Editor’s Note: This article was first published for paying subscribers on May 23.

Here we go again. Another headline that took oil prices lower overnight only to have sensibility push prices back higher. This time around? Another truncated production increase is slated for July (for the June 2nd meeting).

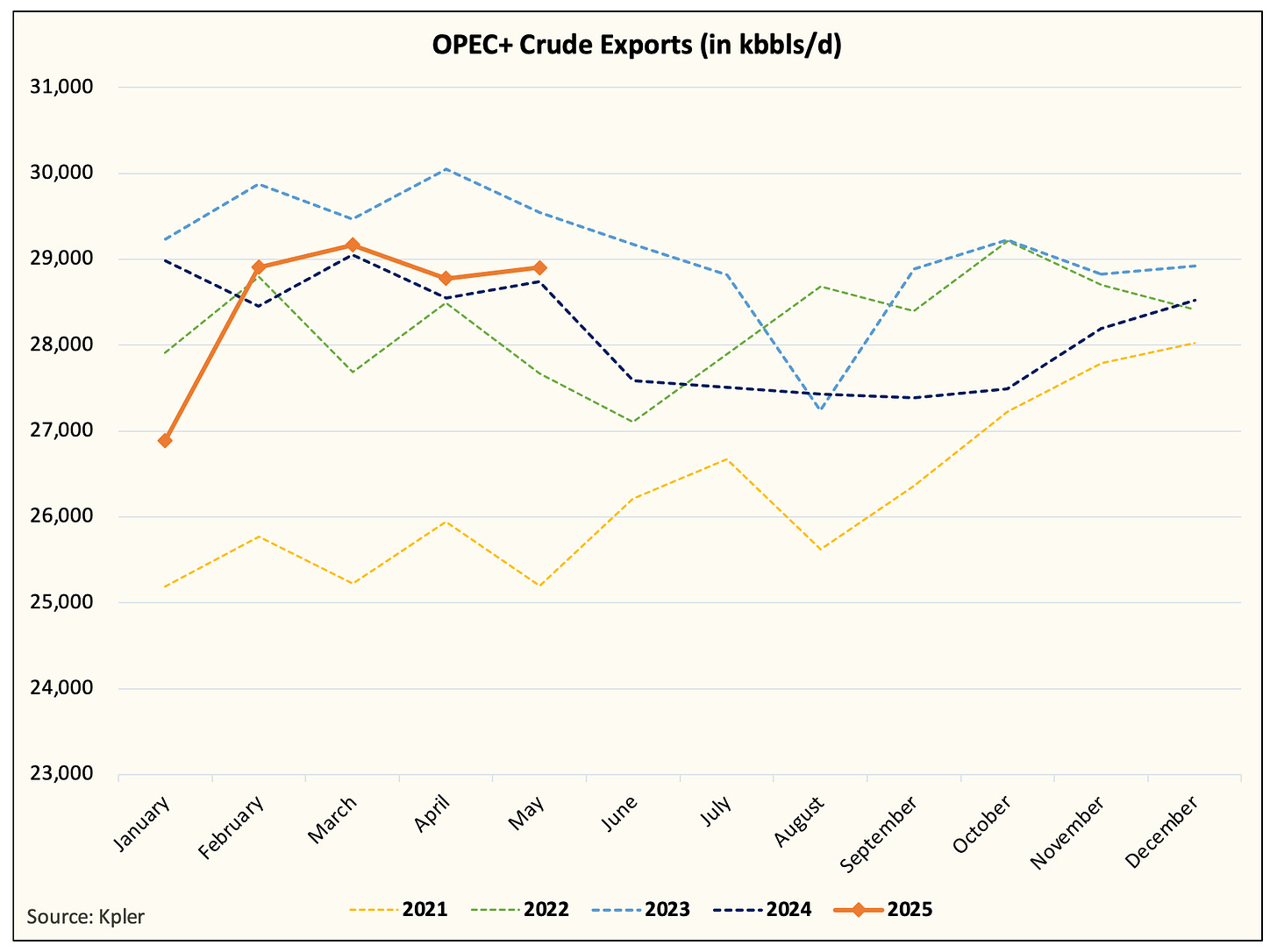

If the V8, as Dr. Anas Alhajji calls them, decides to do another +411k b/d for July, that would bring the total to +1.37 million b/d. If this occurs, it's all but certain that another truncated production increase in August will take place, pushing the total to 1.781 million b/d.

Given the demand uncertainty arising from all the trade uncertainty, why would OPEC+ do such a thing?

Is it to kill US shale?

No, but it certainly impacts sentiment negatively.

Is it to push lower non-OPEC supplies?

Not necessarily, but it doesn't hurt.

So what is the grand plan here?

Well, it was never a cohesive production cut to begin with.

