Editor’s Note: This article was first published to paying subscribers on July 7.

Saudi says, “Tight crude.”

Saudi says, “No visible inventory builds.”

Saudi says, “No more cuts.”

Saudi says, “$65 to $70 Brent.”

Saudi says, “I’m in control.”

That's the global oil market in a nutshell today. Like the childhood game Simon says, whatever the Saudis want, whatever the Saudis will get. We first wrote about this in a WCTW report on May 27. We made it public today.

At HFI Research, we have been well ahead of the curve on the OPEC+ production cut that started at the end of 2023. Do you remember the commentary from oil pundits that once the voluntary production cuts unwind, oil prices will fall into the $40s?

Well, they are nonexistent now. OPEC+ or the V8 agreed over the weekend to decrease the voluntary production curtailment by 548k b/d, or 1 month faster than the 3-month truncated production increase before (411k b/d).

Oil prices ended higher, which befuddled a lot of market participants.

If OPEC+ is increasing production, why are oil prices moving higher?

Well, that's because it was never a cohesive production cut to begin with. Rampant cheating has been obvious for those who pay attention to OPEC+ crude exports.

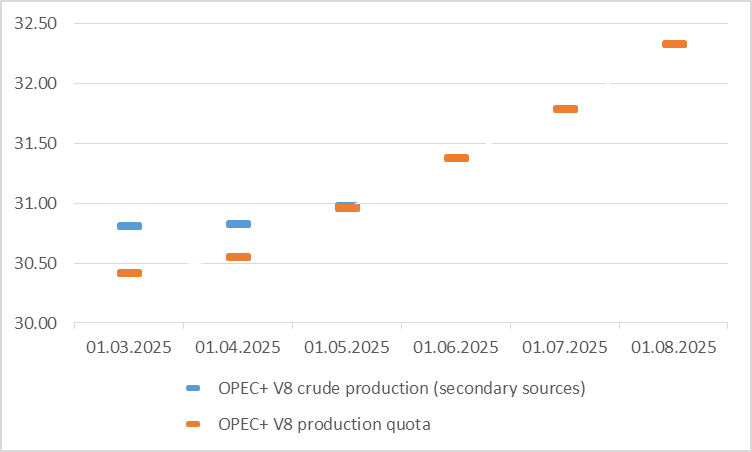

And out of all the charts I've seen following the OPEC+ meeting, this one by Giovanni Staunovo is at the top of the list.

Source: Giovanni Staunovo

As you can see, the V8 production has finally caught up to the production ceiling. The cheaters are now in compliance and will finally be able to “compensate” for all of the previous overproduction from before.

So, what does this mean going forward? With the Saudis in full control, what does the incoming oil price path look like? Will Q4 global oil inventories surge like the consensus is expecting?

Let's dive into this week's WCTW.

Saudi Says

Analyzing the oil market is a bit like analyzing the Federal Reserve, you need to understand the narrative. In this case, it's what the Saudis want. Remember that since this OPEC+ production cut is not a real cut, but instead a Saudi cut, the Saudis will determine just how much supply will be released into the market.

