Consensus came into Q1 2026 calling it the most “widely anticipated oil glut” in recent years. IEA was brazen enough to say that the 2026 oil market balances will be 4+ million b/d in surplus, rivaling the oil surplus we saw in 2020.

Despite obvious signals like the backwardation in oil futures indicating otherwise, the bearish consensus view on oil took hold, and investors remained skeptical.

Brent 1-2 Timespread

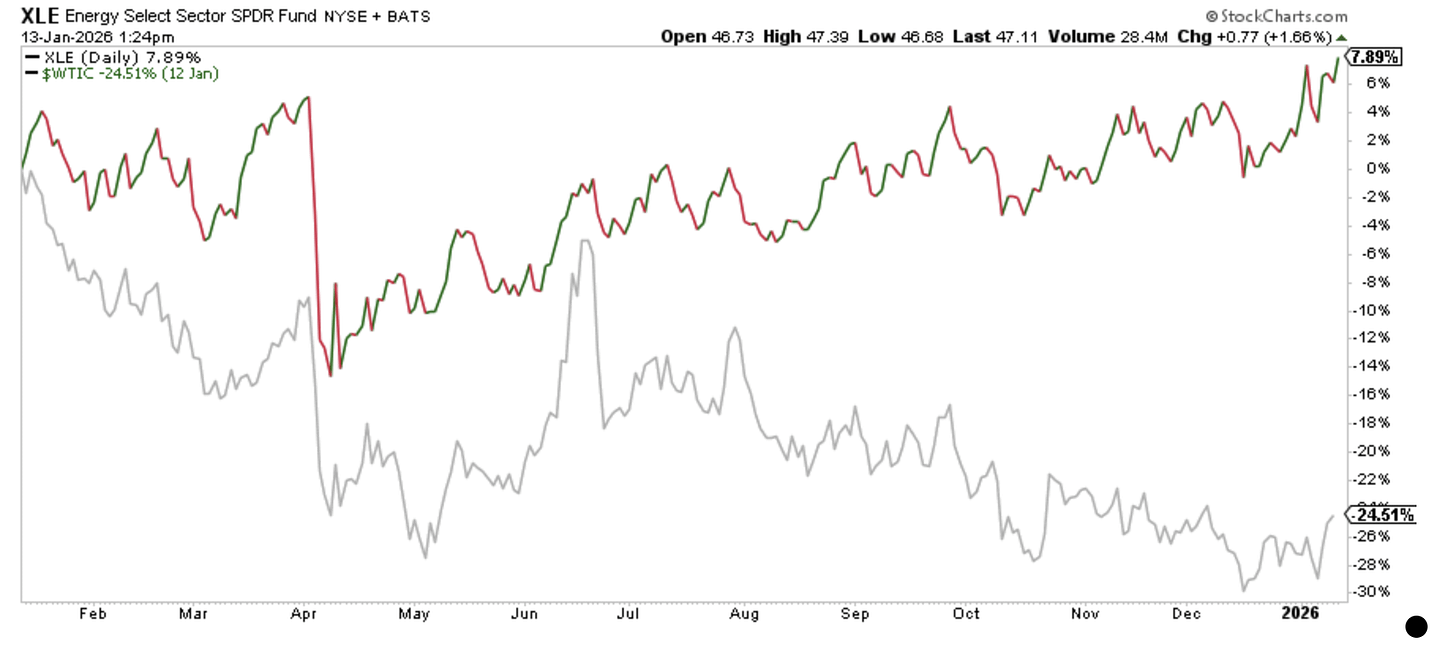

For energy stocks, the weakness we saw in oil into the end of 2025 didn’t materially impact valuation. Instead, we would argue that energy stocks, in general, are pricing in much higher oil price assumptions. This conundrum means that investors willing to bet on higher oil prices ahead will have to sacrifice some of the upside, unless you pick your spots wisely.

In our view, an outright bet on higher oil prices (via futures or ETF (USO)) is a better bet for 2026.

Why we bought USO today

Readers will know that since April 2025, we have been cautious on the oil market. The sudden change in OPEC+ production policy that month implied that the upside in oil prices was going to be capped. As we detailed in our piece here, our expectation for 2025 was for WTI to trade between $55 to $65/bbl.

Fast forwarding to today, we are now in the midst of the highest oil surplus quarter since COVID. Consensus estimates range from +2.5 million b/d to +4.5 million b/d. Universally, everyone expects builds, yet the market continues to contradict everyone’s analysis.

What we are witnessing in the oil market now is the phase: climbing the wall of worries.