Editor’s Note: This article was first published to paid subscribers on July 1. The data in this article was not updated to reflect the latest outlook. If you are interested in reading our latest oil market coverage, please see here.

On July 6, the V8 will meet again to discuss whether or not to announce another truncated production increase. Judging by the leaks so far, it appears OPEC+ or V8 will agree to another +411k b/d increase. But since this plan was first announced in early April (coinciding with the Liberation Day tariff announcements), the increase in OPEC+ crude exports has been nonexistent.

But this is not news to anyone that read our OPEC+ gameplan report. This is what we said:

It was never a cohesive production cut agreement from the beginning. It was always a Saudi production cut. The actual impact of the truncated production increase is more semantic than something fundamental, and those who don't understand that will continue to use this as a bearish signal, when it's really the opposite.

But as the perception of a faster-than-expected increase continues to pressure the market bearishly, energy specialists have to wait for the reality (no real increase) to set in. This will take time, and I think people will grow increasingly frustrated with the material disconnect that's going to take place.

So, yes, while I am saying that the production increase won't actually impact the market all that much, I am not saying to ignore the market price action implications of this. Oil will be negatively perceived because perception "trumps" reality.

With the meeting this weekend set to increase production by another 411k b/d, there will only be one truncated production increase left before all of the voluntary production curtailment disappears. At this point, the oil bears that pointed to the impossible task of unwinding production cuts will have to accept the reality: the production cut was never cohesive; it was a Saudi cut.

It Gets Interesting

For the next two months (July and August), OPEC+ crude exports will remain muted due to higher domestic power burn demand. It is, however, important to keep in mind that despite flat crude exports, the group's overall volumes are higher y-o-y by ~1 million b/d.

