(WCTW) Don't Miss The Forest For The Trees: What We Are Seeing In Precious Metals Will Happen To Oil

In all of the years I’ve followed the oil market, there comes a point in time where you have to drop the attention to the “trees” and focus on the forest. This is especially true for specialists who can overlook the bigger picture and fixate solely on the nuances. Oil-on-water, implied demand, US shale crude oil production, Aramco official selling price, whatever it is, there will always be something that’s happening in the oil market that makes the situation uncertain.

But if you take a step back and look at the global oil market from a 30k view, it’s easy to see that oil prices are low. In the context of the recent rally in precious metals, oil prices are approaching extremes.

And while some people will say that the rally in precious metals has nothing to do with other commodity markets, I disagree strongly. Gold is the king of commodities, and oil is the fuel for commodities. The correlation between the two has always followed a close relationship, and this time is no different.

Except for COVID 2020, we have never seen oil this cheap relative to gold. And unlike COVID, which was led by the brutal demand destruction arising from government-mandated shutdowns, this relative underperformance stems from gold surging to new record highs.

Again, we can argue over the timing of “when” oil prices will catch up, but the historical relationship did not break just because gold is surging and oil is not. Fundamental factors have kept oil prices under pressure throughout this year, but based on everything we are seeing in the oil market, that fundamental momentum will change in 2026.

A Bullish Stance? Yes...

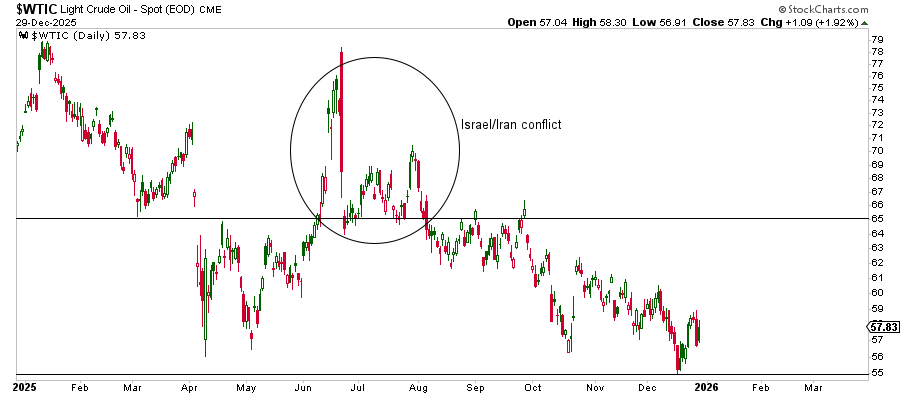

In April this year, following the surprise OPEC+ announcement to unwind all the voluntary production cuts, we wrote at the time that WTI would remain rangebound between $55 to $65/bbl.

Aside from the transitory rally we saw in oil prices stemming from the Israel/Iran conflict, WTI has remained largely inside this range. The price spike that occurred in June also led many US shale firms to hedge prices in the high $60s, resulting in US crude oil production meaningfully surprising to the upside going into year-end.

