The recent rally in crude oil is likely prompting some observers to scratch their heads seriously. However, as we detailed in our May 20 OMF titled, Navigating The Oil Market In The Near Term. We saw near-term upside in WTI to $64 to $65 followed by geopolitical conflicts giving prices a boost to $70. Here's what we said:

Expect the Unexpected?

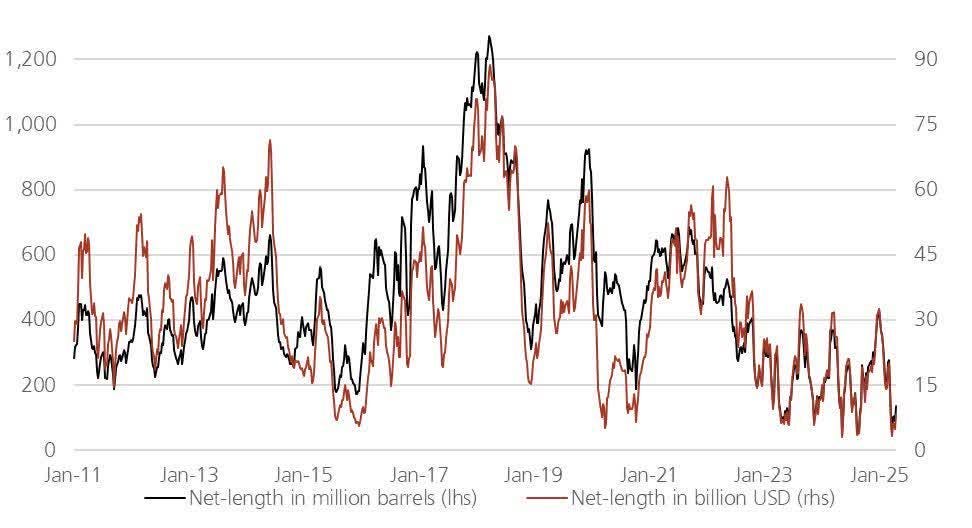

But as I've frequently learned in oil trading, the oil market seldom does exactly what you think it does. This is primarily because financial flows dominate how flat prices trade, and CTA positioning remains low.

From a momentum standpoint, I expect CTAs to pile back in crude, which could take WTI to $65 and possibly to $70, which by this point, it will be an obvious sell signal.

Is there a geopolitical event that could help us get there? Possibly given that the US is currently engaged with Iran on sanction relief. Perhaps the market will price in some remote possibility of supply loss into price, which will push prices higher.

With WTI trading at $68/bbl now, it's time to update the framework for navigating the oil market in both the near-term and the medium-term.

In this WCTW, I will help explain:

Framework for navigating the oil market.

US/China trade war on global oil demand and its impact on oil.

Global oil inventory projections.

Framework

Everything we laid out since the start of the OPEC+ truncated production increase is starting to translate to oil prices.

OPEC+ production cut was never a cohesive one; it was a Saudi cut. The truncated production increase is translating to lower-than-expected supplies.

Global oil inventories won't build massively despite the production increase.

Refining margin strength was partially driven by better-than-expected demand, but also due to lower-than-normal refinery throughput.

