Natural gas prices have staged a meaningful rebound since our last update. With winter heating demand starting, weather model volatility will rule the day.

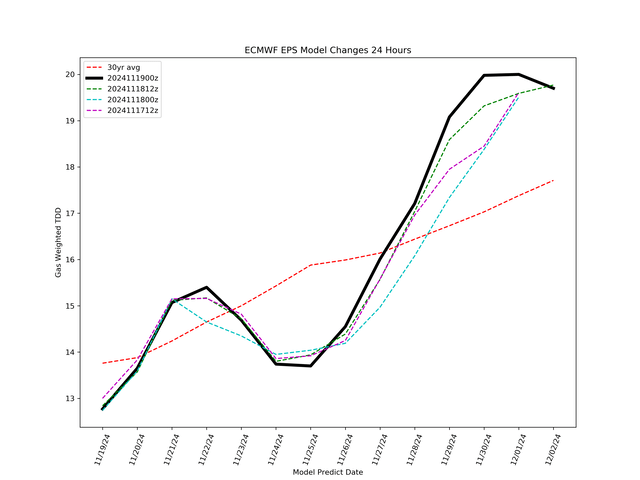

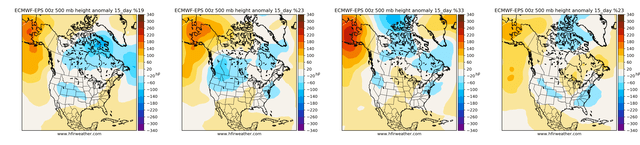

For those of you unaware of this, ECMWF-EPS, or nicknamed King Euro, is the best weather model out there. It updates twice a day (2:40 PM EST and 2:40 AM EST). Typically, you will see natural gas prices trade wildly around these periods. Depending on which way the algos are pushing the price, you can guess roughly which way ECMWF-EPS is trending.

