(WCTW) The Hard Truth

US crude oil production defied gravity despite low oil prices. The market will do what the market always does: punish producers.

I’m going to tell you something that you won’t like to hear (especially if you are bullish on oil prices): US crude oil production growth this year is real and all of the official data is confirming this.

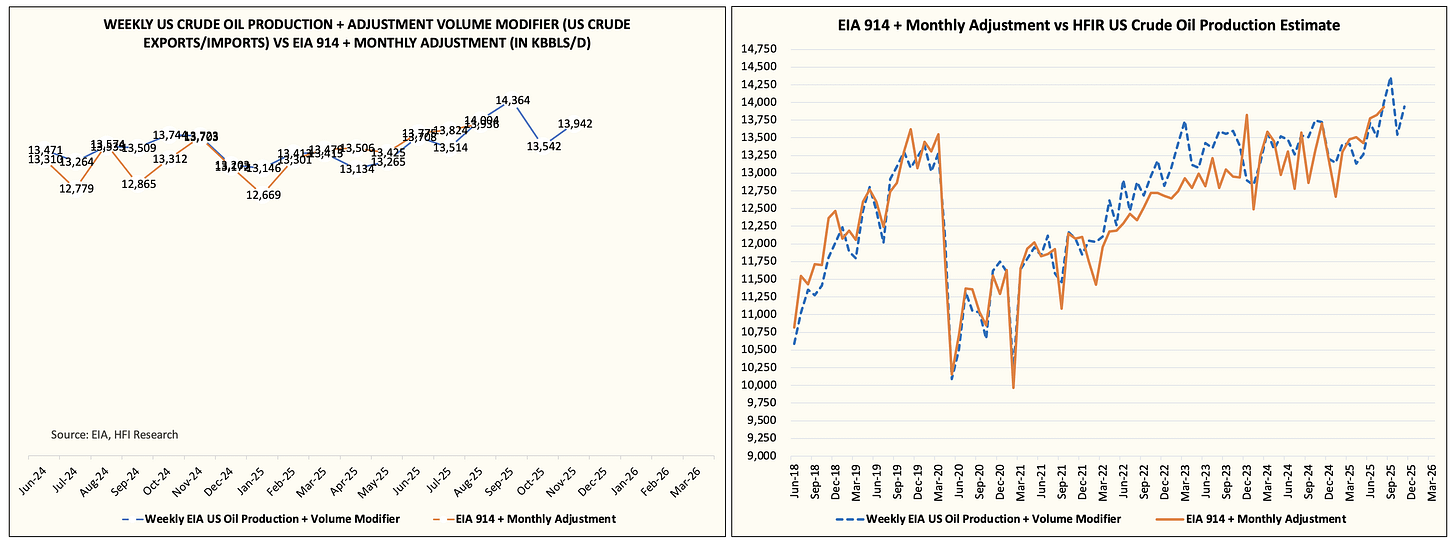

The US government shutdown impacted US crude export figures for August, so when the EIA petroleum supply monthly first came out, the adjustment was reported at -358k b/d. For those of you aware of the technicalities, a negative adjustment figure implies overstated crude oil production figures.

Initially, we were cautiously optimistic about this datapoint, as detailed in this report. However, the official data were released today, and US crude exports were higher in August (compared to July) by ~500k b/d. The -358k b/d adjustment figure accounted for the understated US crude export figure, and when you adjust this, the real adjustment was +142k b/d.

This now puts August US crude oil production + adjustment at 13.936 million b/d. This was in line with our modeled production figure of ~14 million b/d.

Given that we are correct on both the magnitude and direction, it’s safe to say that US crude oil production has and continues to meaningfully surprise to the upside.

