(Public) WCTW - Two Variant Perceptions In The Oil Market Today And Why They Are So Important For Where We Are Headed

Editor’s Note: This WCTW was first published to paying subscribers on March 25, 2024. Our short-term view on the oil market is that oil prices are at the top end of the trading range ($80-$85). However, as fundamentals move along and inventory draws resume (after April), we see oil prices moving to a structurally higher price range ($85 to $95). This will be fueled by the two variant perceptions we discuss below. Thank you for reading.

We think the consensus is making a big mistake on two key views in the oil market today.

OPEC+ voluntary cuts are creating more confusion than answers. Aside from the Saudis, voluntary cuts are not happening with any of the other producers.

US oil production was understated at the end of 2022. Following a methodology change in mid-2023, EIA has now overstated US oil production. This has created a massive misconception of the implied growth rate of US shale.

We think these two variant perceptions will result in a much tighter-than-expected oil market going into 2025. Consensus is expecting the oil market to be in surplus by 2025 due to OPEC+ unwinding its production cuts, but we completely disagree.

While we are of the view that this year will show a rangebound oil price environment, we see an upside risk for 2025 as consensus overestimates supply. Not only is it making a crucial mistake in assuming this voluntary production cut is real, but it is also using an incorrect baseline for US oil production.

The Incorrect Narrative

With Q1 2024 coming to a close, it should be apparent to anyone following the oil market that this OPEC+ production cut is not real. Because of the nature of the agreement, producers are only voluntarily reducing production. This is not required like any previous OPEC+ coordinated production cuts. Now, of course, previous production cuts are also not "required", but given the voluntary nature of this, most producers are not really cutting.

