(WCTW) An Asymmetric Geopolitical Payoff

Geopolitical risk premium? What's that? The oil market is complacent.

The oil market is complacent today.

It is complacent about the fact that global oil inventories are trending down at the start of the year despite the chorus of analysts screaming for builds.

It is complacent on the fact that despite calls for stellar non-OPEC+ production growth in 2024, the growth was all but muted with US shale crude oil production showing the slowest growth since 2016.

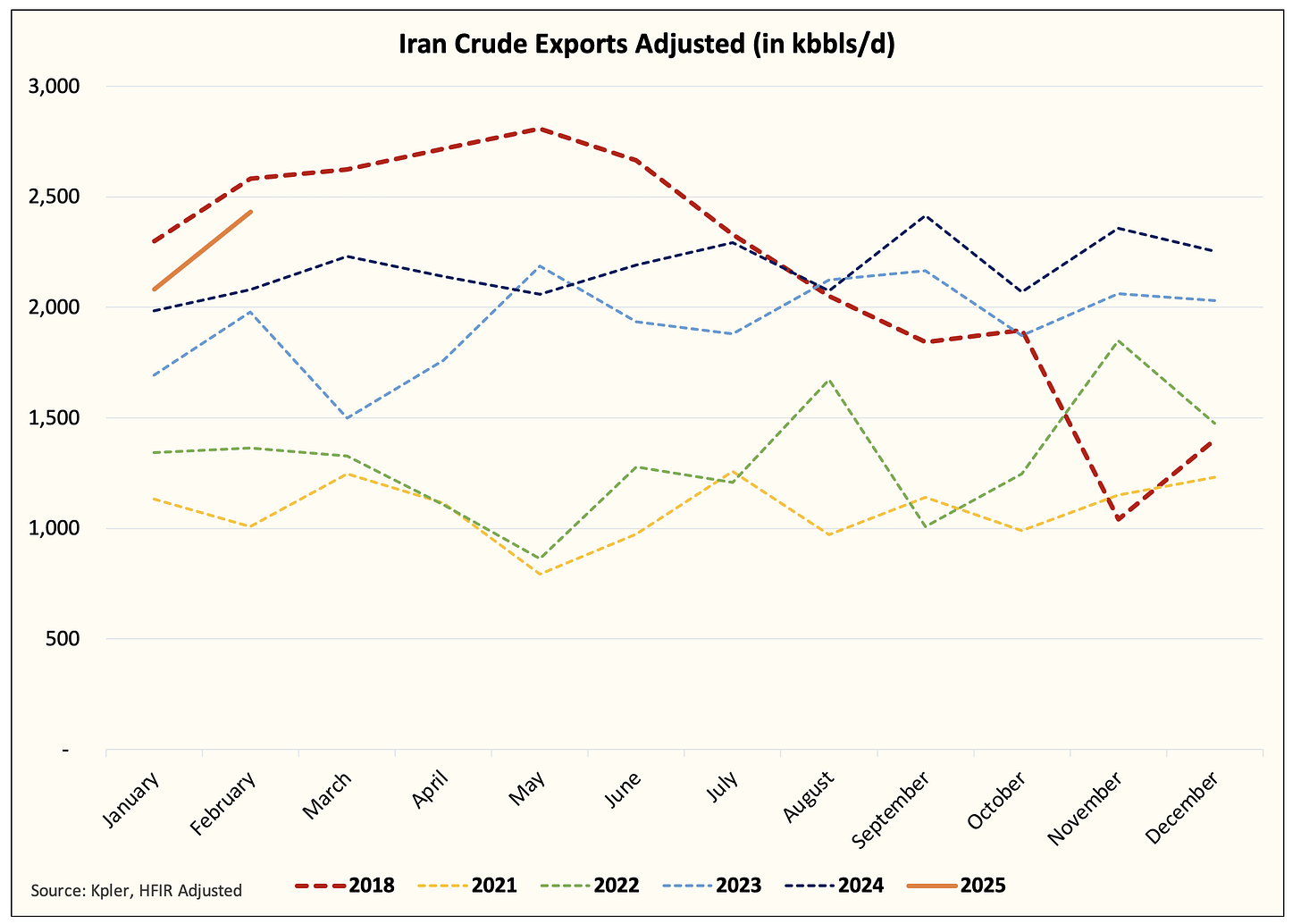

And it is most complacent about Iranian oil production as it is already operating at max, and the market doesn't price in any probability of disruption.

