Editor’s Note: This article was first published on May 27 to paid subscribers. Since then, OPEC+ or the V8 is on track to unwind the entirety of the voluntary production cut.

The market is playing right into what the Saudis want: total control. On May 3, when we made our OPEC+ Gameplan article public, it wasn't widely known that the OPEC+ voluntary production cut agreement wasn't cohesive. In fact, we still see a lot of confusion over this topic today.

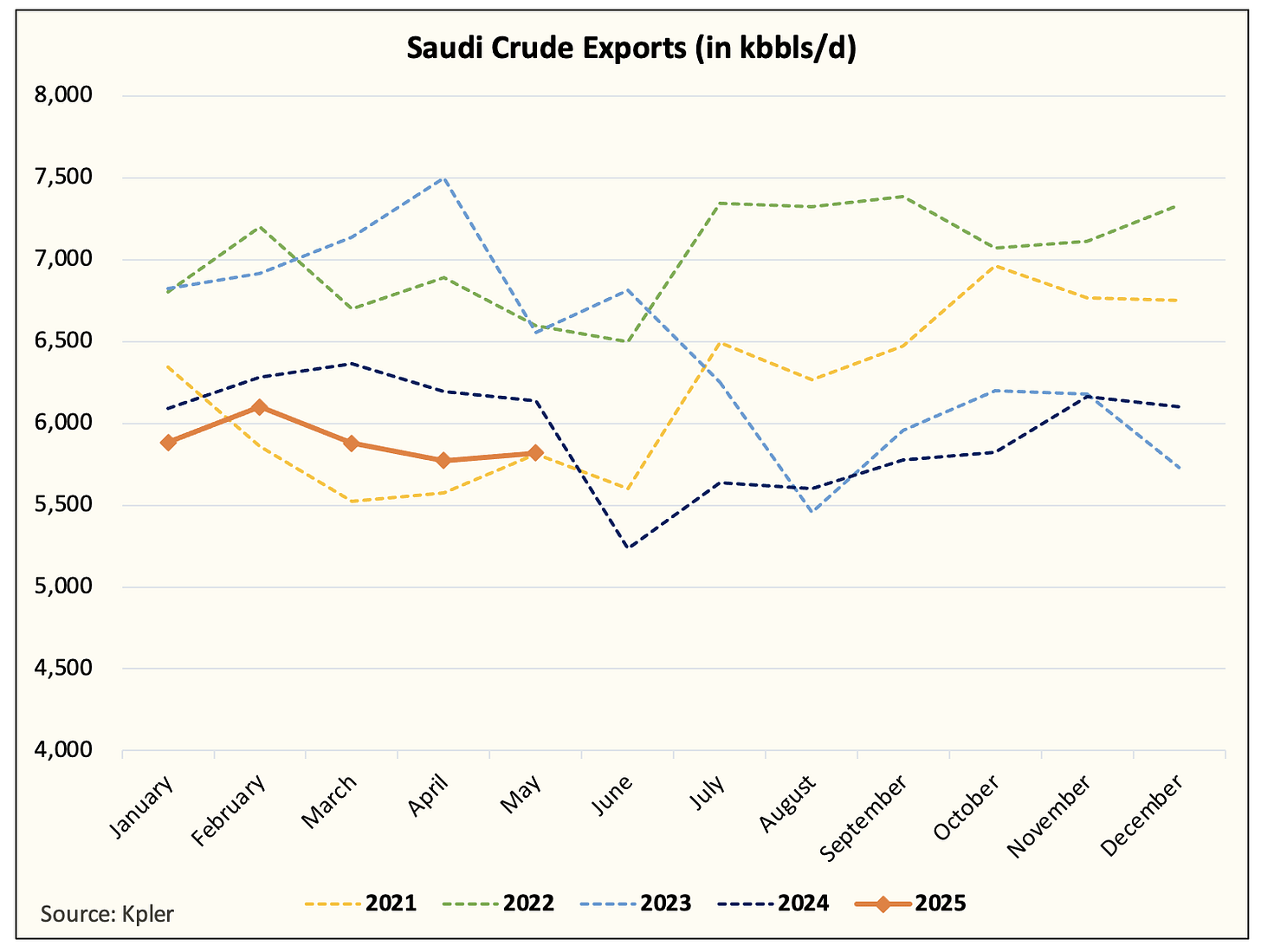

But as we've said repeatedly, this is not an OPEC+ production cut, it's a Saudi cut. This could be illustrated via two charts:

