A week is a long time in natural gas trading. That's certainly how I felt over the past week, but everything we wrote in last week's NGF is starting to play out.

Weather models are finally starting to trend warmer-than-normal towards the end of July and into early August. As we wrote in the section titled "Ray of Hope?" We said:

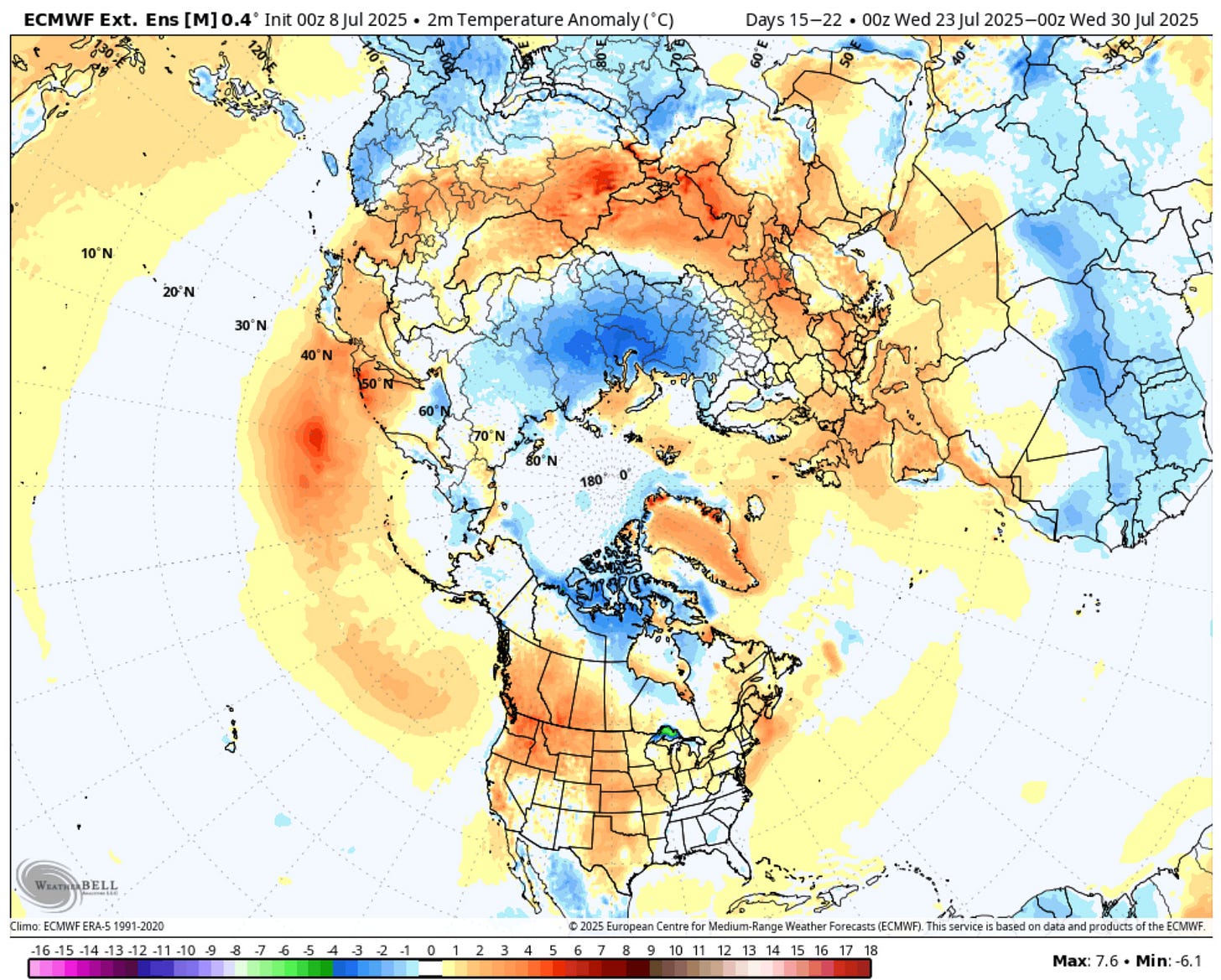

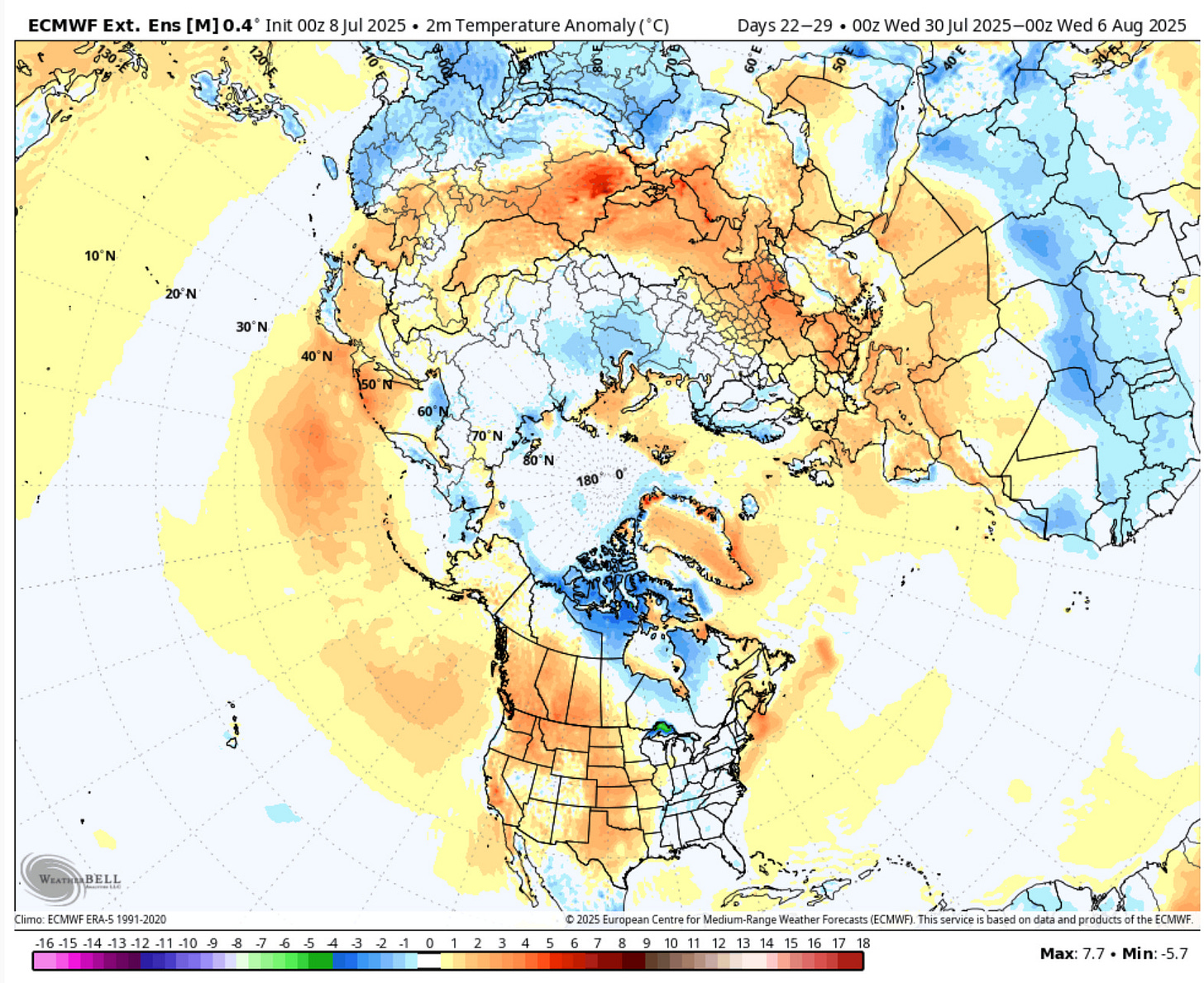

Summer isn't over just yet, and looking at the latest ECMWF-EPS long-range forecast, you can see that the heat returns to the South.

