(WCTW) Waiting For The Obvious

Markets are becoming more efficient and inefficient all at the same time.

It's a paradox. It's an oxymoron. How can global markets become more efficient and inefficient simultaneously?

With fast access information and algo trading, global asset prices are becoming more efficient by pricing in information faster, but the efficiency is also a double edged sword. Rather than pricing asset prices to their equilibrium, like the efficient market hypothesis theorizes, the fast trading prices assets closer to extremes, or as I like to say, the obvious.

I've noticed this phenomenon happening more and more in commodity markets like uranium, natural gas, and oil. Financial flows are becoming a large part of what drives the daily price fluctuations, and physical traders no longer have the upper hand in "pricing" these assets.

What I've noticed over the last 2 years, in particular, is that oil, which you would think is one of the most liquid commodities in the world, sometimes trade in a manner that makes you wonder if the sun would rise tomorrow.

I'm going to use today as one of the clear examples of this wildly erratic phenomenon. Some of you may remember this note I posted back in February:

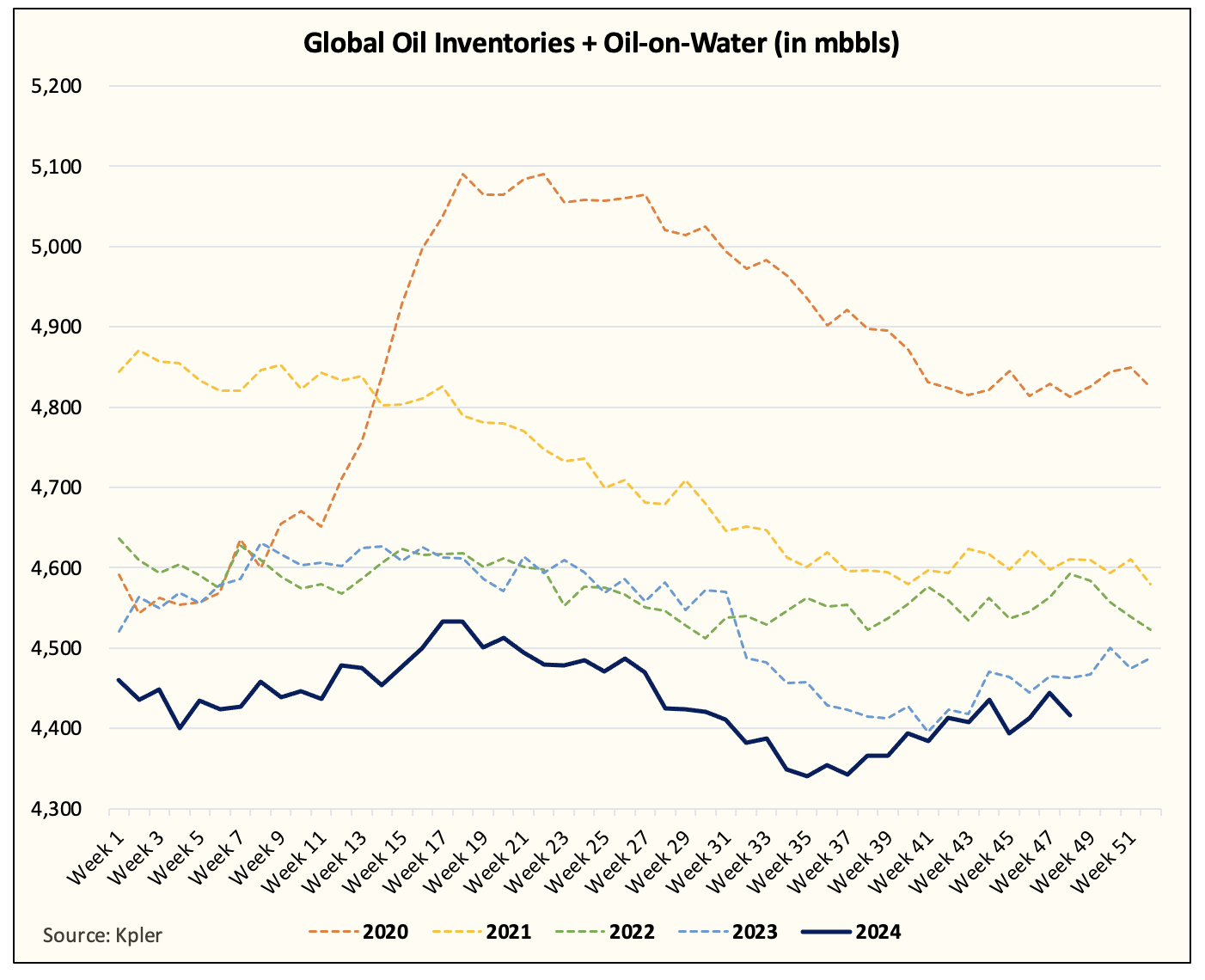

Unlike natural gas, which prices in colder-than-normal risk almost immediately (efficient), oil does not have the same algos responding to any weather-related events. As a result, the oil market underestimated just how meaningful the bullish weather in January was on 1) US crude oil production and 2) US oil demand.

Fast forwarding to today, EIA 914 released its US oil supply & demand figures for January, and the figures were so bullish that it prompted some people to think the report spurred the buying.

And if you just take a step back and look at this phenomenon for a second, you just want to puke.

Why?

All of this was obvious to those who followed the data closely. I mean for the sake of my own sanity here, I wrote about how bullish weather would impact US oil market balances back in December!

Yes, December!

Here's the report, and this is what I said:

For the oil market, bearish heating demand has tampered at least 750k b/d of global oil demand in Q1 2023 and 2024. But this may change with the current outlook for January. According to the latest ECMWF-EPS long-range outlook, bullish weather is expected to show up around the first week of Jan. The colder-than-normal temperature would push down gasoline demand, but it would spike propane/propylene and distillate demand. The surge in the heating demand component coupled with production freeze-off could swing balances by as much as ~1.75 million b/d for one month.

And since market participants are confident that Q1 balances will show a surplus, the draw scenario will immediately shift attention, especially given the low absolute storage environment backdrop.

With this first catalyst, I expect WTI to start trading in the mid-$70s.

And for the sake of some humor, did you know that WTI did end up trading in the mid-$70s, but it wasn't because of 1) global oil balances or 2) colder-than-normal weather?

It was because Biden decided to impose more tanker sanctions on Iran and Russia just before he left office.

Now, fast-forward to mid-February when I published that note. We already knew:

Global oil inventories weren't going to build in Q1.

US crude oil production was meaningfully lower due to freeze-off.

US oil demand was higher than last year thanks to stronger heating demand.

But despite all that, WTI sold off into the mid-$60s!

Wtf?!?!?

The very same thing people are talking about now that is causing a bullish response in oil is old news! Specialists like myself already knew about this a month ago, so what prompted the market to respond suddenly to this information?

And please don't say it's geopolitical conflicts. It's not, and fundamentals have been bullish for a while, and prices have done absolutely nothing.

This is why I'm going to adopt the new investment philosophy of waiting for the obvious.