(Public) OPEC+ Gameplan

Real spare capacity is far lower than you think. Rip the band-aid off now.

Editor’s Note: This article was first published to paid subscribers on April 23. Given the news release today of OPEC+ announcing another truncated production increase for June, we thought it was a good time to share this.

In this article, I will expand on the OPEC+ policy I detailed in last week's OMF titled, "My Latest Thoughts On The Oil Market And Where We Are Headed."

We saw headlines today from a few OPEC sources suggesting that another truncated production increase could be proposed for the upcoming June meeting. This time, Kazakhstan is the cause, and its overproduction is causing other OPEC+ members to call for a faster increase.

As I wrote last week:

I am going to be more contrarian here and predict that OPEC+ will accelerate the production increase faster than expected throughout 2025.

This is a major viewpoint shift from my angle, and I will explain why.

There's no scenario where Russia, UAE, Kazakhstan, and Iraq will compensate for the overproduction. No scenario.

Once you are a cheater and the Saudis acknowledge it, there's no turning back. And since the Saudis are actually tracking all the right stuff now (exports and not reported production), it's obvious to them that these perennial cheaters will continue to cheat.

But as I will explain in this piece today, there's more to this than meets the eye.

OPEC+ Gameplan

Oil is stuck between a rock and a hard place today. From demand concerns over the looming tariff war and the faster-than-expected production increase from OPEC+, it's fair to assume that traders and investors feel skittish about investing in oil.

But this is where things get interesting. Reality is not aligning with perception, and this has been the case with oil for a while now.

