Oil prices are mispriced today given 1) the backdrop in global oil inventories, 2) the upcoming OPEC+ production cut policy, and 3) the mismatch in speculators exiting bullish positions while oil fundamentals improve.

In a WCTW report, we wrote on Jan 13, 2025, titled, "Oh No, Not Again." Speculators got overly bullish on the prospects that sanction enforcement on Iran and Russian crude would hammer supplies. But just as speculators got really bullish, fundamentals did not support the price move. Here's what we said:

Fast forwarding to today, implied balances so far in 2025 are showing no signs of significant inventory builds. Crude storage was already tight to start the year, but with the possibility of sanctions being imposed on Russian and Iranian crude, traders are buying first and asking questions later. Never mind the fact that this rally is coming at the expense of refining margins or the fact that sanction risk might not even be real, traders will always buy/sell first and ask questions later.

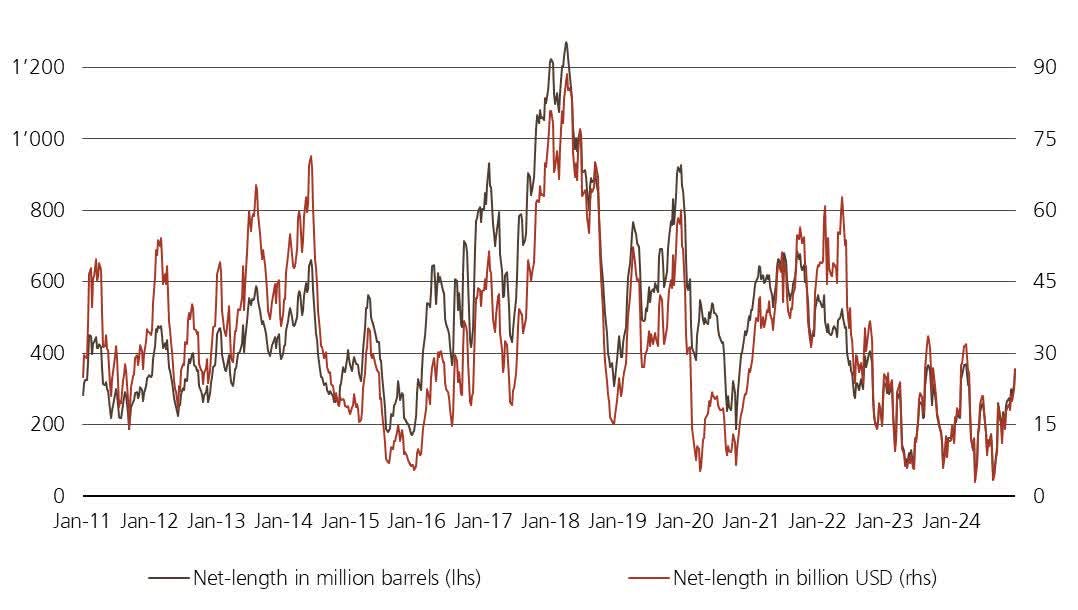

Sentiment, as expressed via money manager positioning, is starting to approach the highs we saw in previous years.

Source: Giovanni Staunovo

So is this rally justified via fundamentals?

It's the theory of half-truths again. I think fundamentally, mid-$70s should be easily supported by 1) low absolute levels in storage and 2) a balanced market for Q1 versus the oversupplied scenario. But should WTI trade near $79/bbl while refining margins are near the lows?

Probably not.

And with Q1 just getting started, the rubber needs to meet the road. Just because we say it's a balanced market in Q1 doesn't make it so. We need to 1) see the fundamentals validate what we are seeing via the weekly EIA oil inventory reports, 2) observe continued global inventory draws, and 3) improve refining margins.

There is a scenario where elevated sanction risks keep crude tight while products catch up. Or, there's the possibility that crude got ahead of itself, retraces another $4-$5/bbl, allows refining margins to move higher, and the market is back to normal again.

Whatever the case, we think the current rally in oil will take a breather. As I will explain further below, this rally is driven by physical movements and not something sustainable.

Fast forwarding to today, the half-truth theory is starting to play on the other side. Two weeks ago, we wrote to subscribers that signs are building that it's time to go long oil again. And last week, we wrote our OMF titled, "Oil Prices Are Going Higher."

Despite signs building that oil prices are bottoming and getting ready to move higher, the oil market does what it does best, it slams prices into the weekend baffling those that follow the market closely.

First, traders suspected that it had to do with the bearish economic data that was released. Then there were talks about the US possibly sanctioning Iraq if Kurdistan flows don't resume shortly.

Whatever the case, oil prices sold off and speculator positioning probably took another beating. The oil bulls are growing increasingly more frustrated, and the oil bears are pointing to nonsensical fundamental data points to justify the sell-off.

This won't be the first time the consensus gets the oil market wrong and based on our view that oil prices are mispriced, we went long another tranche of UCO today in a trade alert.