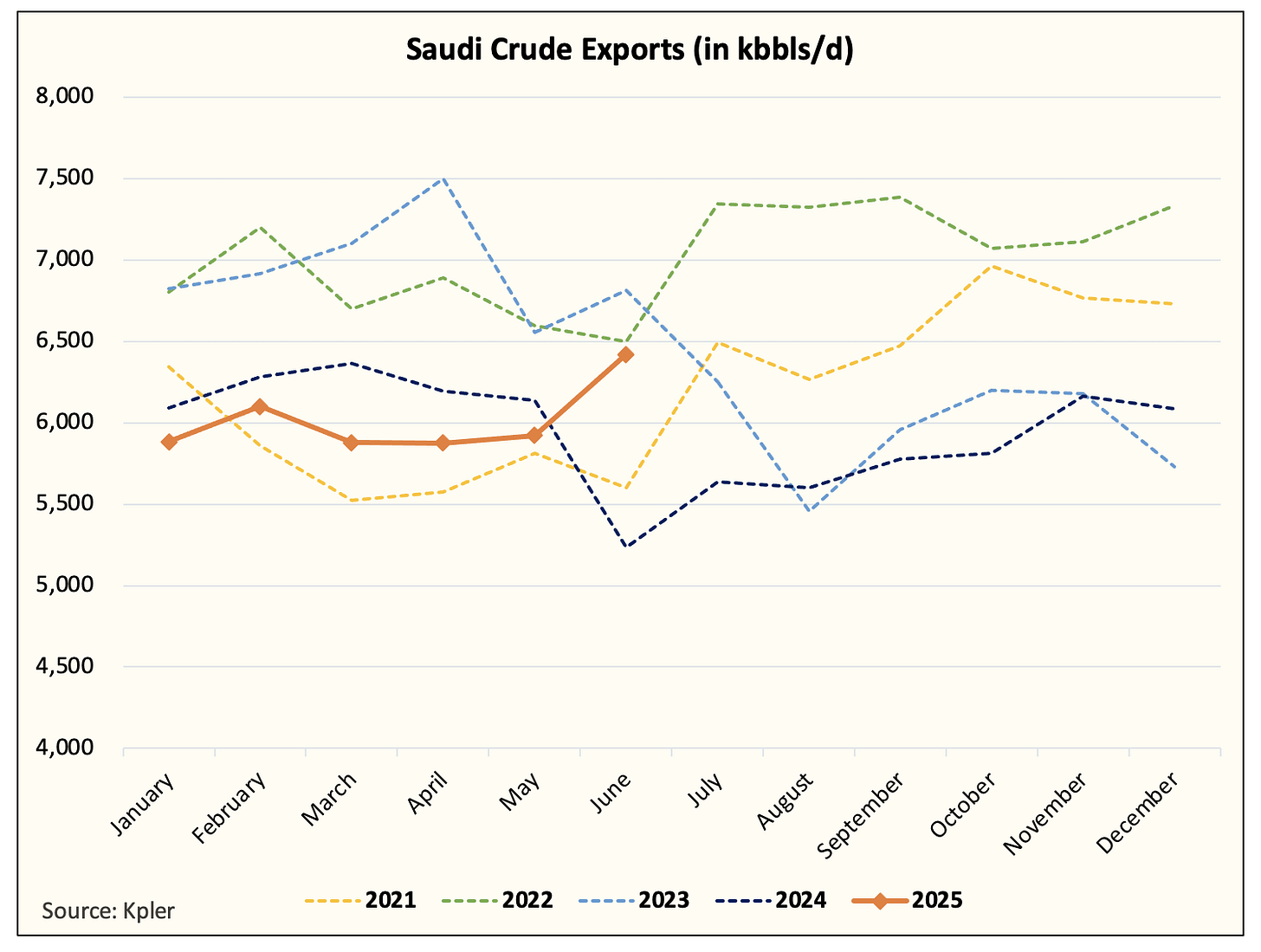

Looking at Saudi crude exports for June, you can see that the Saudis are already increasing supplies to the market. At 6.5 million b/d, Saudi crude exports only have another 250k to 300k b/d before they reach their “optimal” level.

And judging by the official selling price announcement (where the Saudis increased OSP to all regions) and Brent backwardation, the tightness in crude will continue despite Saudi crude exports being ~1.2 million b/d higher y-o-y.

My read on the situation is that the Saudis are only increasing supplies if there's a demand for the crude. This is why you are seeing crude exports surge counterseasonally. If global oil demand was materially disappointing to the downside, you would have seen 1) an official selling price reduction and 2) much lower Saudi crude exports. Instead, we are seeing the opposite, which is supportive of fundamentals.

But that doesn't mean you should get your hopes up and expect oil prices to rally further. I do think there are political forces at play here, and the Saudis are playing both sides.

By expediting the production increase, the Saudis are placating President Trump and siding with his “need” for lower oil prices. Meanwhile, US shale has been slowing down since the beginning of 2024, and the slowdown is picking up steam, which is allowing Saudi to increase production.