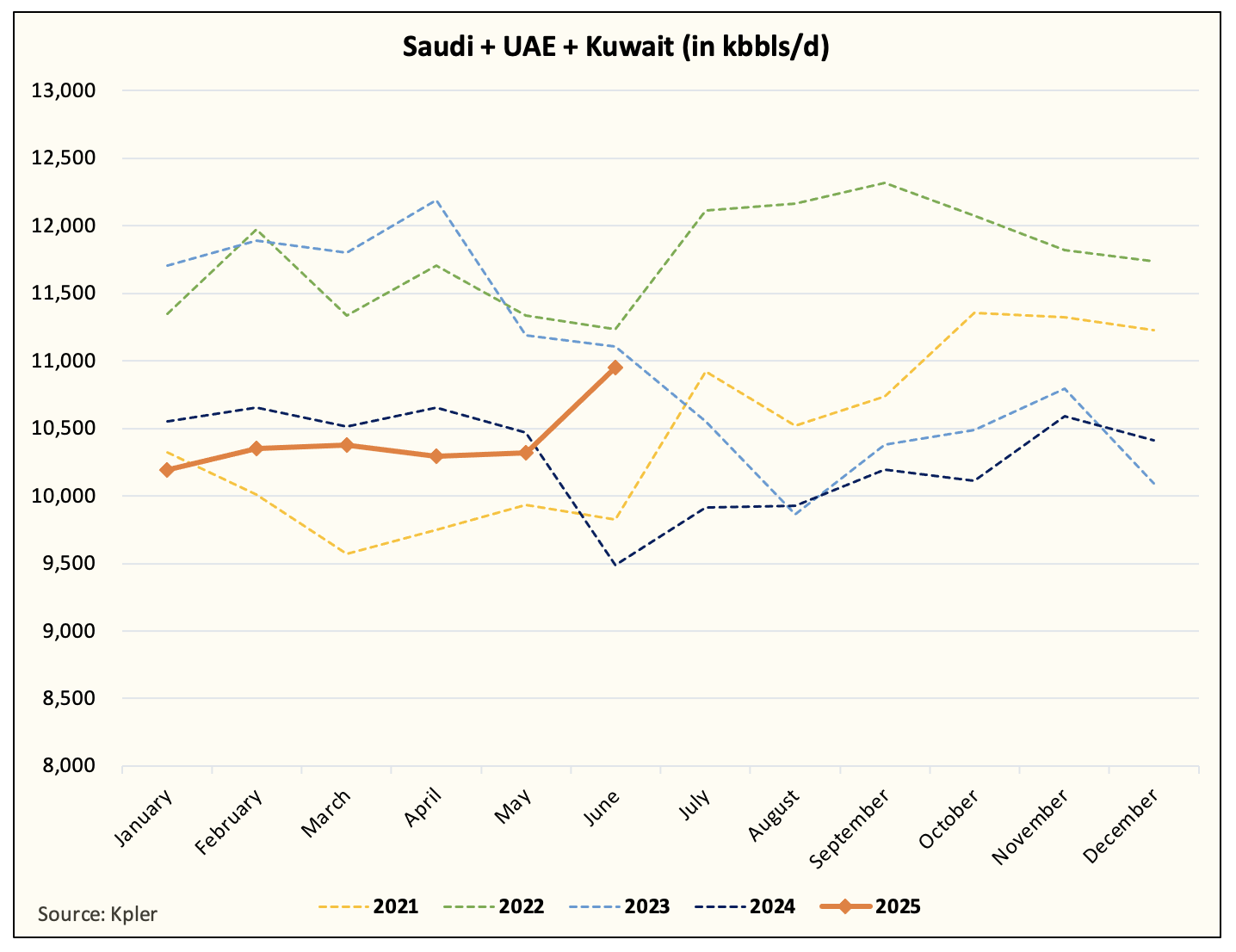

The entirety of the delta is coming from the Saudis. As we wrote before, the incoming production increase from the Saudis is real. For market participants who think otherwise, the chart above should dissuade you.

But looking at the dataset, it appears that both UAE and Kuwait are increasing exports alongside Saudi with Iranian crude exports offsetting to the downside in June (due to tanker loading lag).

In total, you can see that Saudi, UAE, and Kuwait crude exports are higher y-o-y by ~1.5 million b/d.