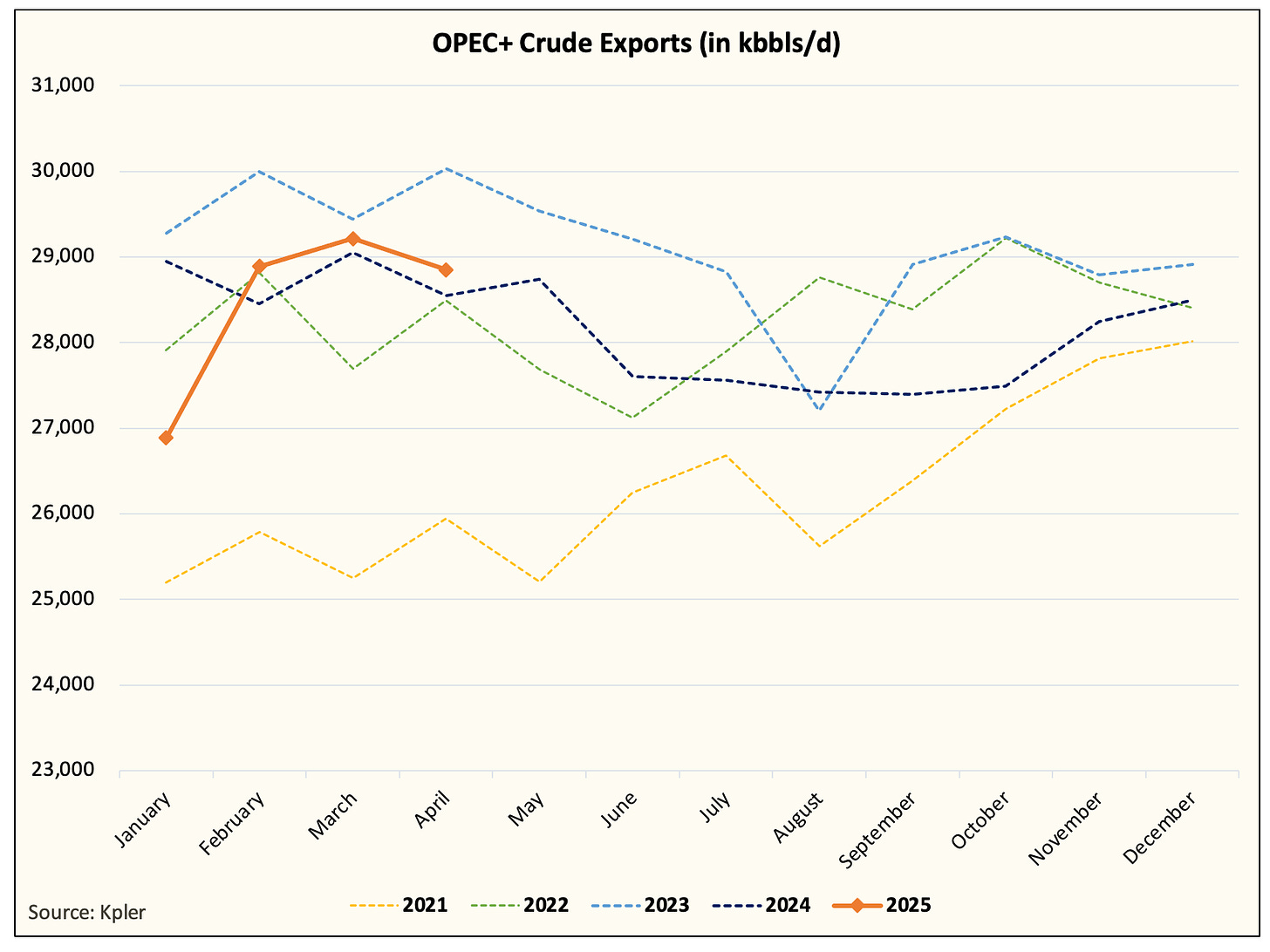

Take, for example, the latest OPEC+ crude export figures for April. Finalized figures are not out yet, but it appears that we are going to trend lower month-over-month despite April being the 1st production increase month following the pause.

In particular, Saudi crude exports have been much lower than expected.

And as we've seen in the past, because the production unwind is voluntary in nature (production cut was voluntary), Saudi can publicly announce a production increase, but keep crude exports low.

What are some potential benefits of that?

Well, from a political standpoint, the Saudis could appease Trump by telling him that they are increasing production, but the reality could be that they are keeping exports low to keep the market tight.

From a fundamental perspective, publicly announcing higher production without actually increasing production could result in a sentiment hit to US shale, just as demand uncertainty builds. This would push capex lower, which would lower US oil production.

And since the announced production increase doesn't actually translate to more supplies, physical oil inventories can remain tight allowing Saudis to keep prices elevated.

Finally, a truncated production increase timeline also solves the issues of the "cheaters" of the group.

Here's a chart perfectly illustrating why the production cut isn't really a production cut at all.

Since the start of the OPEC+ production cut agreement, Saudis are the only ones cutting production.

UAE crude exports have remained elevated.