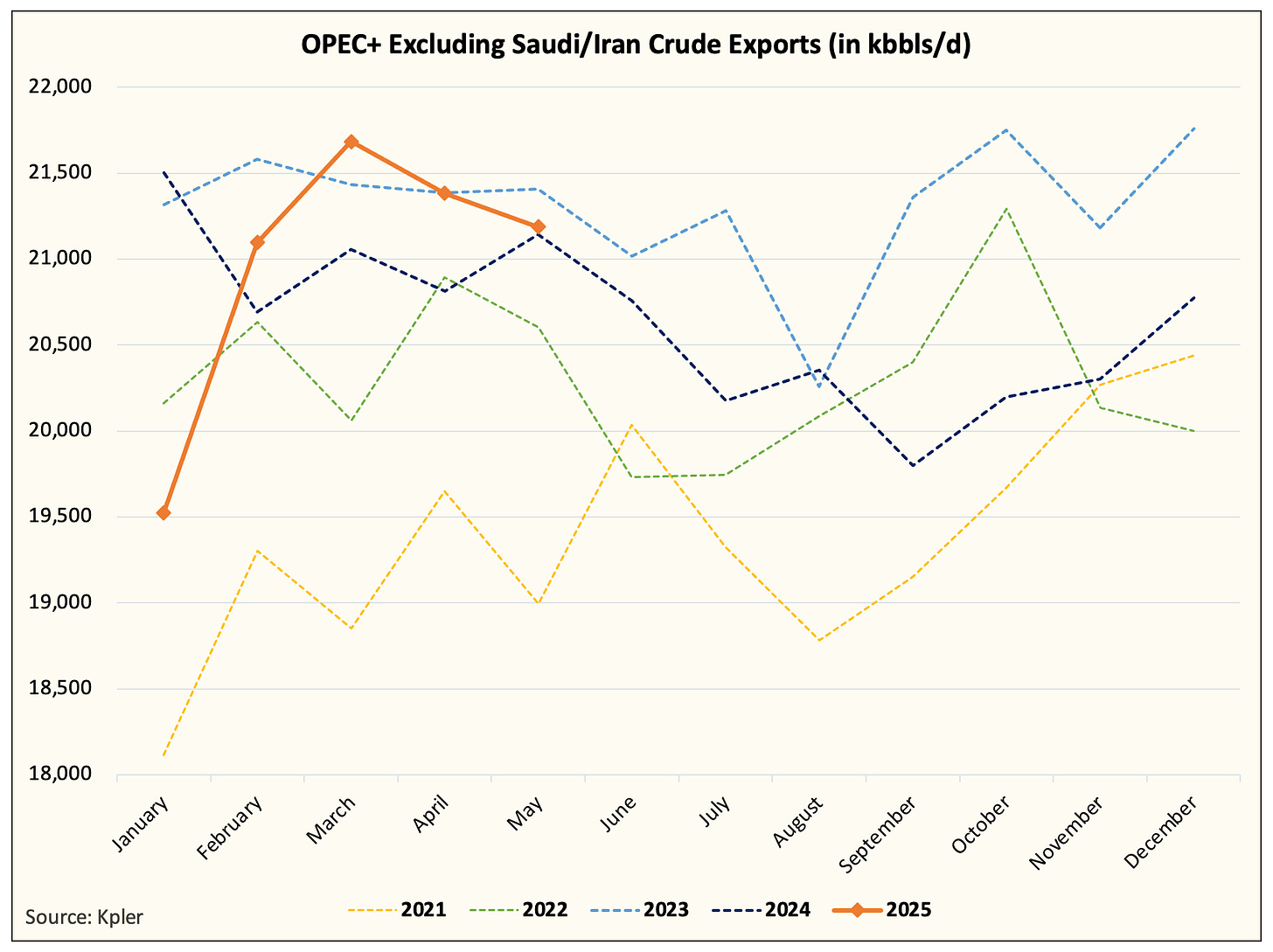

Here's a chart to illustrate my point.

