Our global oil supply & demand balance is so far from consensus, we would call it a variant perception. The central premise of our analysis stems from 1) our understanding of US shale and the current production growth dynamic and 2) a flawed methodology by the consensus.

For 2025, we expect global oil inventories to decline by 0.55 million b/d. This starkly contrasts the oversupplied narrative the IEA and the consensus have been pushing for.

Take for example our constant criticism of IEA's supply & demand projection at the end of 2024. In a report titled, "This Doesn't Make Any Sense." We said:

I feel like I'm screaming into the void. The data I'm seeing and the narrative I'm reading do not match. In fact, the divide between data and reality is so far apart now, that the bulls and bears are at two extremes.

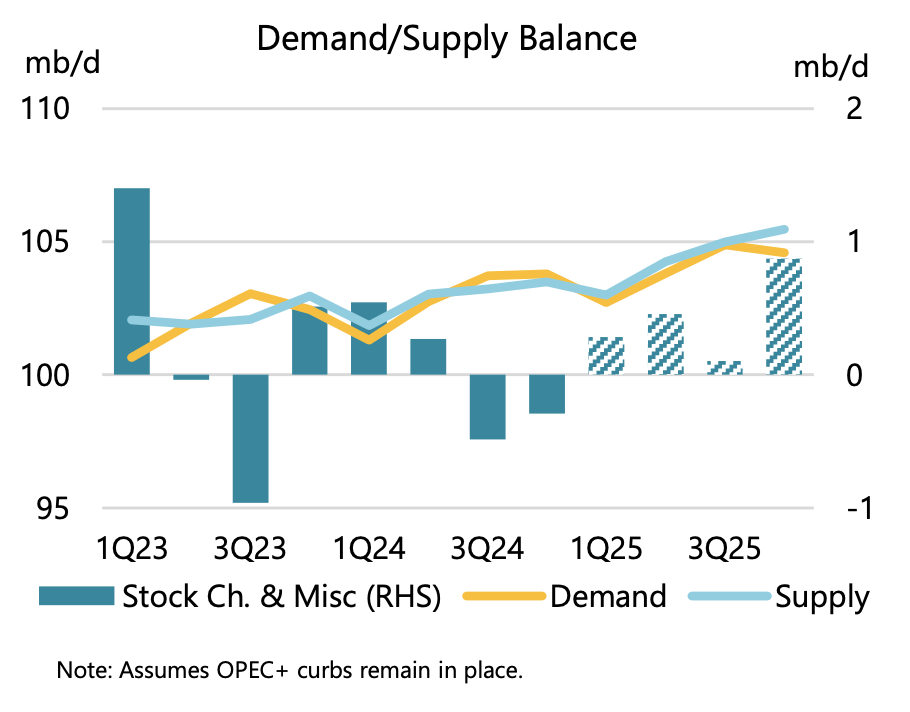

In particular, the disconnect between perception and reality is best captured by this chart:

Source: IEA

In its latest oil market report, IEA is so confident that oil market balances will be in the surplus that it said:

The decision by OPEC+ to delay the unwinding of its additional voluntary production cuts by another three months and extend the ramp-up period by nine months through September 2026 has materially reduced the potential supply overhang that was set to emerge next year. Even so, persistent overproduction from some OPEC+ members, robust supply growth from non-OPEC+ countries and relatively modest global oil demand growth leaves the market looking comfortably supplied in 2025.

It further added the following:

On that basis, our current market balances still indicate a 950 kb/d supply overhang in 2025. If OPEC+ does begin unwinding the voluntary cuts from the end of March 2025, this overhang would rise to 1.4 mb/d. A key uncertainty for the trajectory of OPEC+ crude supply remains the level of compliance with agreed targets, with our estimates showing collective output 680 kb/d above targets in November.

I want you to take a step back and read that again. IEA expects +950k b/d of surplus in 2025. This is one of the larger surpluses since the oil crash started in 2014.

In fact, if you go back and read all of IEA's oil market reports since 2014, aside from the COVID demand destruction, IEA hasn't forecasted a surplus this large since the end of 2014.

It didn't take long for the IEA to start massively revising its 2025 oil market balances. In its latest February oil market report, this is its latest supply & demand projections:

As you can see, the IEA no longer expects global oil markets to be oversupplied by 1+ million b/d, but despite the startingly revision, it is still expecting ~0.5 million b/d of surplus.

The delta between the consensus and our estimate is ~1 million b/d and if you dive into the data, almost ~90% of the delta comes from just the US and Brazil. And if you isolate that further, US oil production explains ~75% of the delta.

So yes, there's a distinct advantage to oil watchers if you understand the US shale production growth story. This is why we have been continuously pounding the table on this all year.