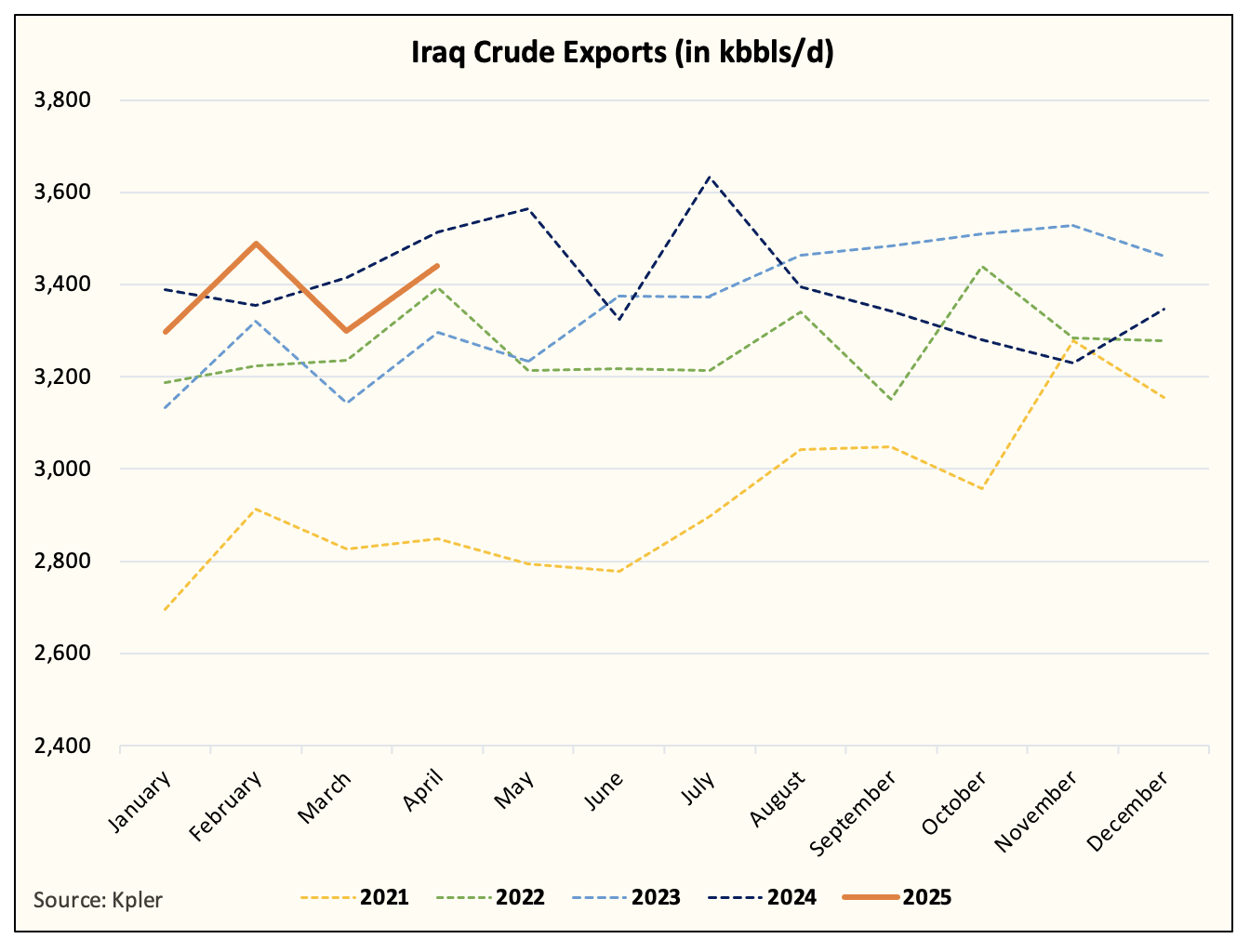

The same goes for Iraq.

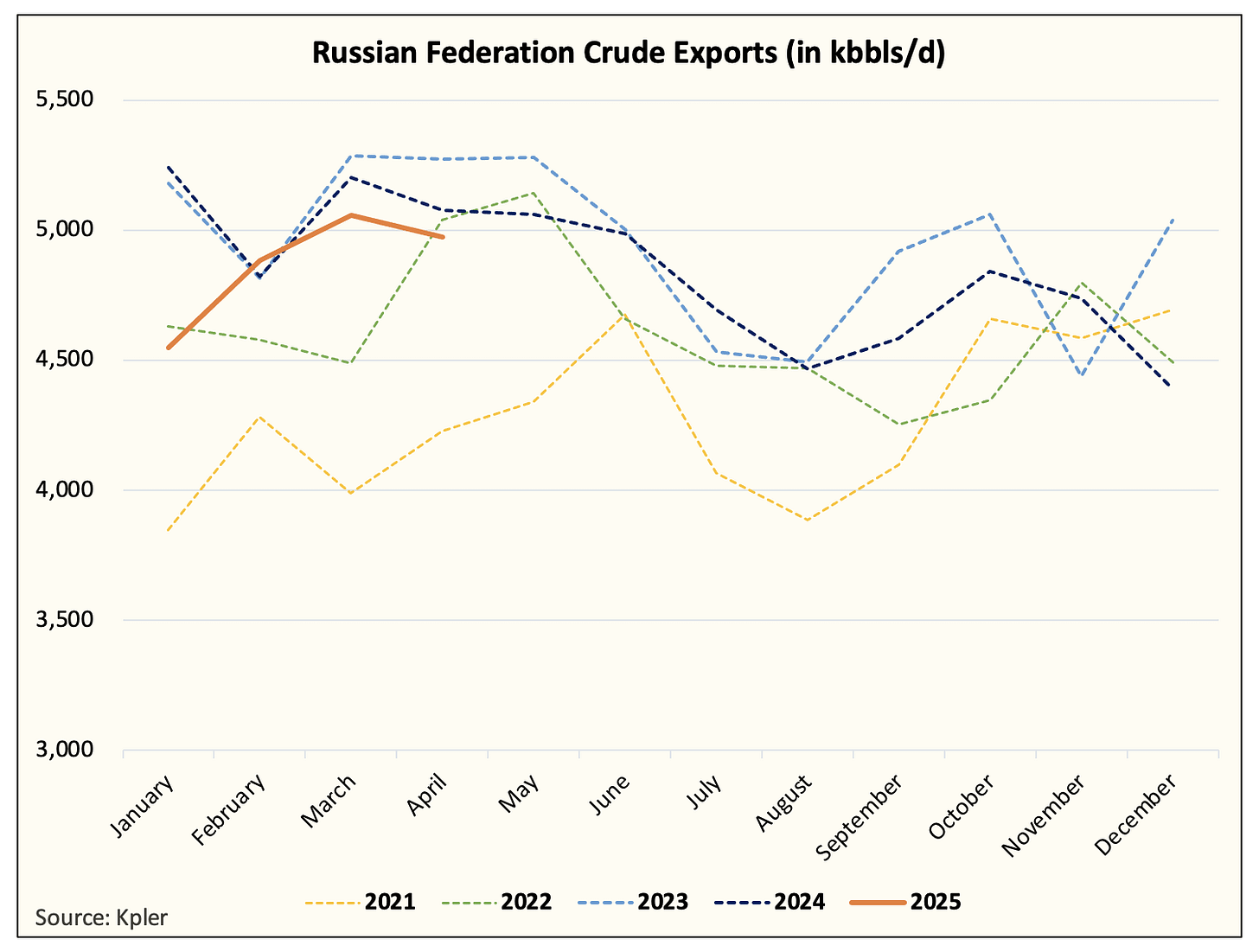

And the same for Russia.