15-22 Day

22-29 Day

Given everything we wrote above, the absence of heat in the South has hammered the physical market and depressed Henry Hub cash prices. With warmer-than-normal temperatures projected in the coming weeks, this could jolt the market higher and result in much higher power burn demand.

Remember, balances can flip just as easily to the bull side, and with cash prices serving as a floor, we think any heat risk could push prices back higher.

How high?

Again, we don't think $5/MMBtu is in play anymore, but we think August still has the potential to reach $4.25/MMBtu. But it comes with a caveat: this heat better happen.

Fast forwarding to today, the heat, thankfully, is showing up in the 10-15 day forecast.

ECMWF-EPS TDD Chart

10-15 Day Range

In terms of confidence level, this is a moderately high confidence forecast. The Lower 48 will experience warmer-than-normal weather, but the intensity of the heat will be subject to the usual weather model volatility.

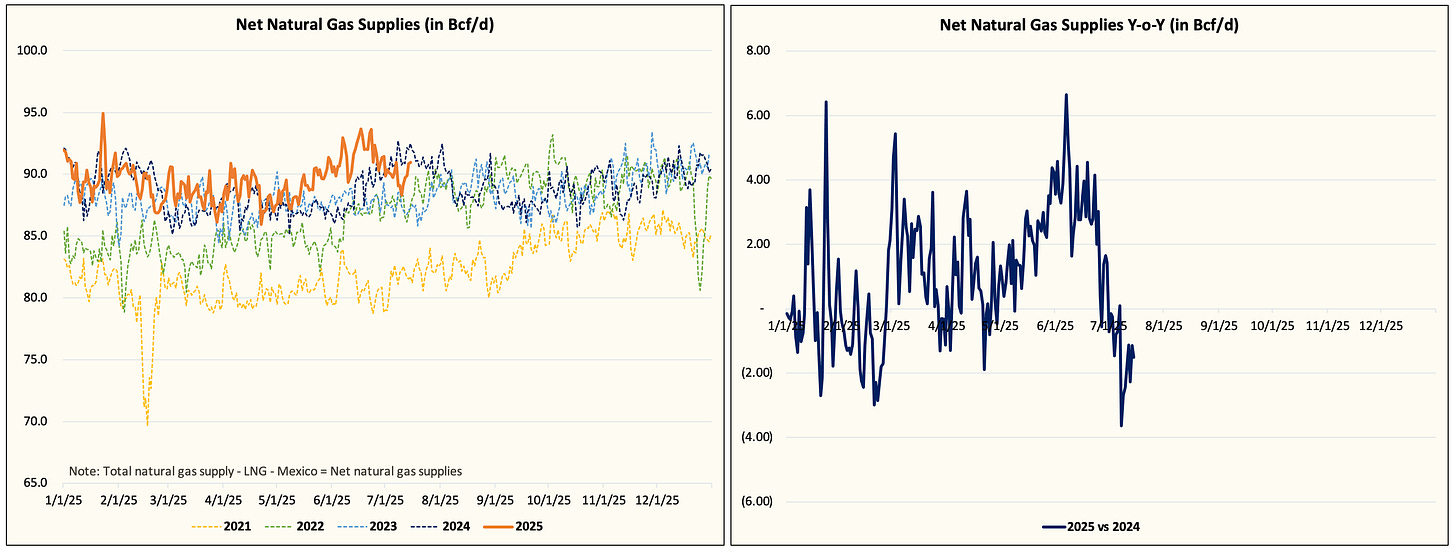

From a fundamental standpoint, the recent disappointing cooling demand has resulted in power burn to be materially lower y-o-y.

We are currently ~5 Bcf/d below last year despite net gas supplies being ~1.5 Bcf/d lower y-o-y.

Materially higher LNG feedgas demand coupled with stagnating Lower 48 gas production has helped tighten the physical gas market.

LNG

Lower 48 Gas Production

But the disappointing heat has kept a lid on Henry Hub cash prices, which saw an average of ~$3.3/MMBtu today. This is a material improvement from the $3.05 lows we saw last week, but far from a price level that's needed to push August contracts to $4.25/MMBtu.