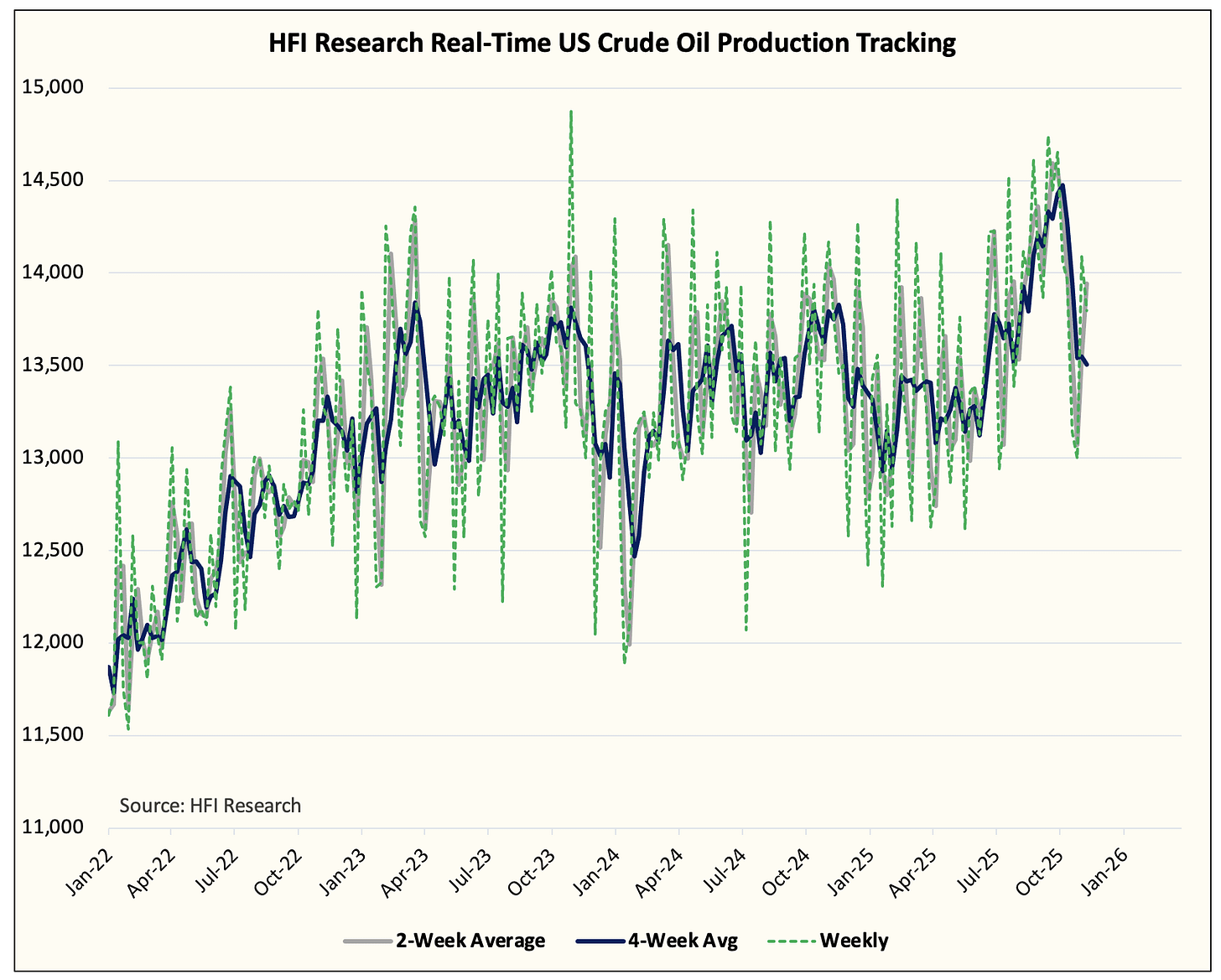

We noted in our “complete reversal” articles that we need to keep monitoring US crude oil production to detect the “turning point,” and as of this writing, November US crude oil production has rebounded meaningfully.

Based on our real-time data, EIA’s weekly US crude oil production reading of ~13.834 million b/d is spot on. Our implied balance shows somewhere between ~13.8 to ~13.9 million b/d.

Keep in mind that such a US crude oil production reading is ~100 to ~150k b/d higher than consensus estimates. So instead of the decline that many of us expected for 2025, US crude oil production has increased. Those of you who have followed frac spread count and well completion will be disappointed to hear this. That’s the hard truth, and there are important market ramifications arising from this.