Framing this in another way, here's the math:

OPEC+ crude exports April 2023 - 30.03 million b/d

April 2025 - 28.325 million b/d

Delta - 1.705 million b/d

Saudi crude exports April 2023 - 7.5 million b/d

April 2025 - 5.839 million b/d

Delta - 1.661 million b/d

Do I need to say more?

No, and that's my point. It's never been a cohesive production cut. The cheaters have been cheating this entire time, so the only real production cut here is coming from the Saudis.

Did the deal prevent the cheaters from producing more?

Possibly, but the reality here is that the cheaters have been cheating, so without a meaningful production increase from the Saudis, the truncated production increase is more sentiment than fundamental.

What's the game plan?

Simple, the band-aid is already off. US shale oil production has already started to slow meaningfully. And since this production increase is not a real production increase, you might as well rip the band-aid off now.

Market sentiment will remain dismal, which will translate to lower capex from US shale, resulting in lower production. Saudis will take advantage of this by slowly releasing barrels back in the market (~1.7 million b/d).

In the meantime, the no real production increase (production increase policy) won't impact the physical market, which would keep physical oil inventories tight.

OPEC+ or the Saudis had to find a way to unwind the paper barrels that were being used as spare capacity, so by doing it now, the timing is rather perfect:

Appease Trump.

Possible Iranian sanction enforcement.

Lower US shale oil supplies.

No impact on the physical oil market storage.

Timing

Tariff uncertainty continues to cast doubts on market participants. With Q1 earnings coming out now, US shale producers are already starting to announce some capex cuts. Matador announced that it is cutting capex by $100 million and dropping from 9 rigs to 8. This should be echoed across the industry, which I think will give the Saudis more reason to expedite the production increase.

As US shale continues to drop rigs and reduce capex, Saudi will use this to increase the baseline to the point where the cheaters will no longer cheat if they produce at the current level. This could imply another 3-month production increase in June, followed by another increase in July.

From a sentiment perspective, this would keep a ceiling on oil prices just as the summer demand season gets underway. And if our oil supply & demand model is correct, global oil inventories should remain tight, which would frustrate oil bulls to no end.

There will come a point later this year when the disconnect between reality and perception grows so wide, even a non-specialist observer can see the material disconnect.

What are the signs?

No meaningful increase in OPEC+ crude exports despite truncated production increase timeline (thanks to Saudis being the delta).

US crude oil production is showing meaningful weakness (real-time data).

Global oil inventories remain tight, and not only failing to build, but drawing.

Oil demand is weak, but not falling apart.

WTI is stuck at $60.

If all of those things happen and WTI is still stuck at $60, the setup will be so obvious, energy specialists might need to be admitted to the insane asylum, but I think that's just where we are headed.

The obvious is going to become so obvious later this year because perception "trumps" reality, and in this case, the fundamental reality will be our guiding principle.

Conclusion

It was never a cohesive production cut agreement from the beginning. It was always a Saudi production cut. The actual impact of the truncated production increase is more semantic than something fundamental, and those who don't understand that will continue to use this as a bearish signal, when it's really the opposite.

But as the perception of a faster-than-expected increase continues to pressure the market bearishly, energy specialists have to wait for the reality (no real increase) to set in. This will take time, and I think people will grow increasingly frustrated with the material disconnect that's going to take place.

So, yes, while I am saying that the production increase won't actually impact the market all that much, I am not saying to ignore the market price action implications of this. Oil will be negatively perceived because perception "trumps" reality.

There will come a time down the road when the obvious becomes obvious. That's not today, so don't be a hero.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Excellent analysis, thank you

Any meaningful reduction in shale production will take at least half a year to materialize. Companies have guidance figures, booked drilling contracts, hedges, as well as management bonuses to prioritize over short term profitability. Oversupply is a matter of going concern until either demand adjusts significantly higher on the back of much higher refining margins (which long predicted this crude oil downswing as I had kept highlighting), or supply adjusta much lower on the back of much lower prices. Prices need to be materially low enough and for an extended enough period to properly curtail drilling activity and affect production. People routinely overestimate US shale's ability or willingness to cut production — indeed, US shale production has consistently beaten predictions of peak and decline until now. This year the broken clocks may well turn out to be right, but unless a major crash happens expect that to look more like a gradual plateau rather than a precipitous decline.