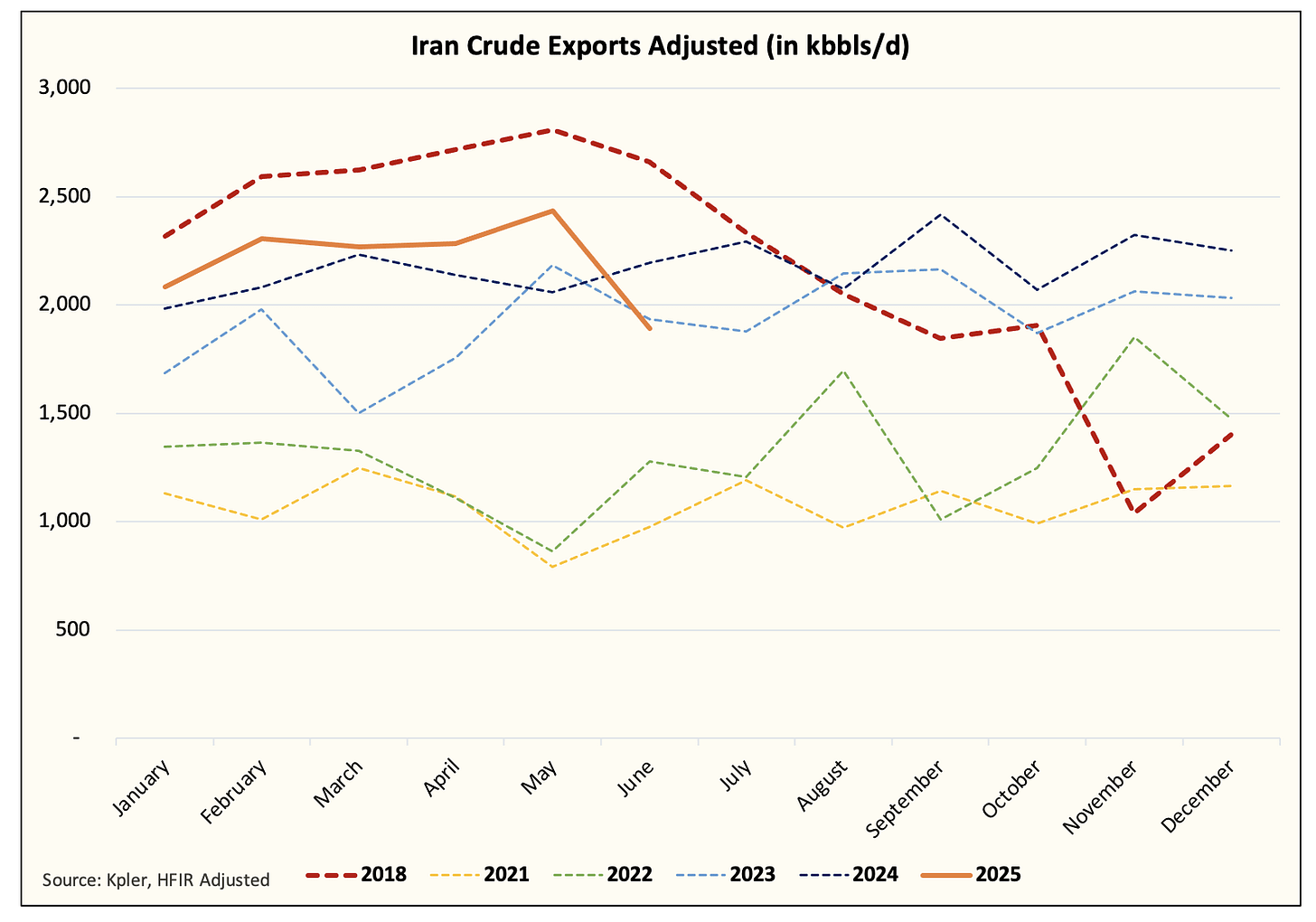

Iranian crude exports are down ~600k b/d m-o-m and slightly below the 2024 level. We do not expect this lower level to persist. The conflict between Israel and Iran likely resulted in tanker loading being delayed, so we expect overall OPEC+ crude exports to be higher in July.

So why am I saying this is getting interesting?