The irony of all this is that just before Biden left office, the sanction enforcement on crude oil tankers sent Brent to $80/bbl. At the time, the market was certain there would be disruptions from sanction enforcement.

But like anything geopolitics, when the market is bullish about potential disruptions, that's when you sell. Similarly, when the market is complacent about disruptions, that's when you buy.

With Iran producing ~3.45 million b/d and exporting close to max capacity, the risk of disappointment far outweighs the probability of more supplies.

Source: IEA

In fact, if you frame it from a risk-taking perspective, the worst scenario is status quo, and the best scenario is a supply drop creating an asymmetric risk/reward profile.

Source: Giovanni Staunovo

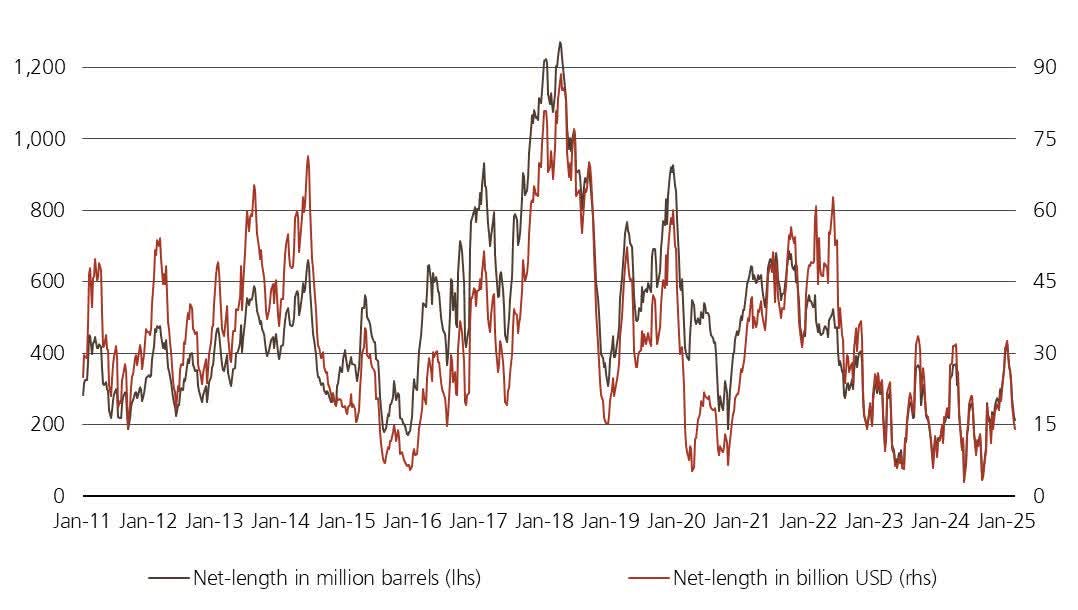

Couple that with the dismal money manager positioning we see and the price risk is skewed to the upside.