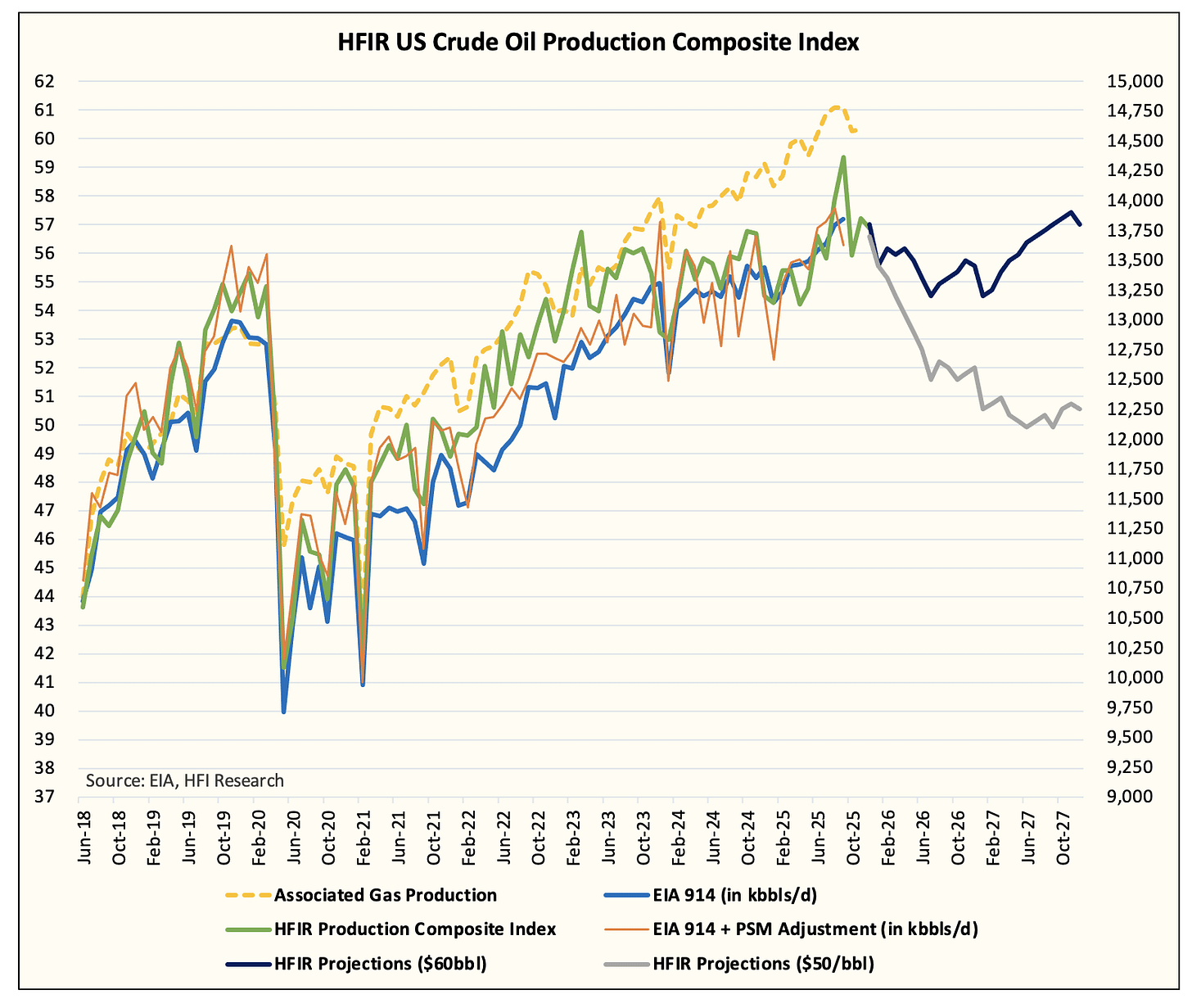

Based on our real-time model, the price bump we saw resurrected US crude oil production by a minimum of ~400k b/d. Relatively speaking, the current production reading of ~13.74 million b/d would have been closer to ~13.3 million b/d if the price spike had not occurred.

All things equal, WTI will need to remain in the $50s for 3-4 more months to eliminate the surplus we saw.

Our latest US crude oil production model pegs US crude oil production to fall back to the ~13.3 million b/d range by the middle of 2026 if WTI averages $60/bbl. If WTI falls closer to $50/bbl, we would see that production reading by Spring 2026.

Either way, oil prices today will push US crude oil production lower; that’s not a question of if, it’s a question of when.

On a global oil supply basis, what we are seeing in the market today is the peak in supplies until the end of 2026. Let me explain and why this is important to understand when you analyze the oil market.