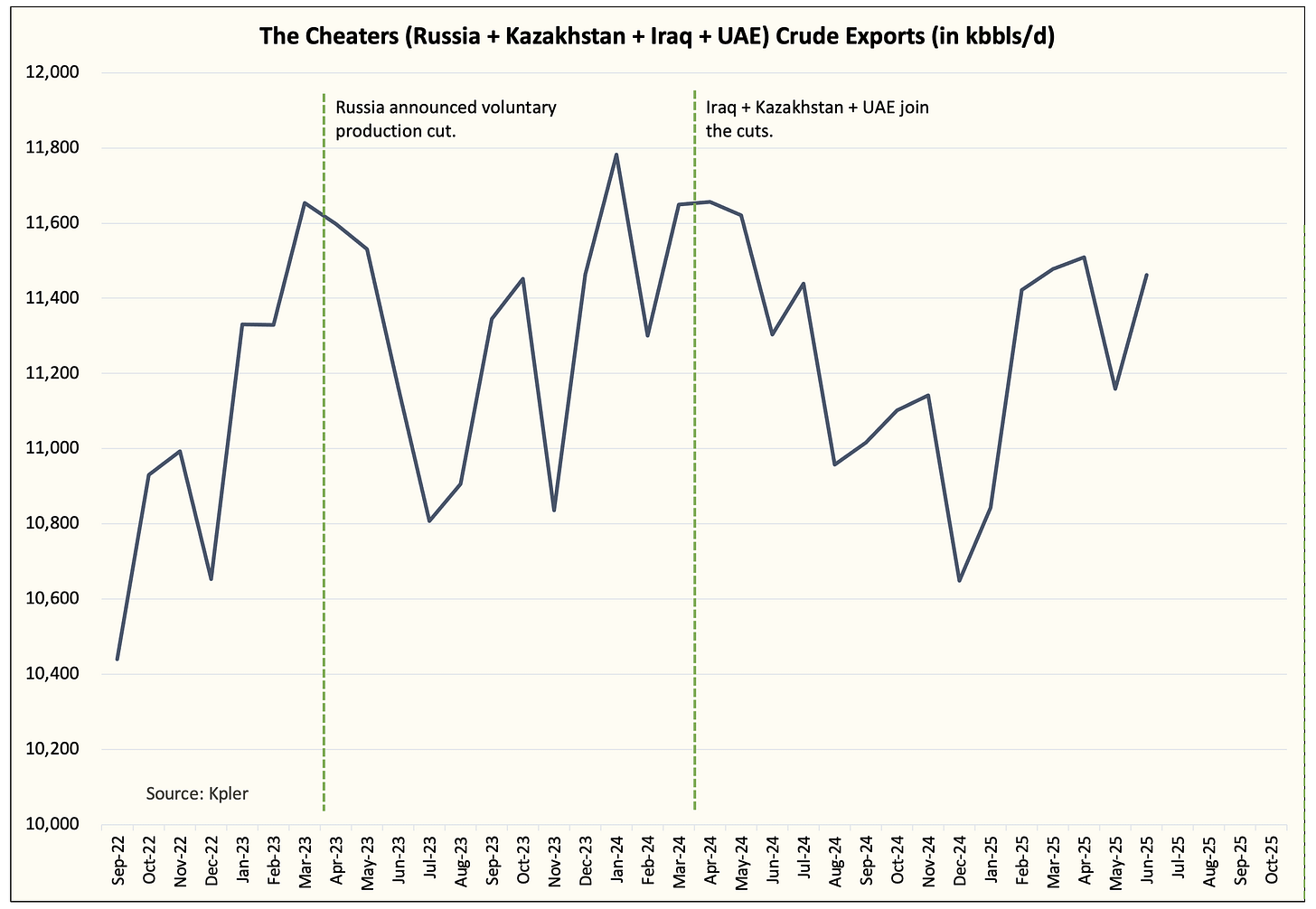

As we said in part 1 of this report, the cheaters have been cheating, so overall crude export volumes have not meaningfully changed despite the truncated production increases.

But on the other end, we know that Saudi crude exports are moving higher and will continue to trend higher into year-end. By our estimate, Saudi crude exports will reach ~7 million b/d by year-end or +700k b/d from June levels.

In order to offset this increase, US crude exports would have to drop ~700k b/d, or Iranian sanction enforcement would have to reduce exports.

For now, our base case shows US crude exports decreasing ~450k b/d by year-end. This should help offset some of the expected supply increases.

Higher demand will have to absorb the other increase to make sure the market is balanced.

As for the other producers, we think the UAE crude export increase is real, while the cheaters will continue to cheat (i.e. no material increase).

