Just two weeks ago, we wrote a WCTW titled, “The Massive Oil Surplus Narrative Will Collapse Soon.” In the conclusion section, we said:

Oil prices are now climbing the wall of worries. Global oil balances are now in the midst of the most anticipated surplus in history, so it will be up to the data to prove to the market that the surplus isn’t real.

We can sit here and write all we want about how the rest of the market is off and how heating demand is not being priced in properly, but the rubber has to meet the road. It’s a prove-it-to-me quarter, so all of this will take time.

Meanwhile, we are now long both USO and UCO. We believe WTI can rally into the $65 to $70/bbl range.

Fast forwarding to today, and with a bit of help on the geopolitical side (Iran), WTI is now trading above $65/bbl with no material surpluses in sight.

Just as we wrote two weeks ago, the incoming cold was not properly priced into oil. The market was quick to reprice natural gas higher, but oil prices remain subdued. Now that the EIA validated the large decrease in storage today, the market is starting to realize that the massive surplus narrative really doesn’t have any merit.

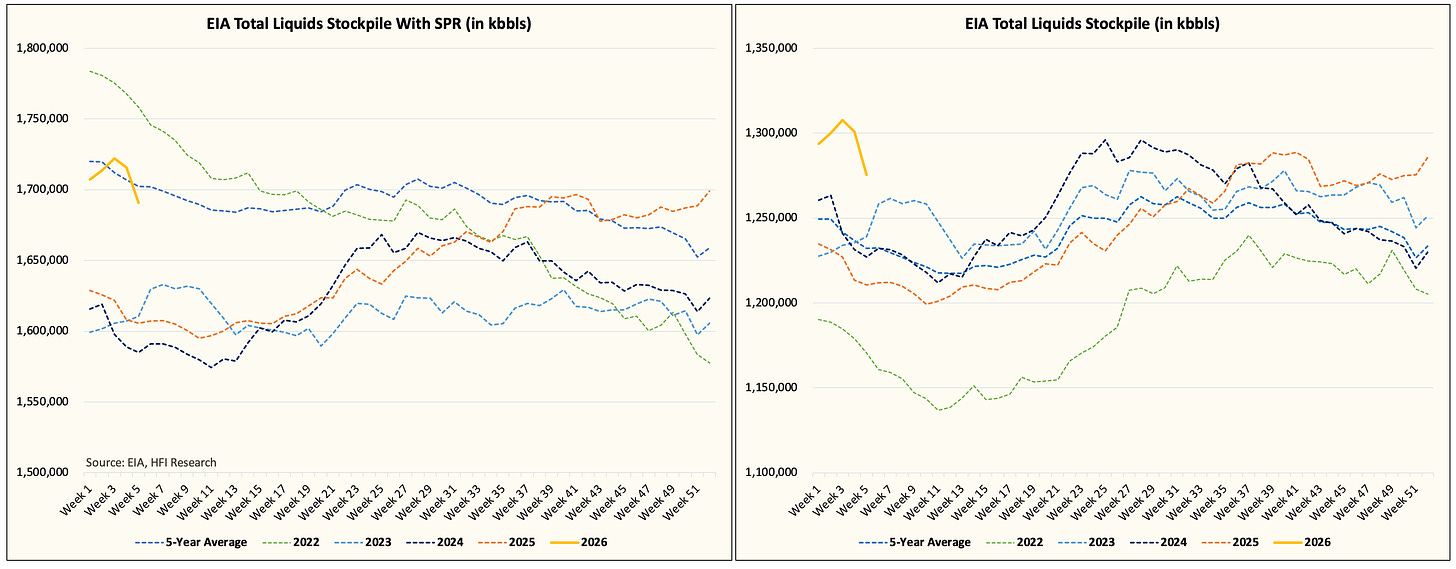

US total liquids stockpile is now down YTD. For next week’s EIA oil storage report, total liquids will show another draw as colder-than-normal weather persisted to Feb 2.

