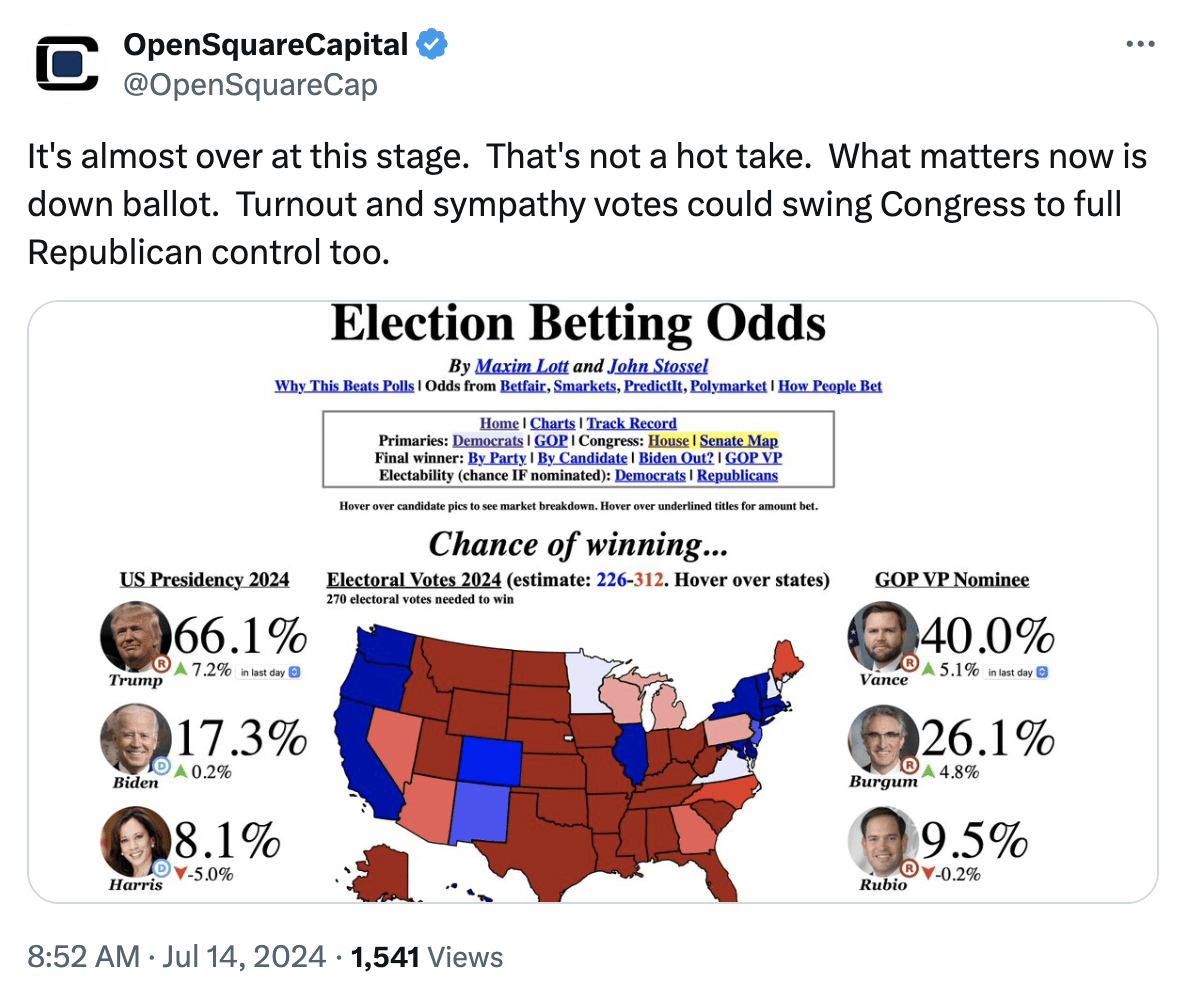

Over the weekend, the world was surprised by the assassination attempt on former President Trump's life. I've largely refrained from commenting on this topic as I think it's best to stay away from the noise and focus on where we are headed. In this regard, I think the odds of Trump winning the incoming presidential election have materially increased. The betting markets are moving in the same direction:

Source: Open Square Capital

With the odds of Trump winning at 66.1%, I think the Saudis and Russians will guarantee a Trump victory by spiking oil prices right ahead of the election.

I will explain my reasoning further below, but if we look at OPEC+ crude exports thus far, you really start to scratch your head.

The timing of this will be extremely interesting as well considering that US economic data has materially weakened, while US oil demand (as we wrote in our OMF) remains resilient. We think while demand could remain strong, but if the broader economy slows down, US oil demand will eventually fall, thus dragging oil prices down with it.

What does a price spike look like?

OPEC+ didn't start materially lowering crude exports until June, which means from an onshore storage perspective, global oil inventories should start to draw now.

But there's an important misconception here and we've seen this discussed on Twitter.

Lower OPEC+ or Saudi crude exports won't meaningfully impact US onshore crude storage. Why? Saudis have already dramatically lowered crude exports to the US since 2020, so the incrementally lower crude exports won't have any effect at all.

Instead, lower OPEC+ crude exports would lower onshore crude storage elsewhere, which would increase demand for US crude exports, and thus lower US crude storage. Remember, it's all intertwined, so lower crude exports from OPEC+ will eventually hit US crude storage.

But this is where things get interesting. We've published two OMFs titled, "Is OPEC+ trying to force a recession?"

In both articles, we point to the dramatically lower crude exports and the impact this will have on the global oil market. By my estimate, the lower exports from OPEC+ will result in a storage deficit of ~1.7 million b/d in Q3. This will send US commercial crude storage down to ~400 million bbl range and effectively shut off US crude exports.

A similar situation took place in late 2023, but the issue was that refineries massively reduced throughput to combat lower margins. This time around, OPEC+'s crude exports are so much lower that refinery run-cuts won't be able to offset it.

In addition, OPEC+ learned from their previous mistake of not letting crude exports recover too quickly. You can look at the OPEC+ export chart above and observe the meaningful dip we saw in August before rebounding.

This time, it's vastly different.

In my view, the only way to deter this oil price spike is if the Biden administration releases SPR. But given the low probability of winning, the Democrats will likely need to play defense (vs offense) and focus on not losing Congress. As a result, we think the probability of a SPR release has also dramatically decreased.