Fundamental Balance

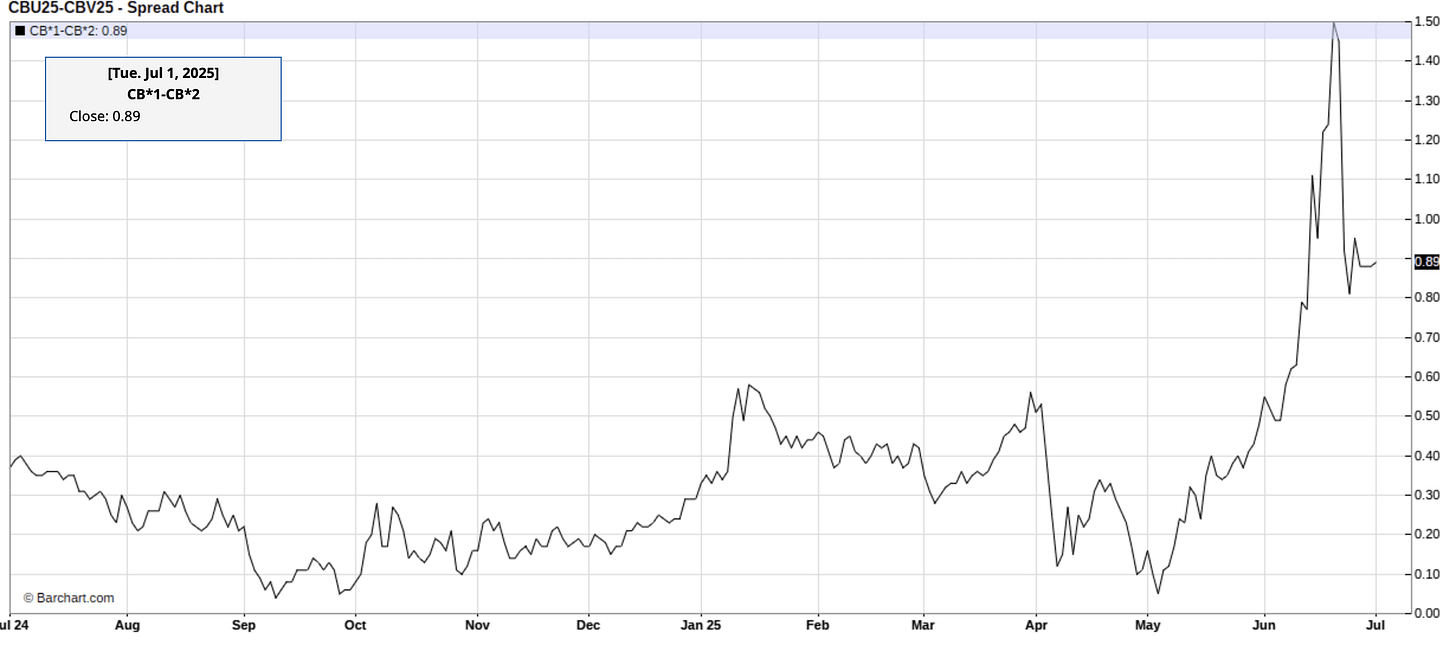

On the surface today, the oil market appears tight. Brent timespreads remain backwardated.