IEA OPEC+ Production

OPEC+ ex-Saudi/Iran Crude Exports

With that said, why do the Saudis have total control?

The low $60s WTI backdrop will usher in lower US shale oil production. Our high-frequency data ranging from associated gas production to weekly US crude oil production show lower volumes.

The voluntary production will be completely unwound by the end of July. The V8, a term created by Dr. Anas Alhajji, is expected to announce another +411k b/d production increase on May 28, which will all but guarantee another increase in June, followed by July. By the July meeting, the entire 2.2 million b/d of voluntary production curtailment will be gone, leaving the Saudis in total control.

The major players in the voluntary production agreement are already cheating; only the complete unwound of the agreement will allow them to "compensate" for their cheating. In other words, the cheaters can produce the same amount they are producing today and compensate for the previous cheating. This equates to no additional production from the other 7 producers.

Variant Perception

In my view, what I am writing today is a key variant perception to understanding the oil market today.

The consensus view is the following:

OPEC+ production unwound will lead to a massive storage build.

JPM Global Inventory Forecast

Source: JPM

Goldman Estimate of OPEC+ Production Increase

In Goldman's latest oil report, it estimates a production increase of ~2 million b/d if the entire production curtailment is lifted.

But there are some big issues with Goldman's figures.

First, UAE production is at 3.38 million b/d today or 0.02 million b/d from the 3.4 million b/d max.

Iraq is already producing at 4.3 million b/d leaving no room to increase.

And Russia is producing close to ~9.4 million b/d, leaving an increase of 180k b/d.

This leaves the only real variable to the Saudis. At ~9 million b/d, the entirety of the increase will have to come from the Saudis or else there won't be any production increase.

In other words, if the Saudis don't meaningfully increase production/exports, the unwound of the production agreement is meaningless.

So yes, this meme stands.

The other 7 producers in the agreement are quite meaningless to the whole ordeal. The Saudis have full control, and they know it.

Narrative Rebalancing

There's a problem with our variant perception. It will require a narrative rebalancing before it filters into sentiment and price, which for experienced energy investors should translate to more pain in the near term.

The sell-side analysts have every right to assume that global oil inventories are about to shoot through the roof. On the surface, the OPEC+ voluntary production cut agreement is what kept oil prices afloat, so conceptually, the unwinding of the production cut should push prices lower.

But given that it is the consensus view, there are so many variables that need to take place first before it is proven wrong. For instance, one of the views prevailing in the market today is that China's oil demand has peaked.

Goldman's latest forecast is that China's oil demand peaked in 2023. The argument is that electric vehicle penetration and LNG trucks have displaced oil demand growth. Whether that's true or not is yet to be seen, which is precisely why the market will need to validate this assumption. This takes time no matter how ridiculous you may believe this to be.

The second view that needs to change is the idea that US shale crude oil production will decline vs staying flat.

Goldman recently revised lower US shale crude oil production, but it stopped short of revising production lower.

Never mind the fact that implied US crude oil production is already ~500k b/d below where Goldman had its latest figures, it is assuming flat production from here on out.

Again, this narrative shift will take time. It will require more data to confirm that production is indeed declining, which is translating to the tighter than expected balance.

Finally, global oil inventory builds need to prove the naysayers wrong.

If our thesis is correct that the Saudis have full control of the oil market, then do you reasonably expect the Saudis to voluntarily increase production to the point that Q4 2024 balances will show +1.8 million b/d of storage build?

Just take a step back from all the details for a second and use common sense. What are the variables that would force the Saudis to do such a thing?