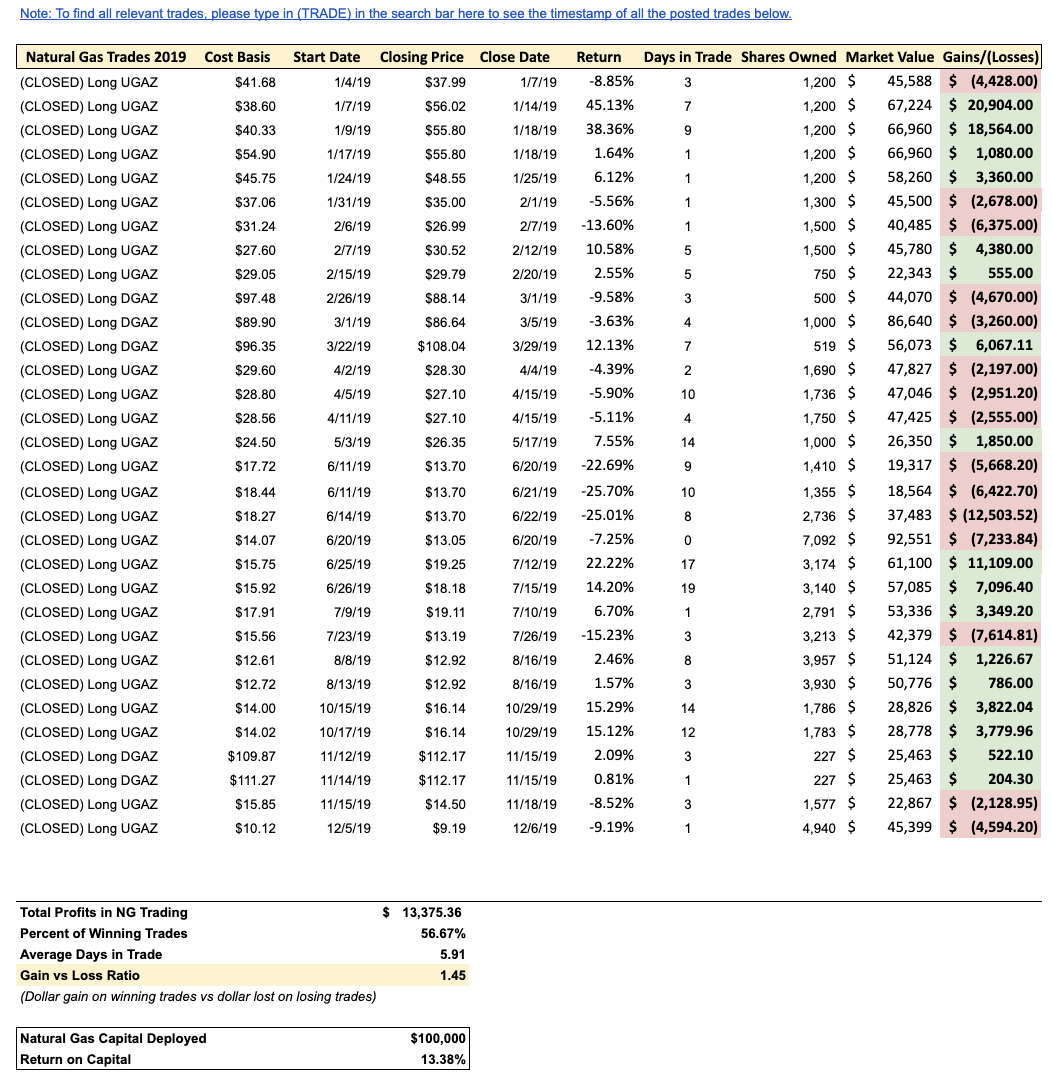

In the past, we attempted to trade using weather models, and over time, we found that method to be unsuccessful.

In particular, I remember in 2019 when we made a very profitable trade in early January. Our bullish long bet paid off and our UGAZ position returned 45.13% in 7 days and 38.36% in 9 days. Those gains were evaporated during the summer months when we thought the weather outlook would be warmer than normal only to see prices fall.

We have since pivoted to trading natural gas equities and I think for the sake of my mental wellbeing, this was the right decision. There will, however, be moments in the market where we would go long BOIL or KOLD (P.S. UGAZ/DGAZ no longer exists). For example, we went long BOIL when the prompt month reached $2/MMBtu in early August.

Since then, we have largely avoided the natural gas market altogether as we will explain below.

For now, readers should know that the weather outlook is trending bullish, and if it continues to trend bullish, then natural gas prices will be well supported here.

ECMWF-EPS HDDs

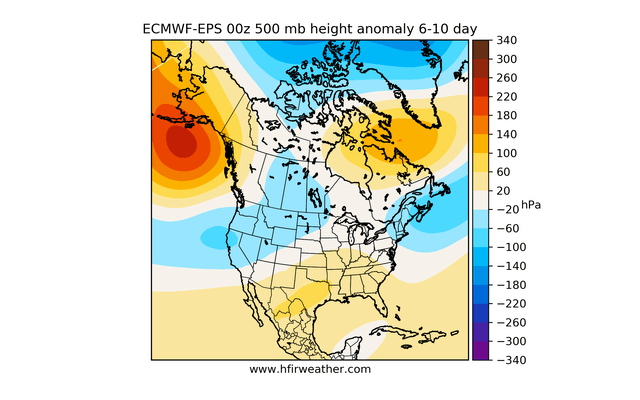

6-10 Day

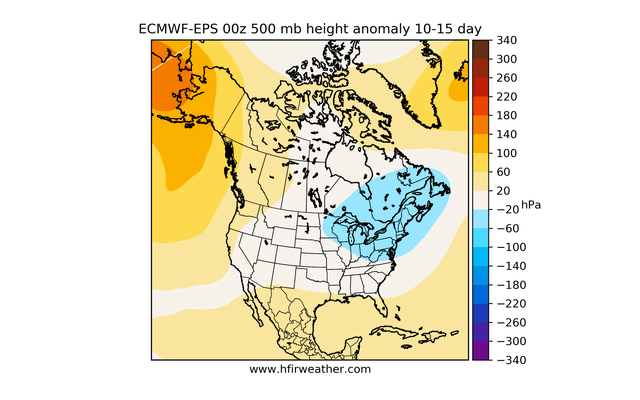

10-15 Day

15-Day Cluster