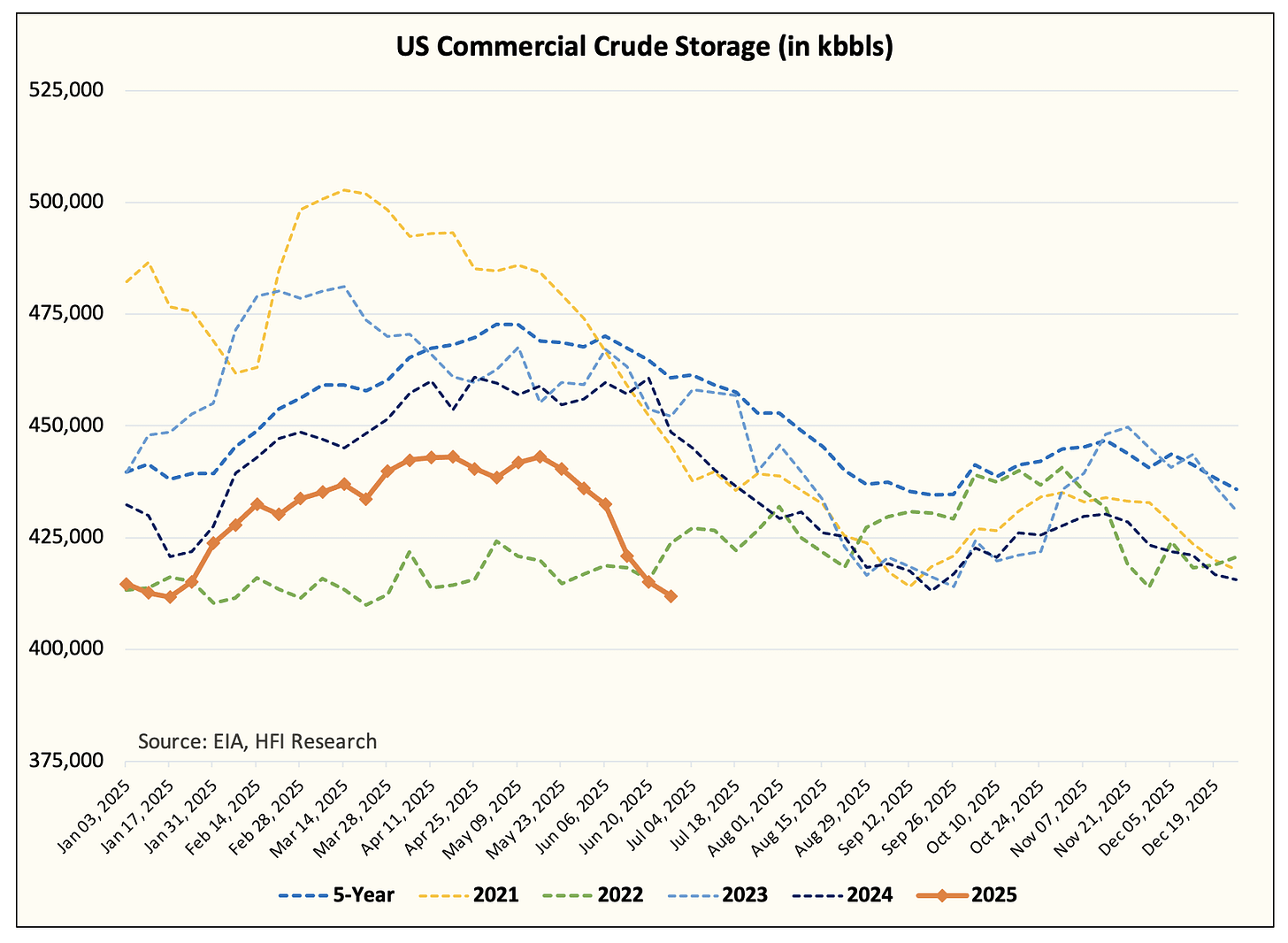

And oil inventories in the West appear very low.