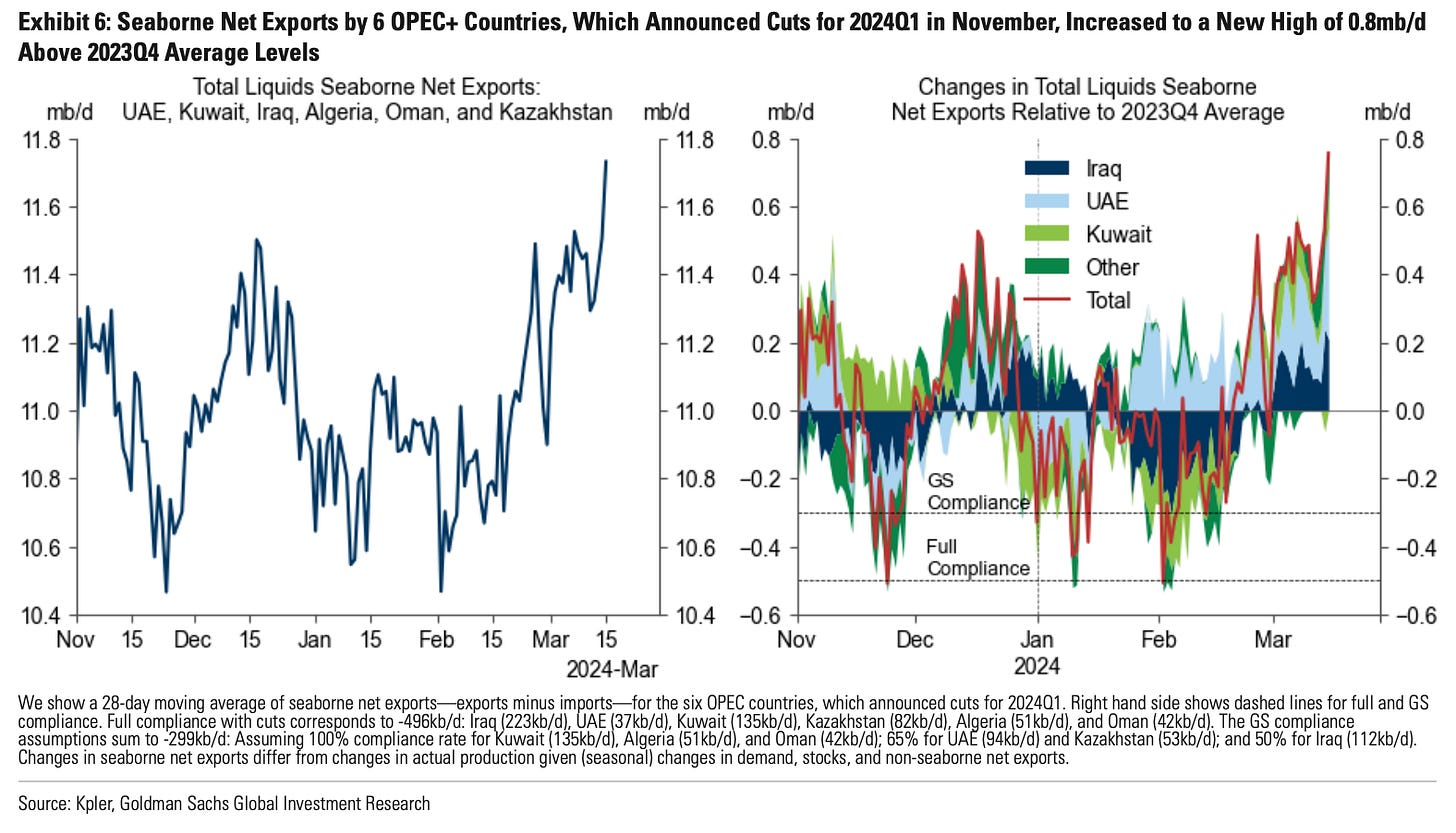

Here's a great chart from Goldman showing just how elevated total liquids net exports are. As you can see, the delta between the full compliance and current net exports totals ~1.3 million b/d. Not only are the 6 countries (Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman) not cutting, but they have actually increased net supplies to the world.