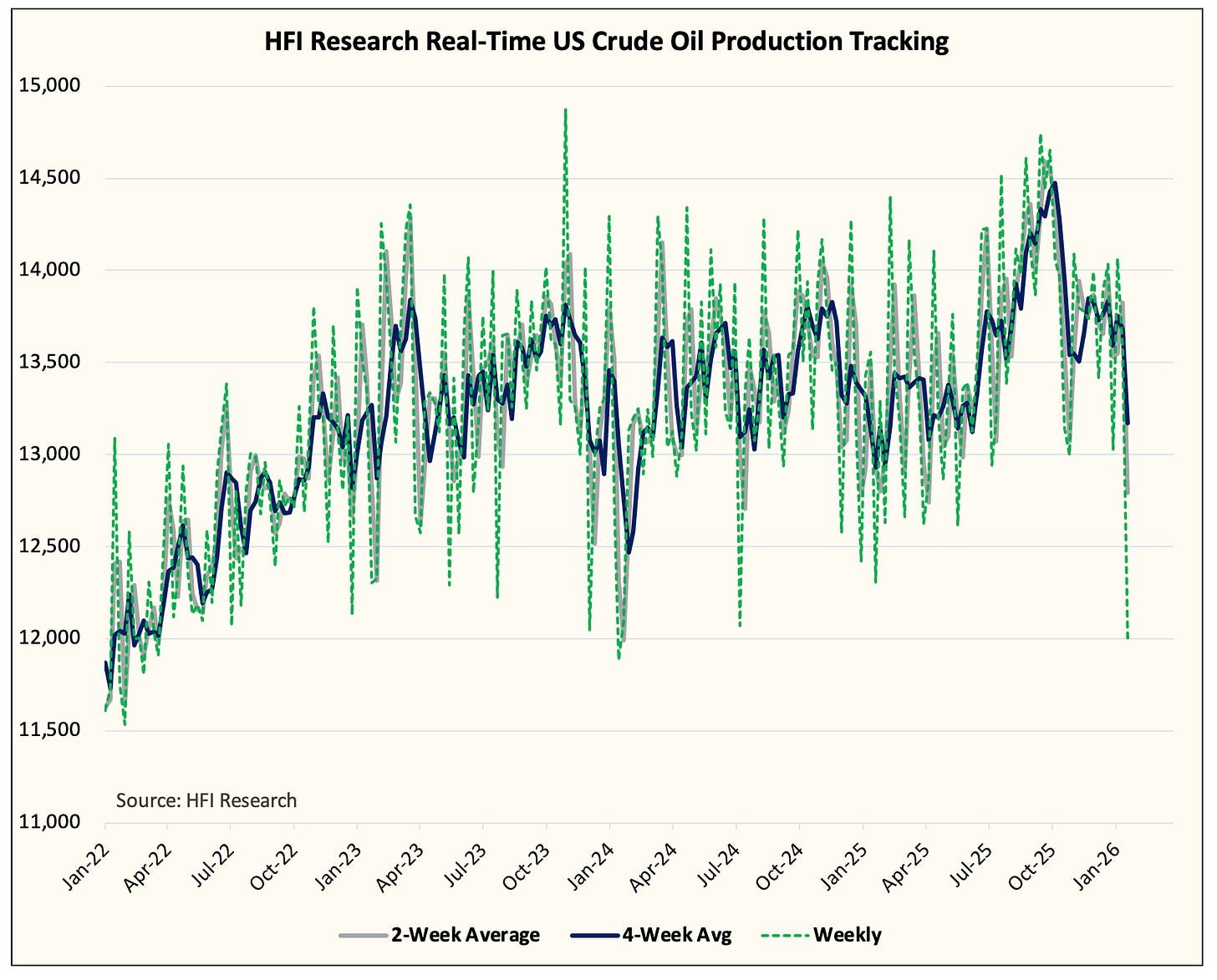

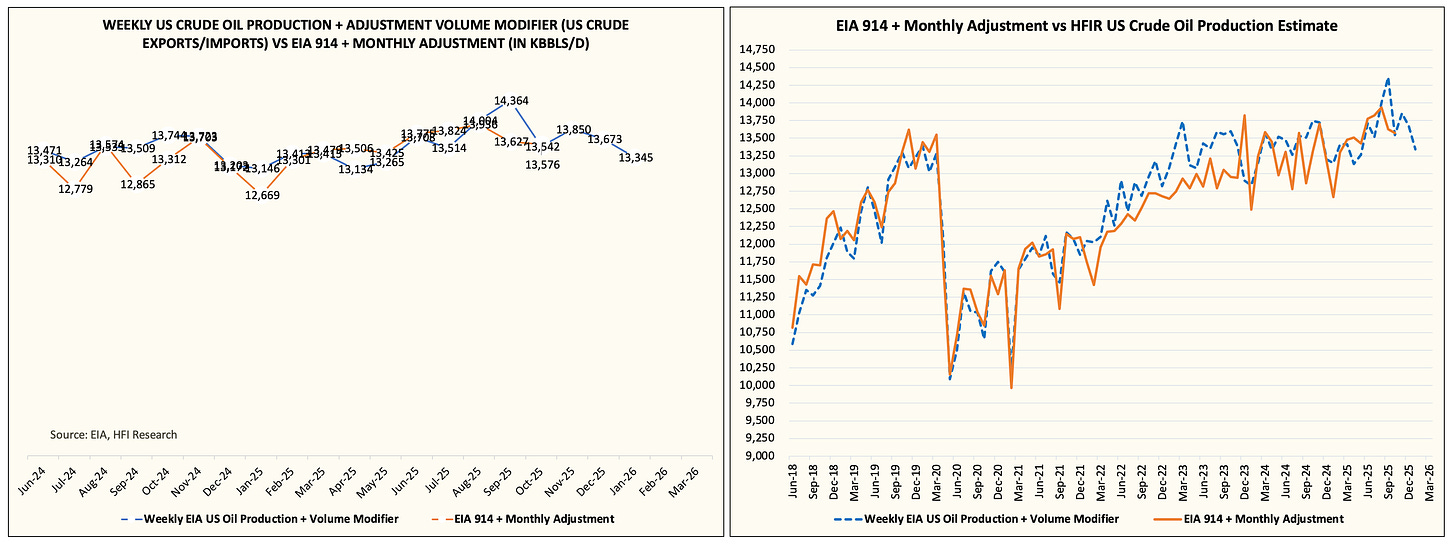

Our real-time US crude oil production showed a material drop due to the freeze-off.

