Here we go again. Another headline that took oil prices lower overnight only to have sensibility push prices back higher. This time around? Another truncated production increase is slated for July (for the June 2nd meeting).

If the V8, as Dr. Anas Alhajji calls them, decides to do another +411k b/d for July, that would bring the total to +1.37 million b/d. If this occurs, it's all but certain that another truncated production increase in August will take place, pushing the total to 1.781 million b/d.

Given the demand uncertainty arising from all the trade uncertainty, why would OPEC+ do such a thing?

Is it to kill US shale?

No, but it certainly impacts sentiment negatively.

Is it to push lower non-OPEC supplies?

Not necessarily, but it doesn't hurt.

So what is the grand plan here?

Well, it was never a cohesive production cut to begin with.

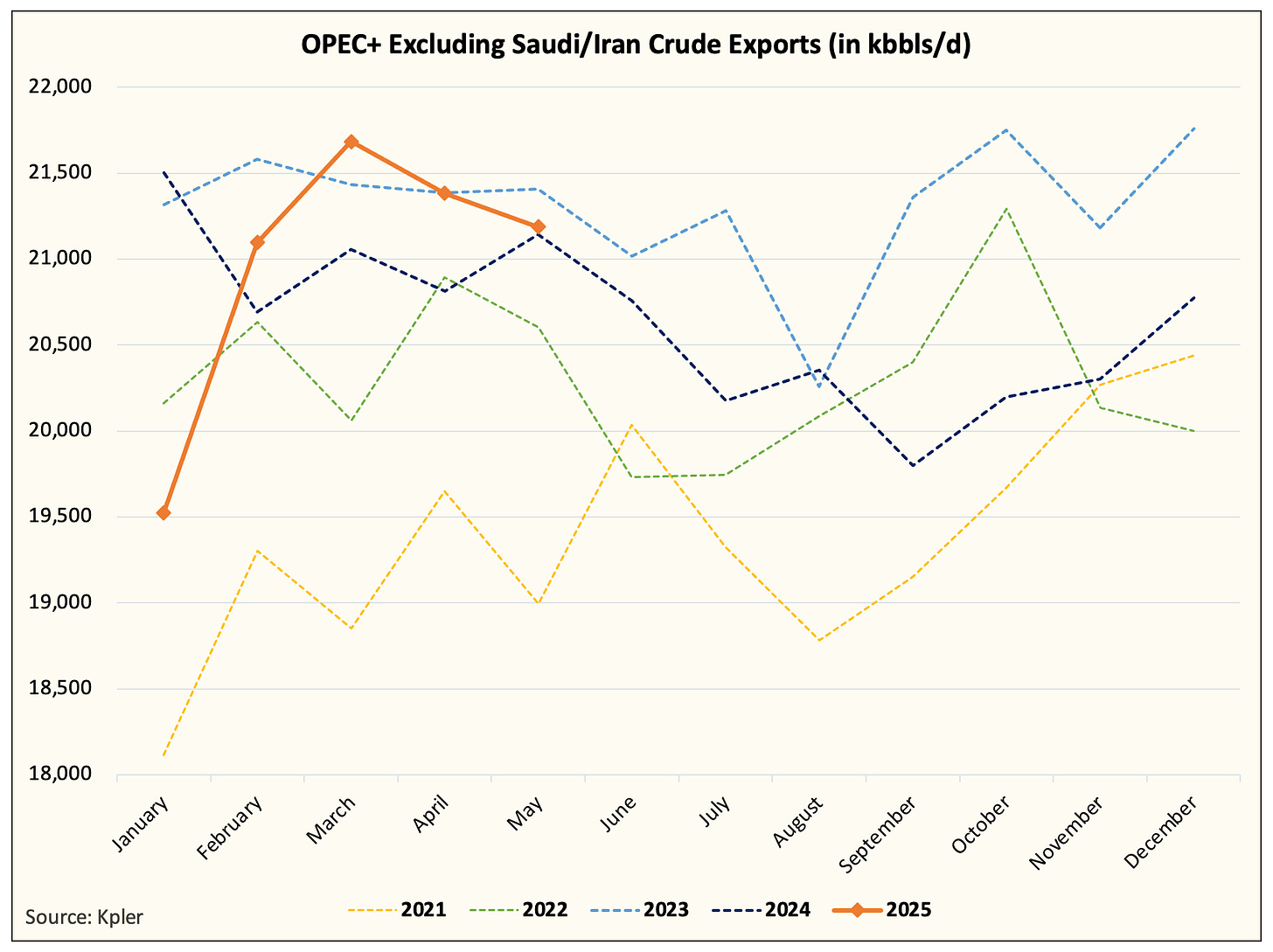

Here's a chart to illustrate my point.

In this public piece I published titled "OPEC+ Gameplan." I detailed how this is really a Saudi production cut, not an OPEC+ production cut.

While some oil analysts might point out that exports do not equate to production, I would just like to remind everyone that crude exports are the only thing that matters because it's what impacts everyone else's balance.

And when it comes to the truncated production increase, if the Saudis don't increase crude exports, then it's not really a production increase.