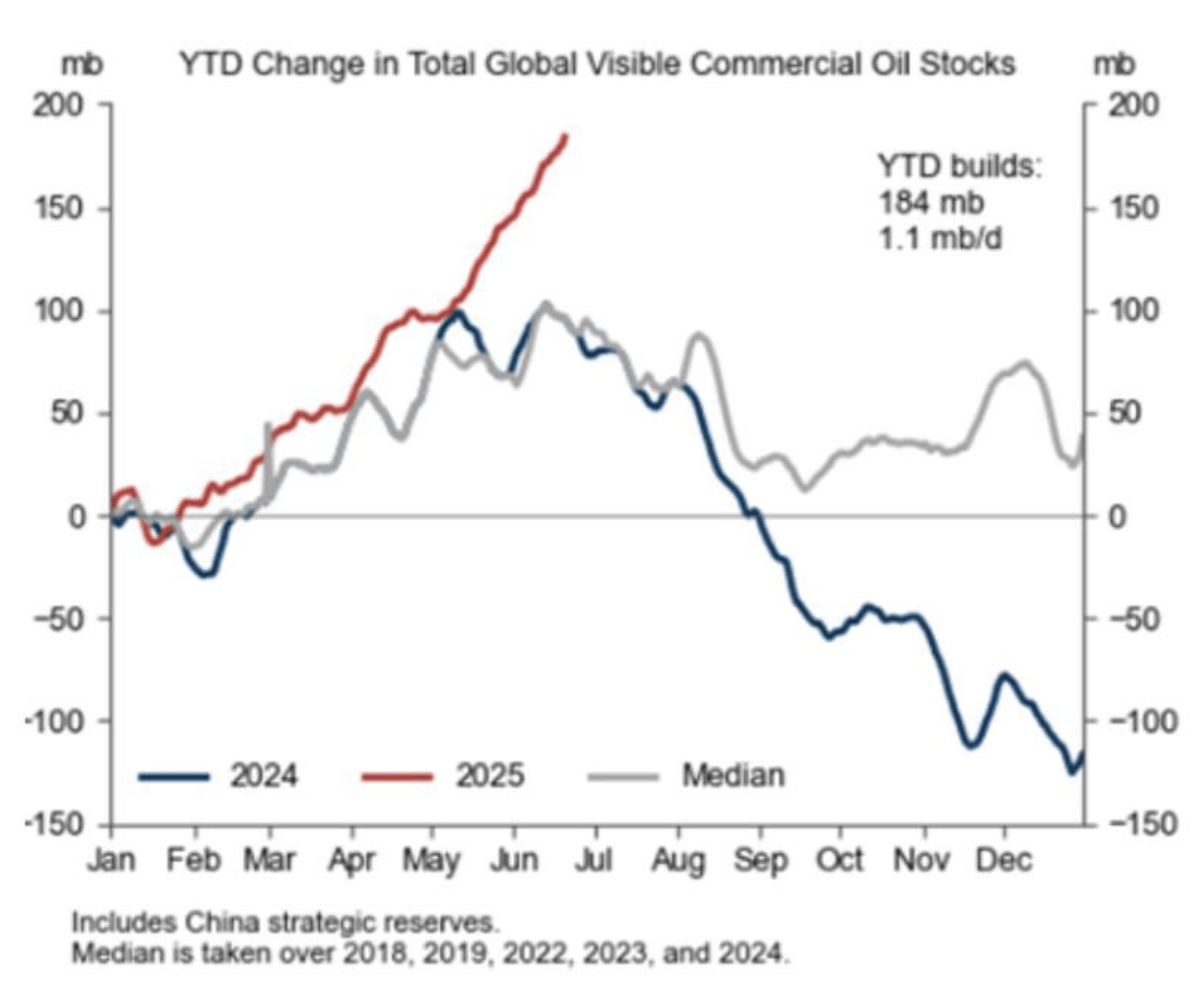

But the visible tightness we are seeing is illusory. Why? Because China has absorbed much of the excess in the market so far.