2018 Replay?

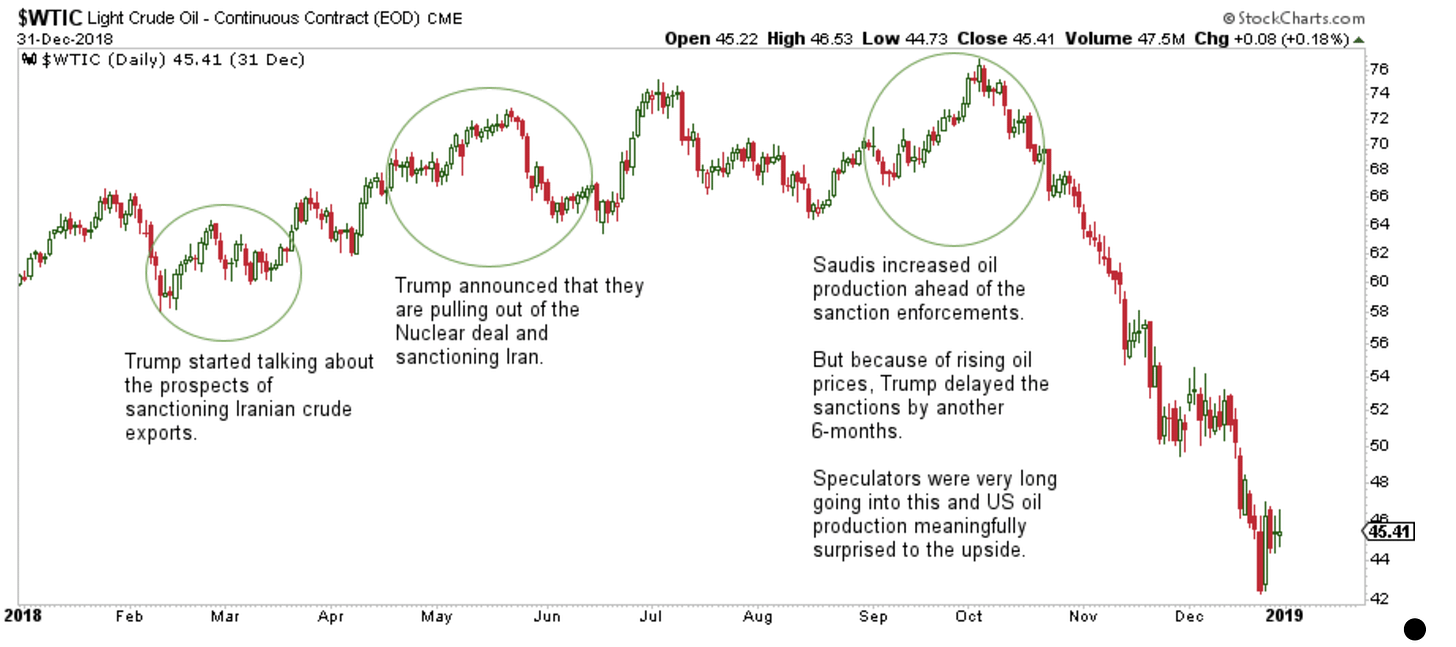

For those of you who have never experienced 2018, here's a rough guide of what happened.

Coming into 2018, oil bulls were pointing to the dismal storage builds we saw at the start of 2018 (sound familiar?).

This was mostly due to the Saudi effect in the 2nd half of 2017 when it specifically targeted US commercial crude oil inventories. Saudi crude exports to the US dropped from ~1 million b/d to below ~700k b/d. This pushed US commercial crude inventories toward ~400 million bbls.

In Q1 2018, Trump's team started to talk about pulling out of the Iran Nuclear Deal and reintroducing sanctions on Iran's crude exports. This was followed up with the official announcement in May 2018. At the time, oil prices fell following the sanction announcement because the Trump team wanted to delay sanctions until October 2018 to give the market "time to adapt" to the sudden loss in supplies.

Saudi, or OPEC+, in exchange, agreed to start increasing production at the end of June to compensate for the potential loss in Iranian crude exports. Although the group as a whole did not agree to a production increase, Saudi energy minister at the time, Khalid Al-Falih, said to the media after the meeting that the Saudis will increase production by ~1 million b/d.

The ensuing months saw a material ramp in Saudi crude exports to the US, which prevented US commercial crude storage from meaningfully falling below ~380 million bbls (a key level).

As the drama unfolded into the end of September, physical Chinese oil traders were scrambling for supplies on the market. At the end of September, Khalid Al-Falih said to the media that the Saudis have done everything they can and if Brent surpasses $80/bbl, there's nothing they can do.