US crude oil production finished January at ~12 million b/d, which brought down the monthly average to ~13.3 million b/d.

We don’t expect a full recovery in production until the 2nd week of February. Warmer-than-normal weather is expected by the end of this week, so operations will return to normal by then.

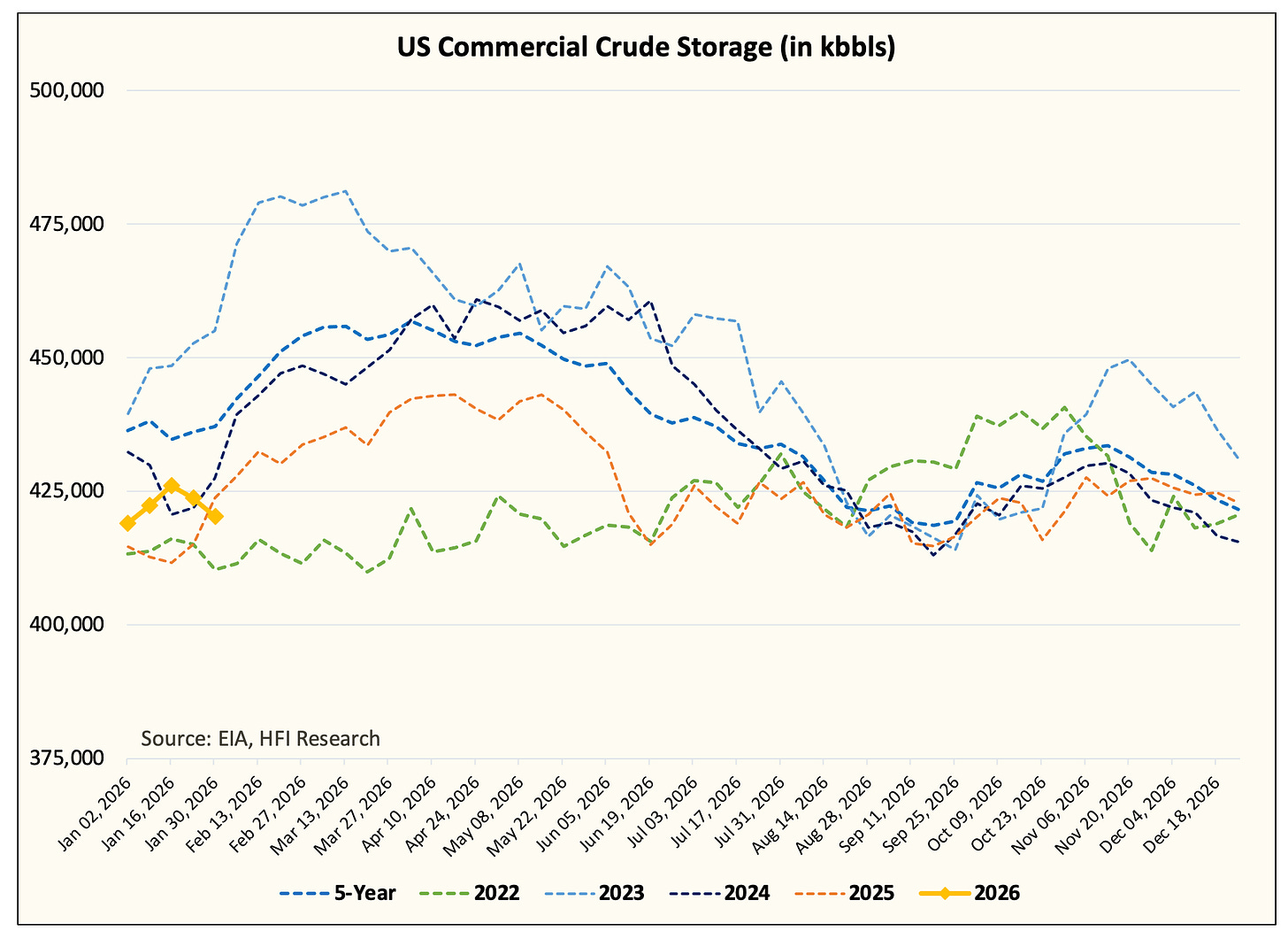

On the product side, gasoline storage didn’t build as much as we had expected. Crude storage surprised with a draw, while other categories showed steep draws as expected.

US commercial crude storage continues to hug the ~420 million bbl range. We expect crude storage to start building soon as refineries enter the turnaround season. Again, this is another data point that invalidates the massive surplus theory.

The market disagrees...

The physical market continues to disagree with the notion that we are going to see a massive surplus.