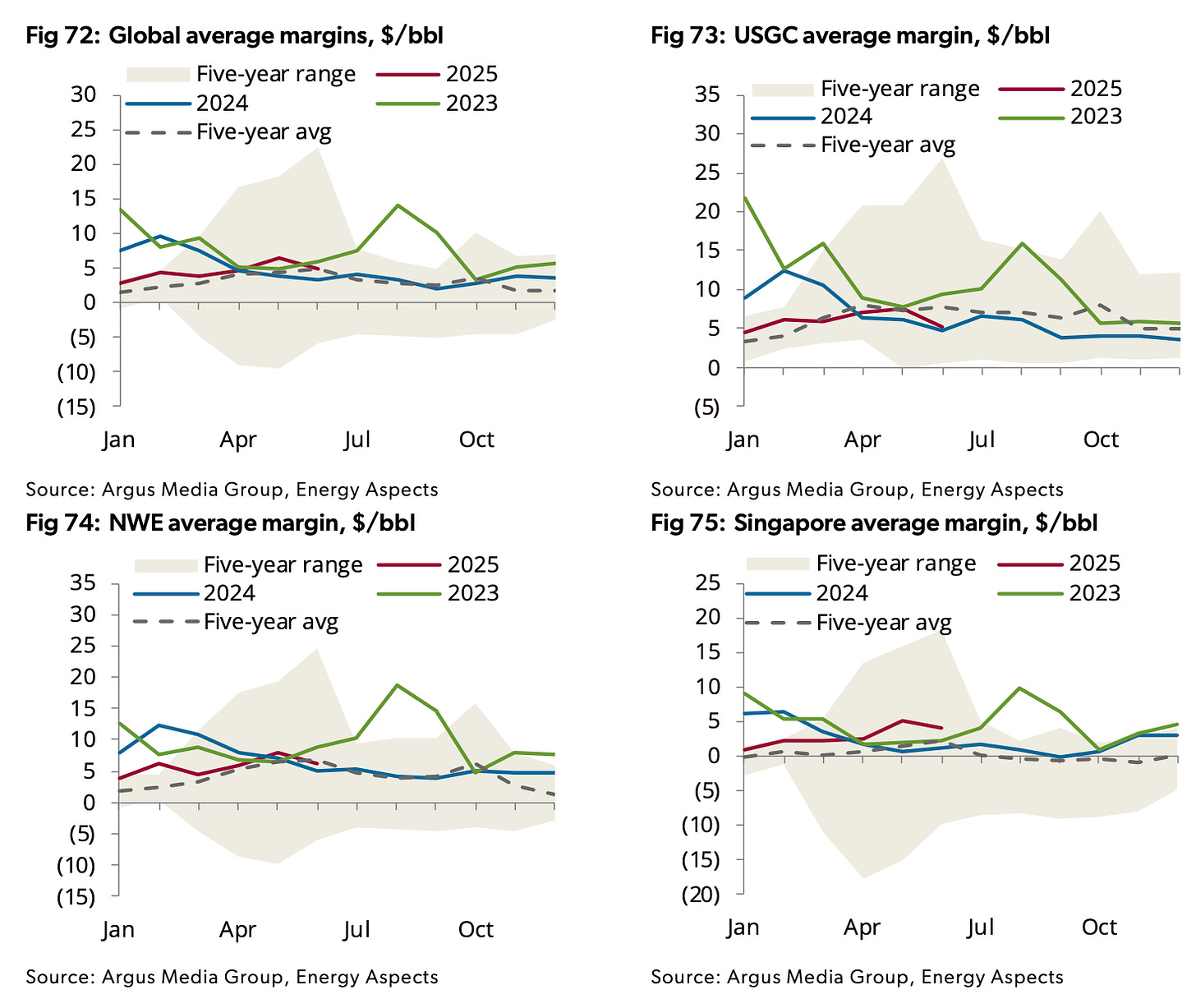

The "China put" in the oil market is when the Chinese oil traders gobble up all of the crude in the market to fill their SPR. In this case, you can see in the chart above that there have been a lot of builds that have occurred outside of the visible datapoints. This, coupled with refining margins remaining weak, suggests to me that the tightness we are seeing in the US is a false alarm.

What will likely happen next is for US crude exports to fall and US commercial crude storage to flatline. This would help tighten global crude inventories at the expense of builds in the US.

And to transfer the tightness from the west to the east, the following needs to happen:

Lower US crude exports.

Higher refinery utilization in the east.

China stops stockpiling crude.

But for the oil market, the moment China stops buying, the market will weaken. We've seen this time and time again. This time won't be any different.

What does all of this imply?

Oil's upside is capped.

While we are confident that the cheaters in OPEC+ won't show any material production increases by year-end, the production increase from Saudi will continue, which will keep a lid on oil prices.

The band-aid is already off, so the Saudis will want to keep that lid on US shale. For now, we do not expect US shale production to decline further from where we are today into year-end. Unless WTI averages in the low $60s, most of the decline is done.

Gameplan

Taking a step back, the Saudi game plan here is simple.

The cheaters inside OPEC+ were already producing well above quota. The truncated production increase resolves the cheating.

Because the voluntary production cut is voluntary by nature, Saudi can adjust crude exports depending on market conditions. China wanted more crude recently, so the Saudis gave them more crude. If there's an apparent slowdown in crude demand, Saudi's crude exports will reflect that. They won't flood the market just to flood the market, but we can expect crude exports to be materially higher than last year.

The production increase policy is meant to be both a sentiment hit and a capex deterrent. From a physical oil inventory standpoint, Q3 needs to demonstrate draws, or else the Saudis will have to quietly control supplies in Q4.

The endgame here is to control non-OPEC supplies via "production increases" while slowly bringing back barrels. Saudis will not want to intentionally flood the market and cause storage to balloon to uncontrollable levels. The mechanism has been to keep storage tight in "visible" data while feeding China's SPR needs.

So, for the analysts that continue to remain extremely bearish, we think the excessive bearishness is unwarranted.

But is it bullish? No.

There needs to be a level of balance to understand the oil market better, and this is one of those precarious environments.

At the end of the day, the Saudis are in total control. The rangebound oil market environment will continue.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.