(Public) This IEA Oil Market Report Reeks Of Political Motivation

Just a month ago, we published an OMF titled, "Don't Be Fooled By The IEA's 2024 Global Oil Market Balance Projection." In the article, we pointed to the global supply & demand chart it used:

Source: IEA

Furthermore, we explained that it was due to the erroneous balances IEA assumed for Q4 2023 that translated directly into how it calculated 2024 balances. IEA also assumed that OPEC+ cuts would be unwound post-Q1 2024.

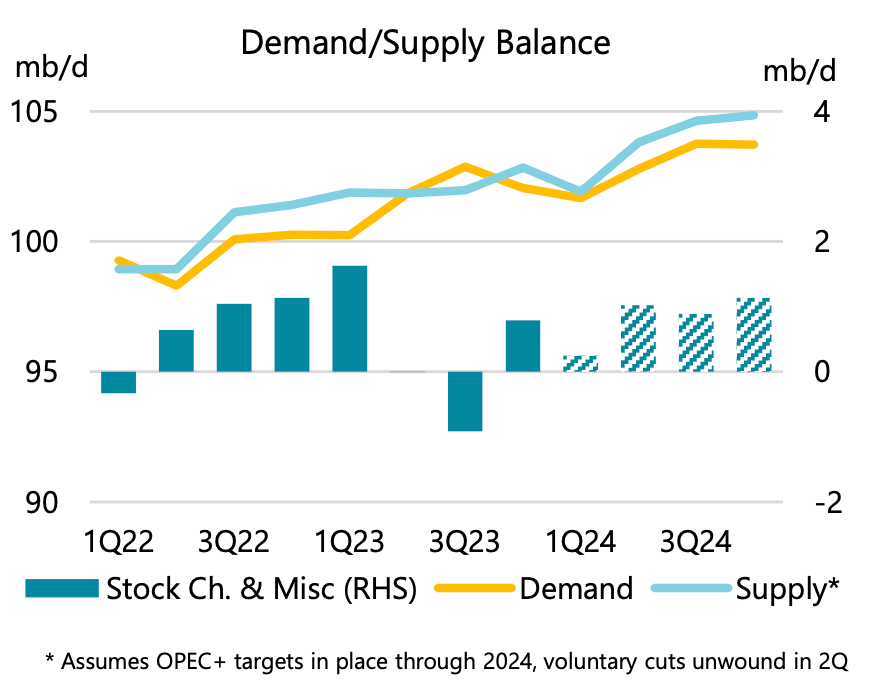

Fast forwarding to today, this is IEA's latest estimate:

The staggering difference, according to the IEA, is attributed to the assumption that OPEC+ cuts will stay in place until year-end.

Source: IEA

In its explanation, IEA said that it is assuming the voluntary reduction of ~1 million b/d from Saudi to year-end. It is also assuming Russia's ~470k b/d cut will last into year-end. Six other OPEC+ producers are assumed to reduce production by ~500k b/d into year-end.

In total, roughly ~2 million b/d was vanquished from IEA's "implied balance". In addition, IEA also adjusted downward the unaccounted for balance in Q4 2023 (~220k b/d), which immediately increased the deficit balance by ~220k b/d in 2024. IEA adjusted that via an increase in demand, how hilarious.

Reeks of political motivation...

Whether it's subtle or not, this IEA oil market report reeks of political motivation. OPEC+ has not announced whether or not it will extend its production cuts (not even a real cut, more on this later), but IEA is already assuming that it's going to last into year-end?

Never mind the fact that this year is an election year for the US, but never in its history has the IEA made such assumptions on oil market balances. By making such an assumption, it is sending a message to the Biden administration that there is the potential for a price spike later this year.

Similar to the terrible forecast the IEA made in March 2022 when it predicted that Russian oil production would fall by ~3 million b/d, which prompted a global coordinated SPR release. IEA is doing something similar this time by assuming that the production cut will last until year-end. By doing this, the US will likely respond with political pressure on the Saudis to start unwinding the cuts by Q3 2024 or the administration could prepare for another slate of SPR releases to combat potentially higher oil prices.

But the issue with the IEA forecast is that it assumes the entirety of the headline cut as a real cut.

In our WCTW, we have repeatedly pointed out that the only real producers cutting in this "coordinated" cut effort are the Saudis.

Everyone else is just masquerading the cut. As a result, IEA's politically motivated message could result in an incorrect response from the US, and a larger-than-expected SPR release would dampen prices (similar to that of 2022).

Thankfully, however, balances are more likely to surprise to the downside...

Although we are firmly in the camp that the OPEC+ cut should be renamed the Saudi cut, oil market balances so far this year are much tighter than what's on paper.

While we believe that IEA is incorrectly assuming that the entirety of the headline cut will manifest into realized production losses, IEA's balance looks to be closer to reality now because of its incorrect assumptions in other areas.

The reality of the oil market this year is that it is firmly in the hands of the Saudis. For participants that think otherwise, just know that even using IEA's aggressive non-OPEC supply growth, by Q4 2024, the velocity of the growth severely declines.

Source: IEA

And with demand growth expected to be ~1.3 to ~1.5 million b/d this year, the global oil market balance should remain in the deficit if Saudi unwinds its voluntary cut by year-end (our figures).

US oil production, which has been a key contributor to growth, is slowing materially in front of our eyes.

In Q2 2024, we expect US oil production to average ~12.8 million b/d versus IEA's 13.409 million b/d assumption. That's a delta of ~609k b/d, which will directly impact global balances.

In aggregate, we believe IEA is overestimating the headline production cut from OPEC+ by ~970k b/d. Interestingly enough, that's the same figure IEA had for unaccounted for balances in Q4 2023.

And since IEA incorrectly overestimated Q4 2023 balances by 950k b/d, it will inevitably have to revise balances for 2024 lower by ~950k b/d. In hindsight, IEA will point to the higher-than-expected OPEC+ production and slowly, but surely drain the unaccounted for balance lower.

Politically motivated, but the conclusion is the same

We think this IEA oil market report reeks of political motivation. By prematurely assuming that OPEC+ will extend its voluntary production cut into year-end, it is sending a message to the US administration that Q3 2024 oil market balances look tight.

While this may or may not prompt a response from the US, the reality of the oil market this year is that it will be firmly in the hands of the Saudis. We do expect the Saudis to start unwinding their voluntary production cut by H2 2024, which should keep a lid on oil prices.

Whether you like to believe it or not, it is not in the interest of the Saudis or anyone else to have oil prices spike. Even for oil bulls like us, a stable period of elevated oil prices far outweighs a temporary spike followed by a demand drop (think 2022).

So at the end of the day, the conclusion is the same. Global oil market balances are likely to surprise to the deficit this year, and this should give Saudi the room it needs to unwind its voluntary production cut in H2 2024. Oil prices, as a result, will be rangebound but at a structurally higher level.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.