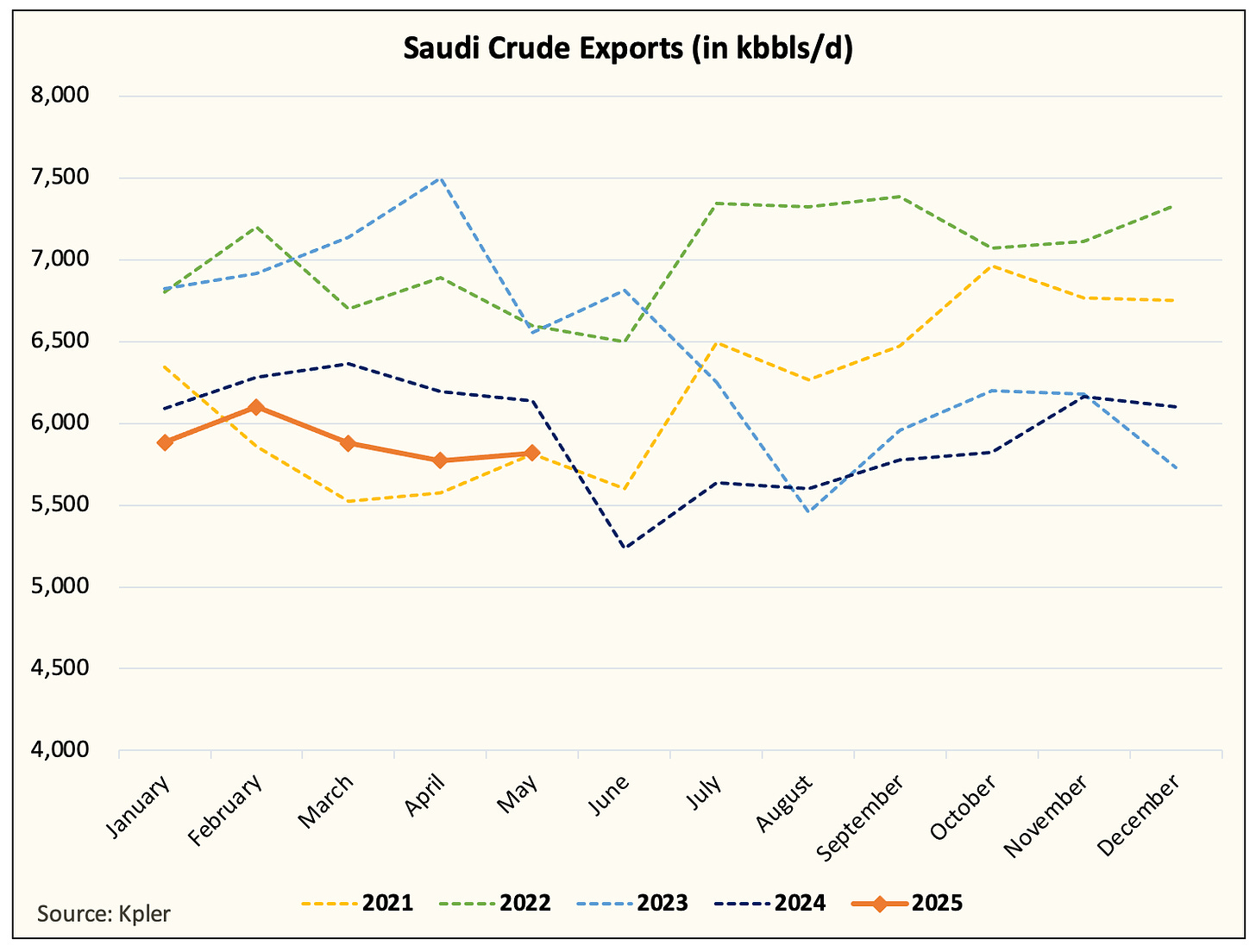

In this public piece I published titled "OPEC+ Gameplan." I detailed how this is really a Saudi production cut, not an OPEC+ production cut.

While some oil analysts might point out that exports do not equate to production, I would just like to remind everyone that crude exports are the only thing that matters because it's what impacts everyone else's balance.

And when it comes to the truncated production increase, if the Saudis don't increase crude exports, then it's not really a production increase.

Looking at May crude exports, Saudis remain disciplined, which should tell you everything you need to know about what they are trying to accomplish.

What are they trying to accomplish?

Four birds, one stone.

What are the four objectives?

Please Trump.

Negatively impact sentiment (turn others away from investing capital).

No material physical oil inventory builds.

Cohesiveness in OPEC+ returns as cheaters start to comply (via higher production ceiling).

I suspect that if I am correct in my analysis of OPEC+, we will receive the following confirmation signals by the end of September.

All of the voluntary production cuts will be gone by the end of September (truncated production increase for July, August, and September will bring ~2.2 million b/d back).

No material changes in crude exports from OPEC+ by the end of summer. Keep in mind that domestic power burn demand will keep crude at home (even for the Saudis).

Oil inventories will draw during the driving season.

There will be a lot of head scratching going around Wall Street trying to figure out why global oil inventories are not building at the same pace as COVID. With +2.2 million b/d, Q4 oil inventory balances must be +3 million b/d!

Well, there's an important difference between paper barrels (Excel spreadsheets) and real barrels (exports). I guess the MBAs of Wall Street will have to learn it the hard way.

What will prove my thesis wrong?

Simple.

OPEC+ crude exports skyrocket. This will be fueled by both the Saudis and others. Thankfully, no sign of that in May.

Oil inventories will build meaningfully in the next few months. Paper barrels become real barrels.

So my job is simple here. I watch these two variables like a hawk, and if they change, I will change my mind. Until that day comes, I'm sticking to my thesis.

Conclusion

Watch what they (OPEC+) do, not what they say. Don't be like the market and react to knee-jerk reactions on headlines. Algos don't know any better, and momentum funds definitely don't know any better.

My thesis is that the OPEC+ production cut was never a cohesive one. It was a Saudi cut from the beginning to the end. As a result, the only variable that will influence oil market balances is Saudi crude exports. Outside of that, everything else is noise.

So until that variable changes, the truncated production increase is just a sentiment cap on the energy sector. Nothing more, nothing less.

Analyst's Disclosure: I/we have a beneficial long position in the shares of USO, UCO either through stock ownership, options, or other derivatives.