It has been 4 months since the announcement of the OPEC+ voluntary production cuts and since then, compliance is virtually nonexistent. We've written about this numerous times. Here are the article links:

Just How Real Is The Saudi Cut?

Asking For A Friend, Does The OPEC+ Production Cut Really Matter?

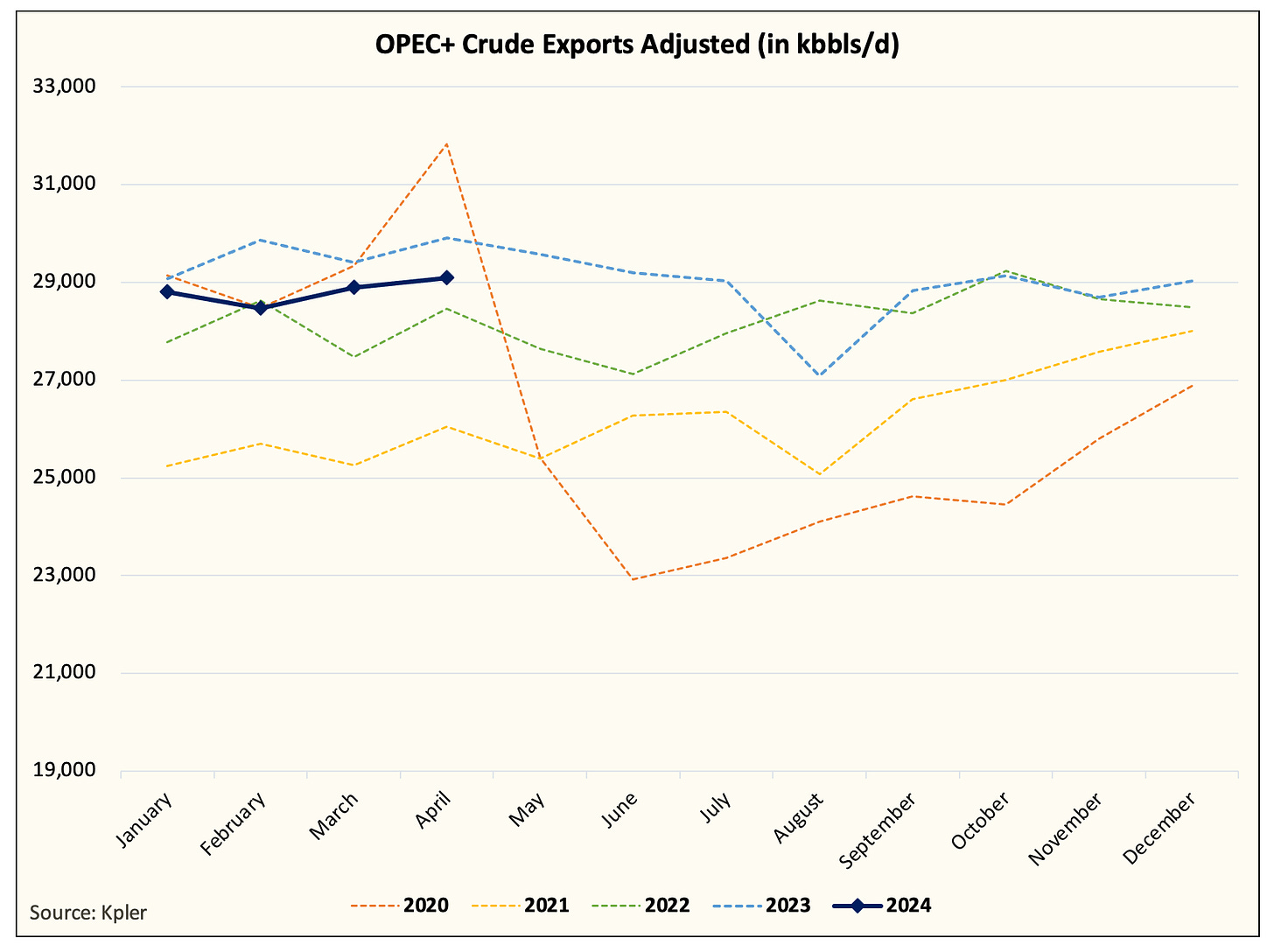

But with April coming to a close, you start to wonder just how real the production cuts are...

Looking at Kpler's month-to-date data, the m-o-m drop is ~800, but when you dig a bit deeper, the entirety of the drop comes from lower crude exports from Iran and Venezuela. Both are under sanctions from the US, so there are shadow fleets that are not being accurately tracked. If we adjust it for the shadow fleets, we have OPEC+ crude exports higher m-o-m.

Since the Saudis and Russians maintained their production cuts from 2023 to 2024, the additional voluntary production cuts from the other OPEC+ members should have shown up. Instead, overall crude export volumes are flat.

In December 2023, crude exports from Iraq, Oman, UAE, Kuwait, and Algeria averaged 9.24 million b/d. The year-to-date average? It's 9.08 million b/d.

So let me ask you, where is the voluntary production cut?

Again, aside from the Saudis, we believe that the voluntary production cut from the others is not real. Only the Saudis are visibly reducing supplies, while Russia continues to export near all-time highs.

Russian crude export Q4 2023 - 4.839 million b/d

YTD - 5.082 million b/d

At some point, the market will realize what we are saying is right and as for the market implications, this is important to understand.

Market Implications

In our OMF yesterday, we wrote about the alarming trend in US shale oil production. One of the big red flags we are seeing is that NGL and associated natural gas production is starting to far outpace crude production growth. Permian has been the center of the non-OPEC supply growth engine for the last 8 years and with the peak in sight, non-OPEC supply growth will peak.

But what does that have to do with non-compliance from OPEC+?

Because headline spare capacity is vastly overstated. The market falsely believes that there are ~4 million b/d sitting on the sidelines. That's simply not true and as we illustrated in the crude export charts, the decline in supplies to the world is nonexistent. As a result, market implications going forward is that if this OPEC+ cut is not real, then the stated spare capacity is vastly below the headline, and the world is truly in for a supply shock if oil demand continues to grow.

I think this realization is not setting in just yet for the investment community. Because for most money managers, they look at oil prices, then they look at oil price's reaction to geopolitical risks and think, "Ah, it must be the excess spare capacity, that's why oil can't rally." But that just couldn't be further from the truth.

The reality is more along the lines of, "Israel/Iran conflict won't result in supply disruption. The physical market has weakened due to weakening refining margins. Stretched CTA positioning and storage builds in April will push oil down." While it's always easy to blame the ups and downs on geopolitics, market participants are simply overlooking the real driving forces of the oil market.

And in the case of OPEC+, they are severely disregarding the true nature of the voluntary production cut. Perhaps the Saudis intentionally designed it to where it was a unilateral cut... perhaps it was just sheer luck. Whatever the case, the Saudis are in full control of the oil market this year, but when demand improves from here on out, that control will look elusive and demand destruction will be the only thing that keeps this oil market in check.

So what's the market implication? After 2024, when the combination of slowing US oil production becomes a reality coupled with a dismal increase in overall OPEC+ crude exports, the investment community will come to realize our 2 variant perceptions. And when that occurs, you want to be long, very long, energy stocks.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.