As we wrote before, the slowdown in US shale will decrease US crude exports by ~450k b/d by year-end. This will support the higher crude exports coming from the Saudis and others (UAE and Iraq).

In the meantime, the cheaters in the V8 get to keep production flat while meeting the compensation agreement set forth in the deal. In fear of enraging the Saudis, the cheaters will be able to compensate solely by keeping production flat. This is another reason why we won't see any unilateral production increases until the 2nd quarter of 2026.

Putting this altogether, the Saudis, on the surface, are saying that the production cut is being unwound, but in the background, they can still play with crude flows to control global oil inventories. I suspect that if global growth did worsen and oil demand started to surprise to the downside, Saudi would support the price by reducing crude exports. It just might not make it so public this time around due to Trump being the president.

There is a dilemma...

Yes, there is a small problem, the US trade war.

Liberation Day might have been 3 months ago, but so far, the US has only signed two trade deals: Vietnam and the UK. The big fish in the pond have yet to agree, and Trump just posted a letter that he sent to Japan, insisting that a 25% tariff would be put in place.

TACO (Trump always chickens out) Trump or not, the tariff threat continues to loom over the oil market like a dark cloud on the horizon. Demand uncertainty aside, what the Saudis are embarking on is like trying to walk a tight rope while trying to juggle 10 things all at once.

If the Saudis push the oil market too hard (i.e., real production increase resulting in a surge in global oil inventories), oil prices would fall into the low $50s and high $40s, sending off another massive wave of capex cuts. This would inevitably sow the seeds for even higher oil prices down the road and lead to demand destruction. We know for a fact this is not a scenario the Saudis want.

On the other end, if the Saudis continue to keep supplies tight, oil inventories could remain low, and the elevated oil prices would draw attention from Trump and potentially higher/stable US shale production. In addition, the cheaters in the V8 might see this as an opportunity to increase production, which will inevitably result in higher inventories and lower prices. This is also not a scenario the Saudis want.

In essence, the Saudis have to walk a fine line here. They need to increase production just enough so that oil prices don't move meaningfully higher, but they also can't increase production to the point where global oil inventories build and much lower prices are on the horizon.

They also have to keep prices in a range where it keeps Trump at bay while simultaneously keeping US shale constrained.

What is that price range?

$55 to $70/bbl

In a perfect world, WTI would trade between $60 and $65/bbl. That's the range where US shale has enough to survive, but not enough to thrive. Overall production will continue to trend lower; meanwhile, global oil demand growth would be supported by a lower US dollar and oil price.

Do I think the Saudis will be successful in keeping oil in this range for the next 12 months?

Yes, but so long as there are no geopolitical conflicts that disrupt oil flow.

Also, we need a decent oil demand outlook. I don't think we need a strong growth backdrop to keep prices in this range, but a global recession would require the Saudis or OPEC+ to cut production again.

Conclusion

Saudi says, “The oil market will be rangebound.”

What the Saudis want, what the Saudis will get.

I think the oil market consensus is starting to buy into our premise from 18 months ago that this wasn't a real OPEC+ production cut, but a Saudi cut.

As this becomes consensus, the next step to figuring out the oil market is to figure out what the Saudis want, and these are the things the Saudis want:

Publicly support Trump's need for lower oil prices (to an extent).

Keep oil prices rangebound (preferably $65 to $70 Brent or $62.5 to $67.50 WTI).

Keep global oil inventory builds to a minimum (it might not be severe draws, but no major builds).

Pressure non-OPEC supplies lower.

If the Saudis are successful in achieving these objectives until the end of 2026, then the range will materially shift higher. Non-OPEC supply growth will be nonexistent going into 2027, and if global oil demand growth continues, Saudi will have to start tapping into its spare capacity to meet the incoming demand.

This imbalance, coupled with relatively tight global oil inventories, should usher in the multi-year oil bull cycle. That's the ultimate long game the Saudis are playing, but all of this takes time to play out.

Thank you for reading. Be sure to check out some of our other public articles like this one:

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.