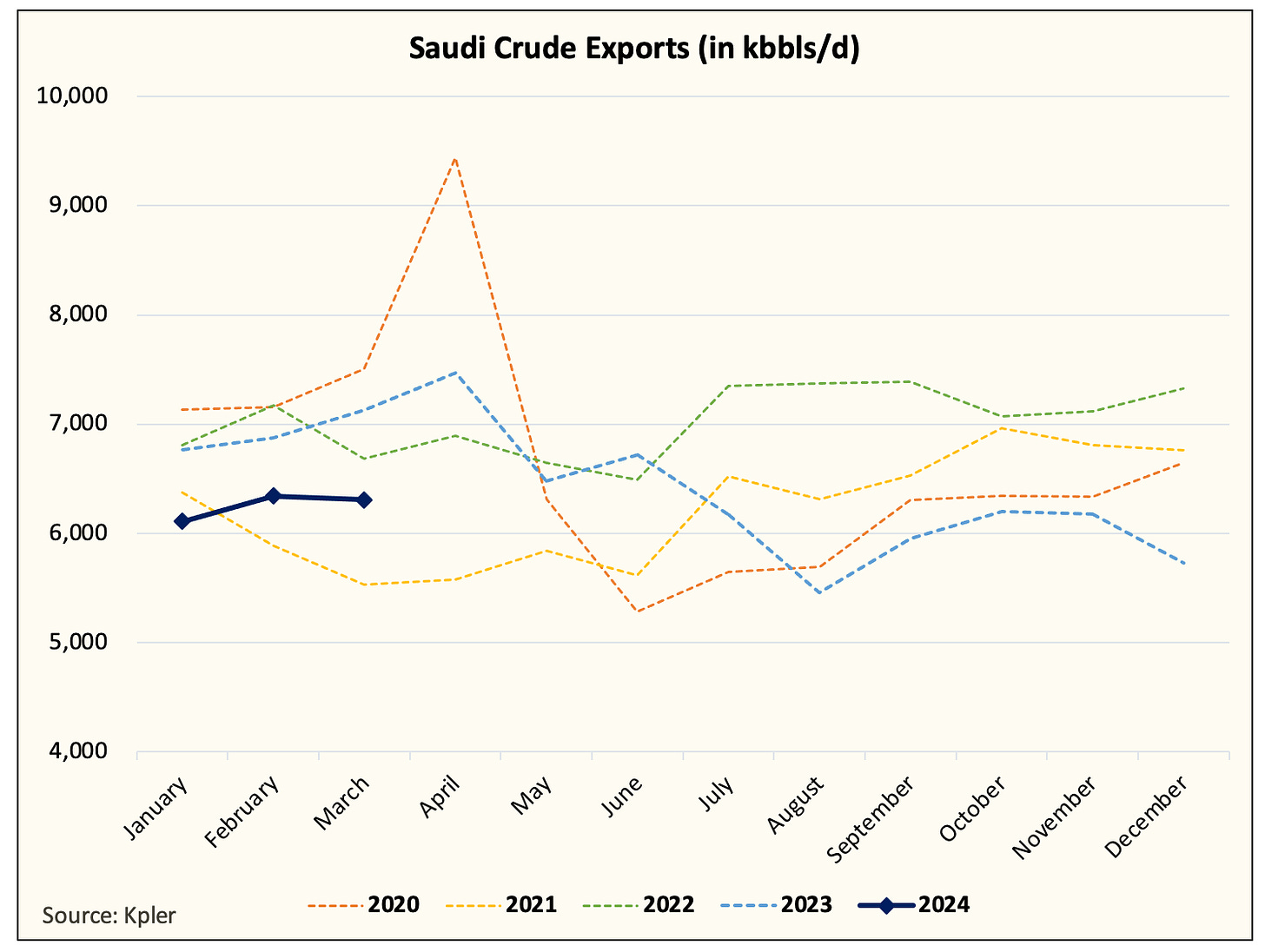

Similar to the theme we've repeatedly pointed out, outside of the Saudis, total crude exports are higher y-o-y. In addition, if you look at the overall OPEC+ crude export volume, you will find no supply reduction whatsoever.

Q4 2023 - 28.846 million b/d

Q1 2024 - 28.839 million b/d

Why is this so important?

When oil analysts compile global supply & demand tables, they Excel plug a "production" figure for each country. In the case of OPEC+, they typically take the committed voluntary production cut, apply some risk factor (for not complying), and input the figure. To derive 2025 balances, they would then eliminate this voluntary production cut, assume a higher production level, and arrive at the new net balance.

The issue here is that given the crude export data we are seeing, those 6 countries that are voluntarily reducing production are not reducing at all. As a result, those Excel figures have to be readjusted upward today (not 2025).

In addition, because supplies today are higher than what people are modeling, the implied balance for 2024 is much tighter than people think. This is a reason why we started Q1 2024 with draws, and crude backwardation is still increasing. The market is much tighter than what's on paper.

And the only way for this narrative to flip is for the voluntary production cuts to unwind by H2 2024. While this may seem like a bearish headwind for the oil market, it's only under this scenario will people realize that the cut is not real. Because crude exports excluding Saudi will be flat.

If the Saudis decide by H2 2024 that they will start to unwind the voluntary production cuts and if the oil market remains tight (like we think it will), then the consensus will quickly sing a different tune for 2025. Because by this point, people will realize that US oil production is not what it seems.