The market went into a brief frenzy in early October just ahead of the sanction announcement. But by the time Trump was set to announce the sanctions, the price of oil made him second guess his decision, and he rug-pulled not only the oil market but the Saudis.

This event coupled with US crude oil production massively surprising to the upside (by ~1 million b/d) sent WTI freefalling from $76/bbl to $45/bbl by the end of the year.

History Rhymes A Bit Here?

There's an uncanny resemblance to the oil market we are seeing today to the one we saw in 2018. Namely, global oil inventories remain low, all the while, the market seems to ignore it entirely.

The big differences this time are:

Global oil demand growth is not great. In 2017, we had synchronized global growth.

US shale oil production cannot repeat the feat it did in 2018 growing at +250k b/d per month. We will be lucky to get +250k b/d per year at $70/bbl WTI.

Saudis have learned their lesson and are instead increasing production at a very slow pace (OPEC+ to increase production by ~139k b/d per month).

Iran is already under sanction, so it's just sanction enforcement this time around versus any real announcement. It is also producing near max capacity, which the market is complacent about.

The wildcard appears to be how the Trump administration will enforce sanctions. No one knows the specifics and sanction announcements will do little in the way of dampening the black market trade. While this may create more friction in the process, our experience tells us that if they are exporting, someone is buying.

This means that the only way to truly stop Iran from exporting is to stop it at the source: Kharg.

In relation to the Middle East:

This little island is basically responsible for almost all of Iran's crude oil exports. Tanker tracking services like Kpler have adopted their systems to adapt for shadow fleet ship-to-ship transfers. And because of the previous administration's lack of sanction enforcement, Iran has been more open about its exports.

In recent months, we have seen more stealth, so Iran will be going back to its old tactics of hiding exports from tanker tracking services.

But while it can hide, it can't completely obfuscate its volumes. Oil experts know that Iran ships its crude to Malaysia, where it gets rebranded to Malaysian exports to China. China is Iran's largest crude oil purchaser, so any disruption will have to come from sanctions on Malaysia or sanctions on China, neither of which is feasible.

All of this leaves the Trump administration with only one real viable option, an attack on Kharg Island. This is a very small probability event as this basically opens up an all-out war. Israel is well aware of the importance of this place and likely urged the previous administration to give it the green light to attack.

With Iran already weakened in Lebanon and Syria, Israel will feel more emboldened to push for the final straw that breaks the camel's back. From a timing perspective, the sooner Israel can cut off Iran's funding source (oil revenue), the harder it will hurt Iran's economy. But with each passing day that goes by, the probability of this event happening decreases.

And like all previous Trump decisions with regard to oil, he seems to be price-dependent, so the longer the market remains complacent, the higher the probability of geopolitical disruptions.

What about sanction enforcement?

In my view, sanction enforcement is highly dubious. From the geopolitical experts I have spoken to, the US is very limited in what it can do to stop Iran's crude flows from continuing. The only way to truly stop it is by using brute force (stopping tankers, etc).

Keep in mind that Iran has had 6 years to perfect its black market dealing, so even if Bessent and the team were set to stop the money flow, it would likely take too much time.

The only way I see the US applying maximum pressure is via force, which would ultimately prove to be very disruptive for the global oil markets.

Forget the upside for now, it is asymmetric...

I won't allow you to fantasize about the potential upside, because it's such a remote possibility. Nonetheless, the upside is asymmetric since 1) Iran is already producing at max and 2) the market hasn't priced in any possibility.

Similar to the write-up I published last week titled, "No One Is Going To Care About Oil Fundamentals Until Something Breaks." I strongly believe that the oil market is sleepwalking itself into chaos. In essence, the longer prices and sentiment remain subdued, the greater the surprise down the road (either from fundamentals or geopolitics).

Analyst's Disclosure: I/we have a beneficial long position in the shares of UCO either through stock ownership, options, or other derivatives.