Is there a market share war within OPEC+? No, because the cheaters are already cheating.

Is there a threat that US shale will grow relentlessly? No, US shale is in decline.

Is non-OPEC+ supply growth outside of US shale exploding? No. Most of the supply growth is expected to come from Brazil and Guyana, and Canada will show lower y-o-y growth due to the recent oil price decline.

In essence, there are no supply threats that would make the Saudis want to forcefully push oil inventories higher, which would materially lower prices.

But if we frame this in another way, there's also nothing that will push prices meaningfully higher until all of these consensus views are proven wrong.

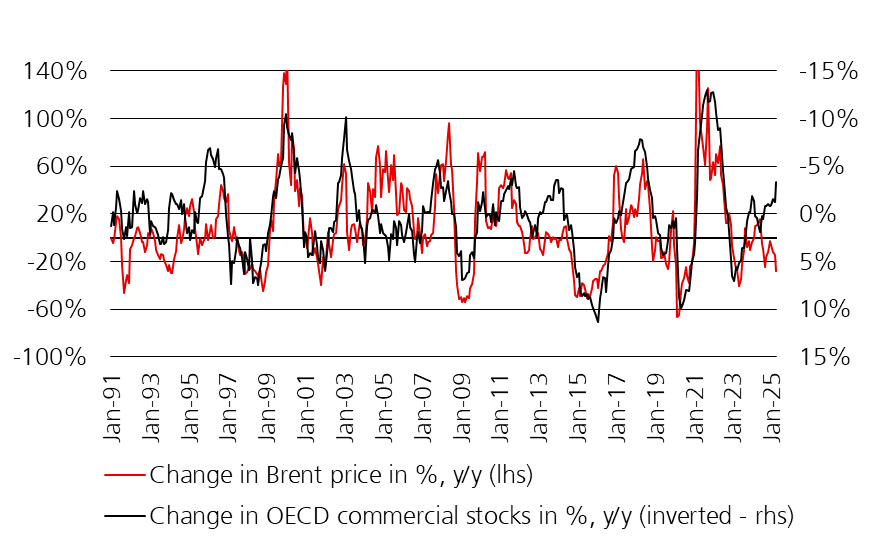

Source: Giovanni Staunovo

This is why the chart above illustrating inverse OECD inventories relative to Brent will continue to diverge meaningfully. Until all of the prevailing narratives fly out the window, the market won't push oil prices higher in fear of global oil inventory builds.

Timing

Here's what we know:

Global oil inventories can't build massively. If it does, it will validate the consensus view.

US shale production can't just be flat from now to year-end; it needs to decline.

Saudi crude exports need to remain low despite additional truncated production increases to validate our thesis that they are in full control.

China's oil demand needs to grow versus the peak that the consensus is predicting.

If you take a step back, you can see that there are a lot of hurdles we have to navigate in the coming months. In the event that everything goes smoothly, oil will be rangebound in the $60 to $65 scenario. But in the event that the global economy starts to weaken, prices can quickly drop into the low to mid $50s to force an even faster rebalancing.

From a timing perspective, most of these issues will be resolved by Q4 this year. In the absence of any meaningful oil inventory builds going into Q4, that's when you know the consensus is wrong. Every variable we mentioned above will have been validated or invalidated, so there's plenty of time to reassess in the meantime.

Meanwhile, we continue to urge readers to be positioned in natural gas. With US shale oil producers reducing production, lower associated gas production will be a tailwind for higher prices later this year. Natural gas producers will disproportionately benefit.

Conclusion

Saudis have full control of the oil market into year-end. The V8 will need to unwind the entire voluntary production cut agreement by the end of July if the cheaters are to start complying with the production agreement. Meanwhile, Saudis can control how much they export, which will ultimately be the fact that influences what happens to global oil balances.

But despite this being our variant perception, the narrative rebalancing that needs to take place will take time. The consensus will have to be proven wrong before oil prices meaningfully move higher. As a result, readers should remain cautious on oil from now into Q4.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.