The Ugly Truth

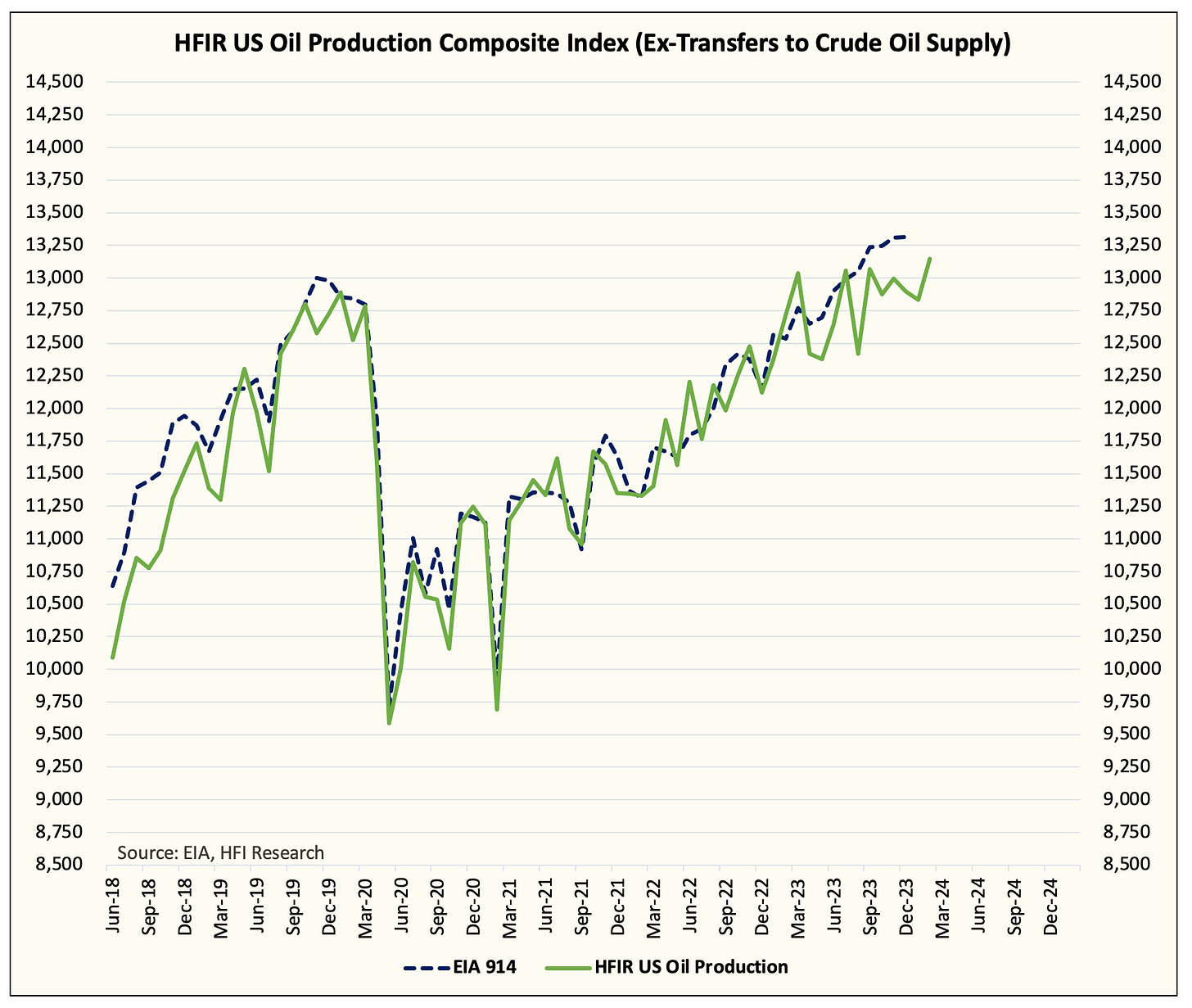

For a long time now, we have covered in detail the ugly truth of US oil production. To summarize, EIA is overstating US oil production figures.

The overestimation started in June 2023 and has continued since. The last phase of the analysis is concluding this month so the EIA 914 reports will have more clarity. We eagerly await the results at the end of this week.

However, this still doesn't take away the fact that 1) EIA underestimated US oil production at the end of 2022 and 2) EIA overstated US oil production at the end of 2023.

By our estimate, US oil production exited 2022 at 12.55 million b/d versus ~12.3 million b/d. And at the end of 2023, US oil production was 13.05 million b/d versus the reported 13.33 million b/d.

Reported growth y-o-y exit: ~1 million b/d

Reality growth y-o-y exit: ~0.50 million b/d

The real growth was 50% of the headline growth. And there are major ramifications arising from this.

US oil production, despite private sellers ramping, was already stalling.

As a result, the pace of the decline in H1 2024 will be higher than expected. We are seeing ~12.9 million b/d today.

Because of the higher implied decline rate, exit-to-exit for 2024 and 2025 will be materially impacted.

We see US oil production exiting 2024 at around ~13.3 million b/d with 2025 exiting at around ~13.5 million b/d. Once we reach the ~13.5 to ~13.6 million b/d range, this will be the peak in US oil production.

Summary of the Two Variant Perceptions

With the exception of the Saudis, the OPEC+ cut is not real. Supplies are higher than what's being penciled in, so the risk of supplies surprising to the upside is significantly lower than what people think.

US oil production growth is nowhere near what headline figures show. As a result, the decline will be larger and more severe than people expect. This will directly impact how we exit 2024 and 2025.

What does that mean for price?

Even with our variant perception, we still see oil prices being rangebound this year. Why? Because the Saudi cut is real and they have every incentive to start unwinding it by H2 2024. This means supplies could surprise by ~500k b/d to ~1 million b/d.

This year is an election year and if oil prices get too hot, the US could use SPR again to combat higher prices. China is also capable of releasing SPR this year, which could complicate things.

Either way, both China and the US are capable of releasing SPR to combat higher prices.

However, once the market sees what we are seeing, the unwinding of the voluntary cut will be bullish for balances in 2025. People will realize that this production cut is not real, and the reversal of it will have no real impact on the market. Analysts will have to readjust their modeling for 2025 and oil traders will see that despite the production increase, exports are the same. Physically and financially speaking, oil prices will get a tailwind because of this (unwinding of the voluntary cuts).

Lastly, because of the overstated growth in US oil production, market participants will be surprised to see both the drop in US oil production this year and the subsequent lack of growth. This will alter people's perception of supply growth in 2025. Once US shale production peaks, non-OPEC supply growth also peaks. The peak supply thesis is going to come much sooner than the peak demand thesis.

What does it mean for price?

It's going to be a lot higher than $90/bbl WTI.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

What is your oil production estimate based on?