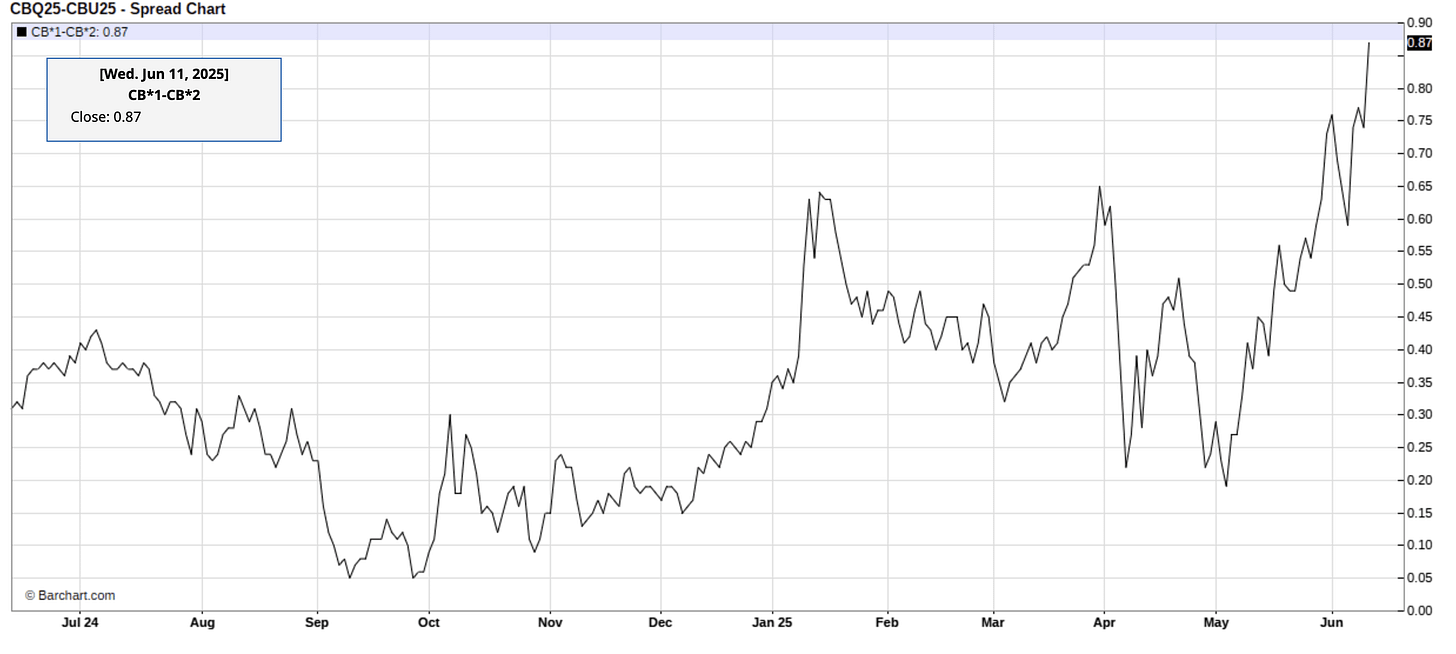

Fast-forwarding to today, the mainstream media is catching on to the fact that the May production increase isn't translating to more supplies. The consensus is starting to understand that despite the many truncated production increases coming, OPEC+ crude exports for this summer will remain tight. This is one of the reasons why we are seeing Brent timespreads remain backwardated.

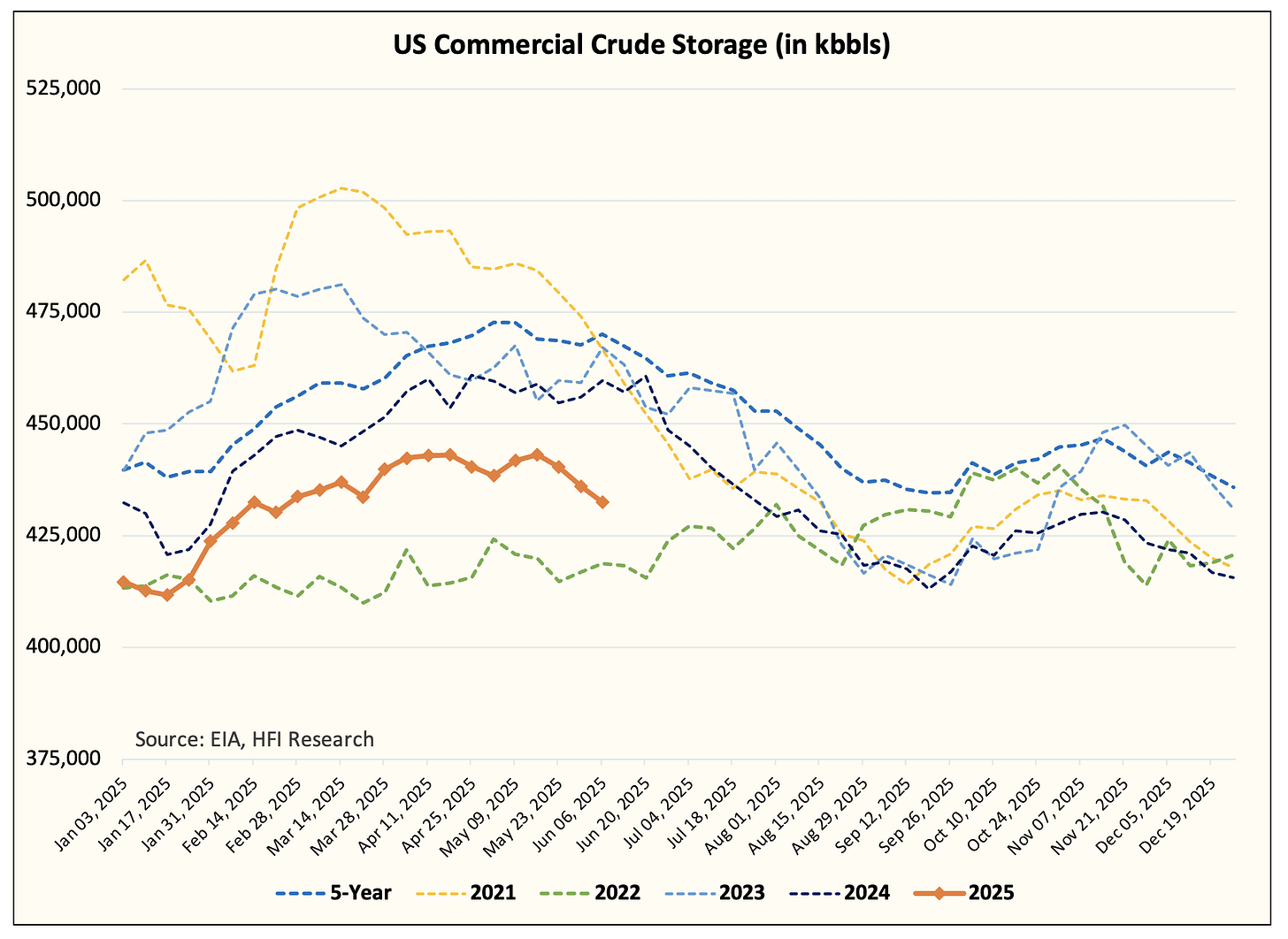

Couple this with the fact that US shale crude oil production was already meaningfully lower than consensus expectations coming into Q2, and we have a situation where US commercial crude storage is also tighter than expected.

But given the recent strength in WTI, we have to make a few changes to our underlying assumptions going forward: