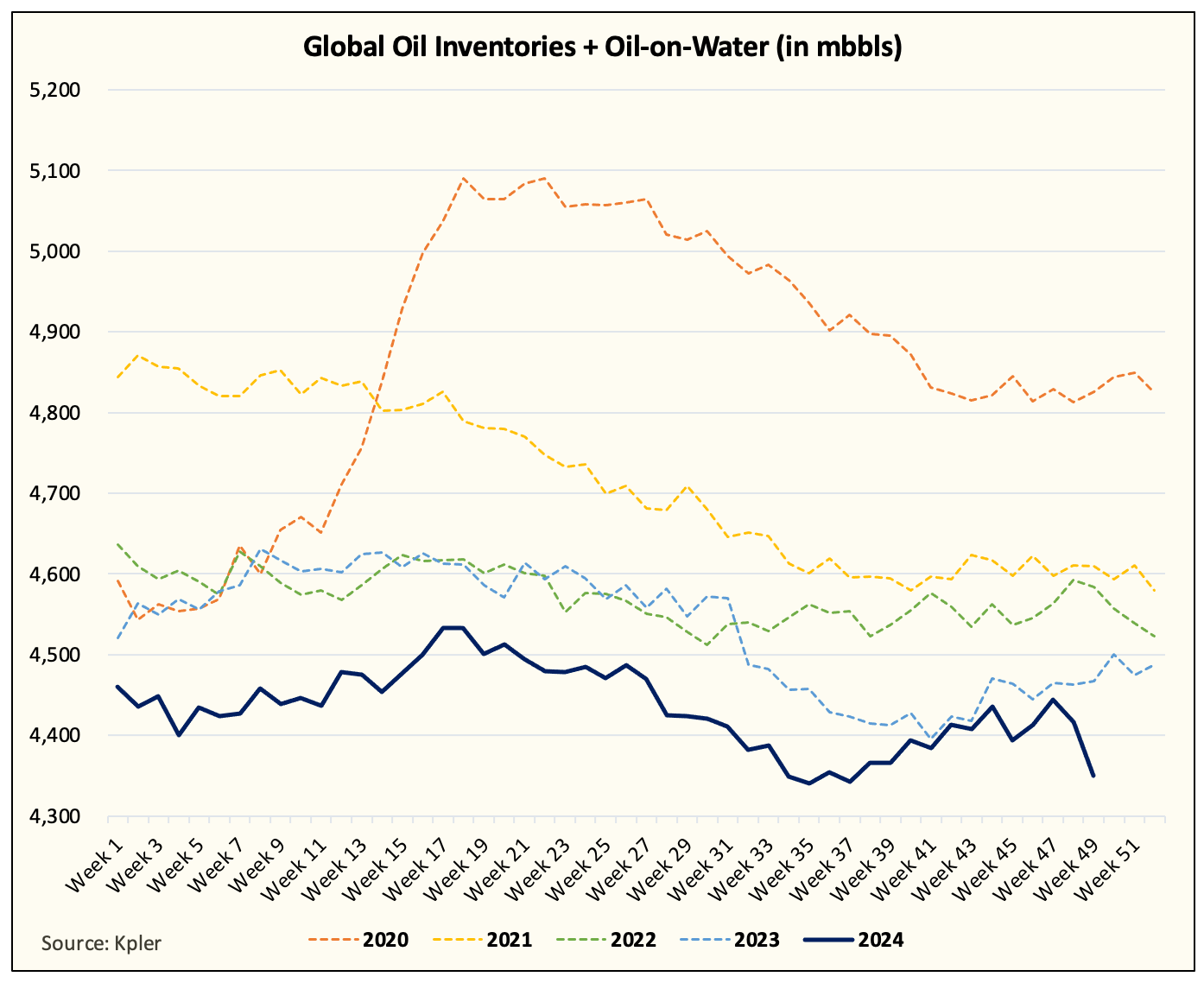

Earlier today, I read a great tweet from JH. He's been a long-time subscriber and he's excellent in oil trading/analysis. I won't post the entirety of the tweet here as it's very long, but in essence, he's pointing out the fact that physical oil market timespreads are disconnected from the perception that there will be large builds in Q1 2025.

This is something we pointed out in our oil market report last week titled, "This Doesn't Make Any Sense."

But as I read his argument, I can't help but feel like we are just screaming into the void. I mean seriously, who's listening?

Fartcoin has a market cap of ~$900 million and global oil inventories are heading into year-end at the lowest level in the last 5 years.

No one cares. And sadly, no one will care for a while longer, so if you think this trend will suddenly change, I have a news flash for you: it won't.

But like all the things insane in this world, insanity usually doesn't last. Things can temporarily get out of hand, but reality eventually sets in.

The only problem with this eventual outcome is that people, along the way, usually don't make it to see the light at the end of the tunnel.

Whether it's the pain of not being able to tolerate a 13-year-old making more money than you (I'm only half joking), or whether it's not being able to stay disciplined in your process as your holdings continue to fall.

Whatever the case, most people don't make it.

And with value stocks now down 12 days in a row, the longest stretch in history, I suspect a lot of people won't make it out of this.

But if you are somehow alive and reading this memo, you will know that perhaps now is not the time to give up. Perhaps there's never been a better time to become a value investor. I guess it's something we will all have to live through to know the eventual outcome.

Who gets the last laugh? I don't know, but I don't think it's the hype bandwagon guys.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

This is excellent. I've forwarded to a couple other near-suicidal value investors 😆

Totally agree…keep up the good work!